What are the consequences of not filing current and back tax returns?

Every year millions of Americans for various reasons fail to file their tax return. Failure to file will be worse than the taxes you would have owed if you file on time within a short period. The failure to file penalty is 5% per month. The failure to pay penalty is ½% per month. When you add the interest accruing to these two penalties, it doesn’t take long before they exceed the original tax due.

If you have a refund coming to you there are not penalties or interest. However, refunds that are older than three years are forfeited.

The statute of limitations does not begin until an assessment of the liability. The IRS only has three years in which to do an audit on a timely filed tax return. This IRS has on limitations on audits until you file your return.

Tax years that could be discharged in bankruptcy if filed timely will have to wait at least two years before becoming eligible for discharge.

Valuable tax credits such as the earned income tax credit will be lost after three years. These refunds cannot be used to off set taxes owed in other years.

There are negative effects during the collection settlement process if one has not filed back tax returns. The IRS knows that anyone can get caught in a situation of not being able to pay their taxes, but there are few legitimate reasons why a taxpayer cannot file a return. The IRS thinks that failing to file (5% penalty) is 10 times worse than filing to pay (1/2% penalty).

How do I file back tax returns?

It will depend on the situation. If you are working with a revenue officer, the usual procedure is to file the returns directly to them. If you are working with ACS, it may be possible to file the returns at the closest IRS office and get proof of filing. Some Large Dollar Accounts out of Holtsville, New York will request that you mail returns to them.

Before I prepared any unfiled return, I will do a review of all documents that have been turned in to the IRS under your social security number for the tax year involved. This prevents unnecessary audits for neglecting to report income that the IRS is aware of. If a return is being mailed to the IRS, I always recommend mailing the return—Certified Mail, Return Receipt Requested. I also recommend only one return per envelope. If you have several years to file it is best to put one return in each envelope before putting them into one big envelope that contains all of the returns being filed. By labeling the tax year involved on the outside of the envelope, the IRS personnel who is opening you package will be alerted that there is more than one tax return being mailed to them. This may seem like a silly procedure but it WORKS.

Do I need to file if I don’t owe any tax?

You may know that you don’t owe but the IRS may think differently. Let me give you one example. If you had on stock sale and lost money—you know you don’t owe. But the IRS doesn’t know that. They just know the amount of the sale, not the cost of the stock you sold. So in this example if you sold stock for $100,000 that you paid $120,000, the IRS will calculate a gain of $100,000. The best approach is to file every year, even if you don’t owe. Many transactions such a purchasing a home will require you to provide copies of recently filed tax returns. If the bank knows you have not been filing tax returns they may decide you are not worthy of a loan—even if you did not owe any taxes.

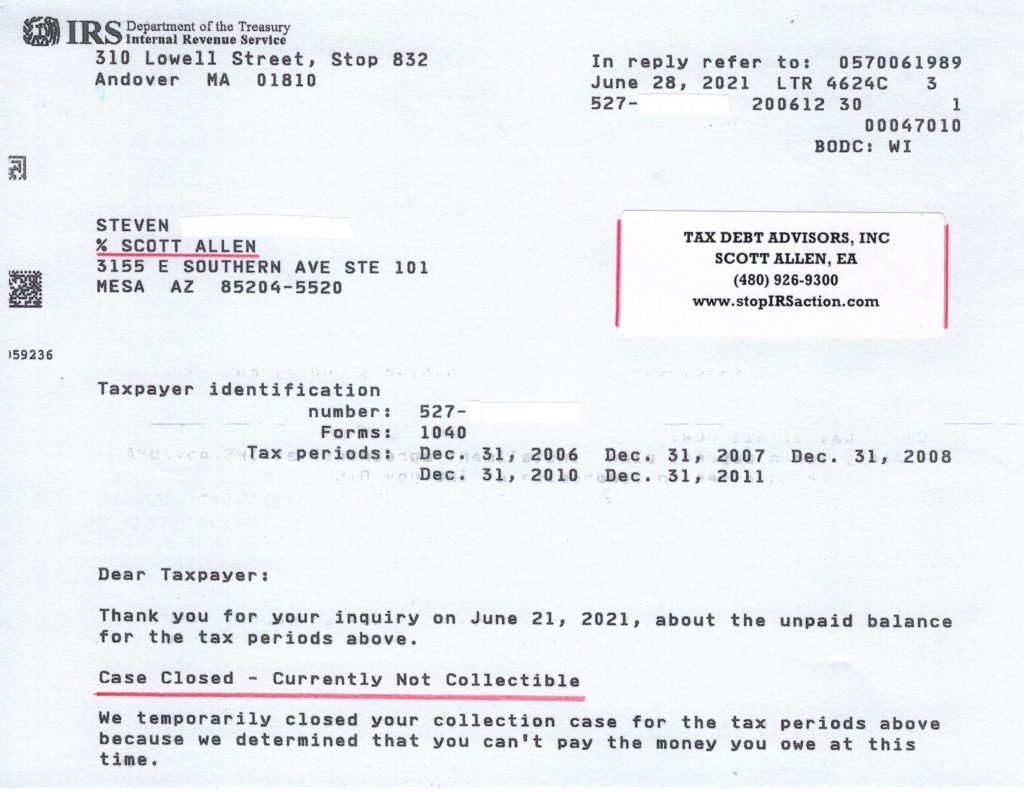

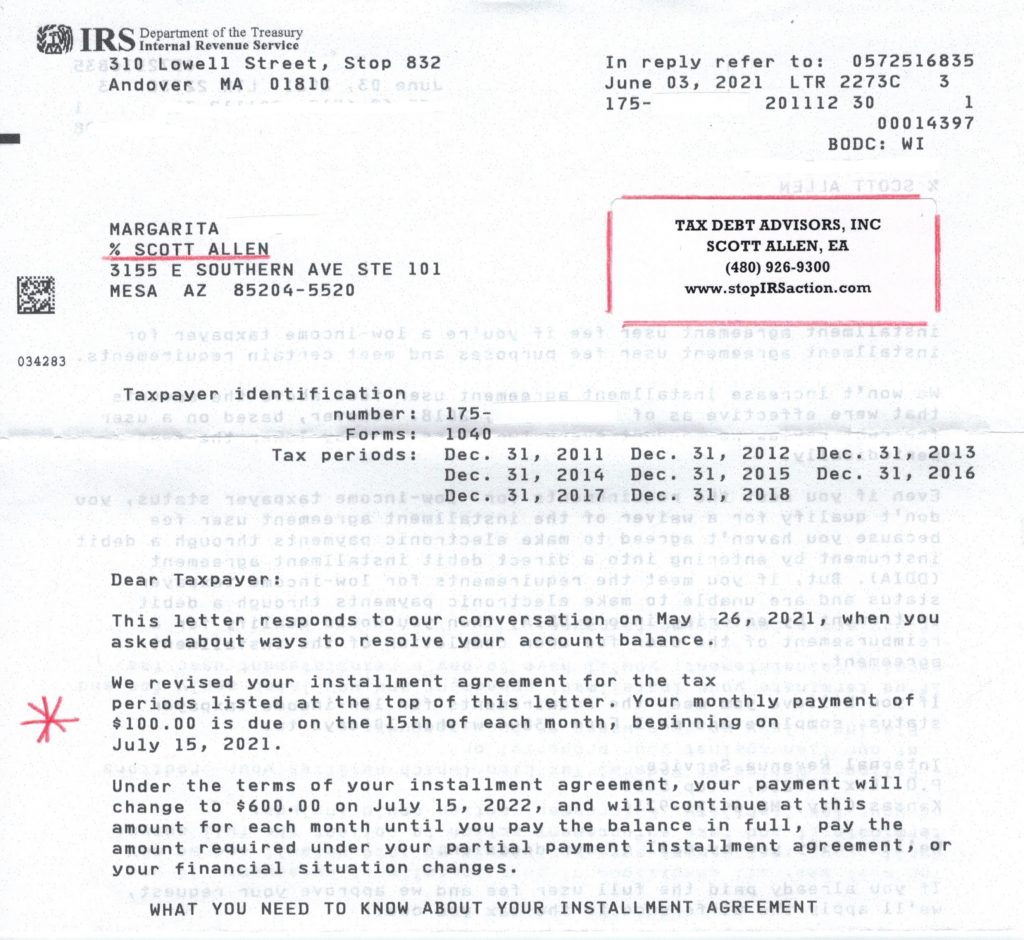

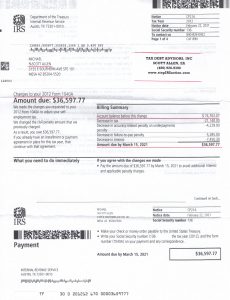

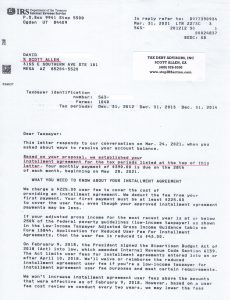

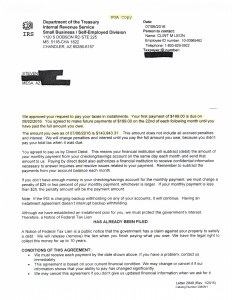

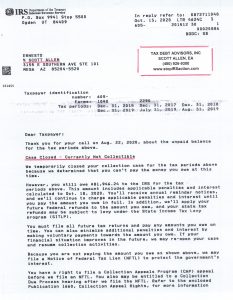

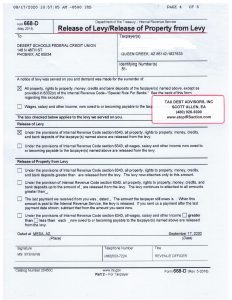

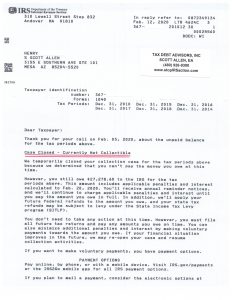

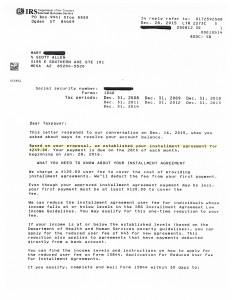

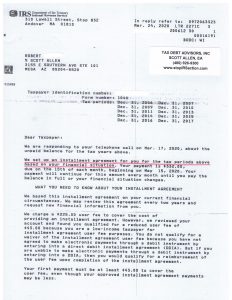

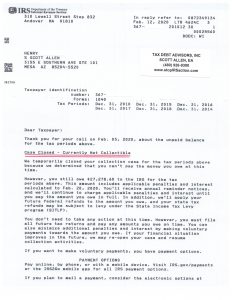

Below is an example of a success story on a client who had unfiled tax returns in Arizona that needed to be prepared (six years worth). After getting the client in compliance a settlement was negotiated in his behalf. Due to his current financial status we showed the IRS that he could not afford to make any payments on the back taxes and that is exactly was was negotiated for him – Currently Non Collectible Status!

Unfiled Tax Returns in Arizona

Call and speak to me today regarding your unfiled tax returns. You are probably carrying around a much bigger burden than you need to be worried about. Just getting started is the hardest part but it is also the best way to get a good night’s rest.

Mesa, Apache Junction, Avondale, Buckeye, Carefree, Cave Creek, Chandler, El Mirage, Fountain Hills, Gila Bend, Gilbert, Glendale, Goodyear, Komatke, Litchfield Park, Luke AFB, Paradise Valley, Peoria, Phoenix, Queen Creek, Scottsdale, Sun City, Sun Lakes, Surprise, Tempe, Tolleson, Waddell, Whitman, Wickenburg, Youngstown, Flagstaff, Tucson, Payson, Winslow, Sierra Vista, Page, Prescott, Globe, Yuma

www.TaxDebtAdvisors.com