Glendale Arizona IRS Settlement

Glendale Arizona IRS Settlement: 11/2017

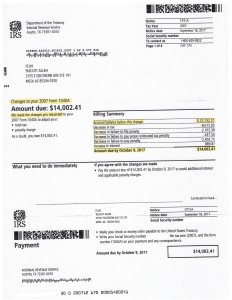

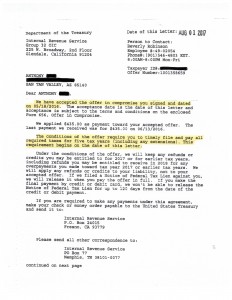

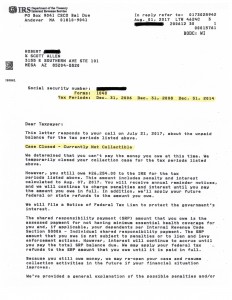

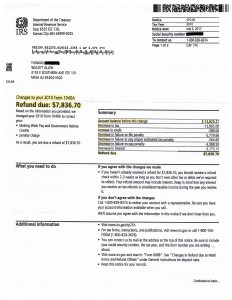

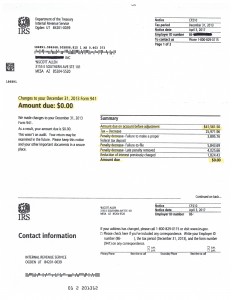

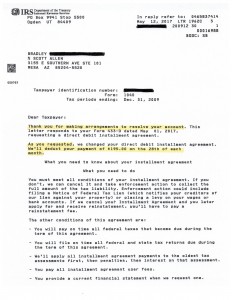

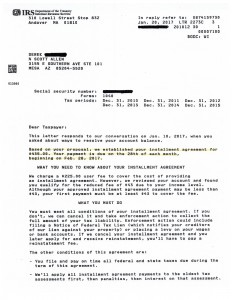

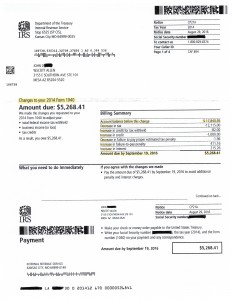

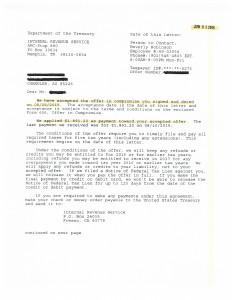

This is an example of a recent Glendale Arizona IRS Settlement case resolved by Tax Debt Advisors Inc. All of Marks’s IRS debt was negotiated into one low monthly payment plan. This payment plan was established to begin after the first of the year to allow the taxpayer ample time to prepare and also get him past the busy holiday season coming up. Tax Debt Advisors Inc was also able to take advantage of the IRS’s Fresh Start Program and prevent the them from filing a federal tax lien against his personal credit. When Mark met with Scott Allen EA this was the most important negotiation aspect to him. Upon a simple but complete evaluation it was determined that he qualified to have this done.

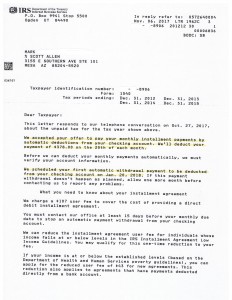

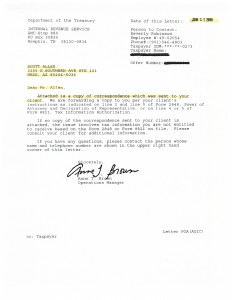

View the IRS approval letter received in the mail on the IRS installment arrangement setup by Tax Debt Advisors in behalf of the taxpayer.

You too can get the IRS off your back. Stop the stress and face the Internal Revenue Service with the right representation. That representation is Scott Allen EA of Tax Debt Advisors Inc. He can get you the best possible Glendale Arizona IRS Settlement allowable by law. He will meet with you (and your spouse) for a no obligation consultation to discuss ALL AVAILABLE OPTIONS TO YOU. Proper information is the power to go “against” the IRS.