You also might need an IRS settlement in Tempe AZ

An IRS settlement in Tempe AZ is possible

Just look at the IRS notice above and you can have what Edward has. Scott Allen EA of Tax Debt Advisors aggressively negotiated an installment arrangement on his debt with the IRS. The best part – no tax lien was or will be filed by the IRS. When Edward and his wife came in to meet with Scott Allen EA they were confused on what to do or where to begin. Scott was able to clearly lay our a plan with the taxpayers that would satisfy the IRS but all work within the budget of the taxpayers. They were on a fixed income and did not have the ability to pay for services all at once. However, over the course of about 3 months they were able to get all their Tempe AZ back tax returns filed while working out an installment arrangement with the IRS.

Tax Debt Advisors has been filing back tax returns and settling IRS debts since 1977. Over those 45 years they have settled over 113,000 IRS debts. This is their niche and this is all that they do. The most important decision you can make in dealing with your IRS matter is finding correct and competent representation. Always work locally; never with an out of state company. Your IRS settlement in in Tempe AZ is important enough that you will want to work personally with your hired IRS power of attorney. Scott Allen EA of Tax Debt Advisors promises just that. Call and schedule a free initial consultation with him today at 480.926.9300.

Another IRS Settlement in Tempe AZ

An IRS Settlement in Tempe AZ can vary depending on what the taxpayer owes, their income, their assets, their debts, household size, among many other variables. This is exactly why it is important to look at all the different settlement option before making a final decision. That is why it is important to meet with Scott Allen EA and have him guide you thru that entire process.

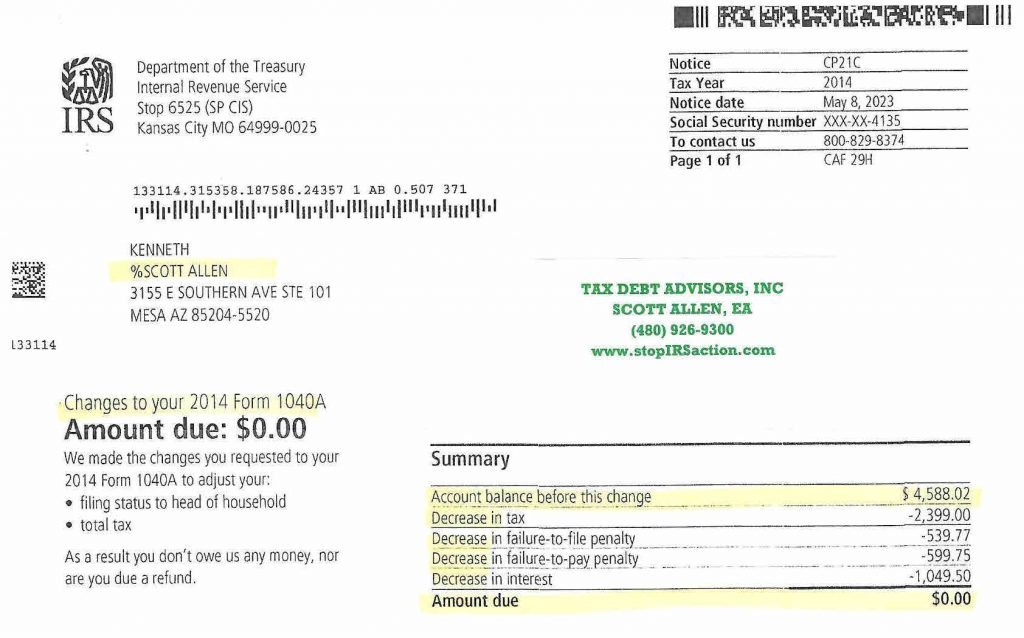

See what he did for his client Kenneth in securing him the best possible IRS Settlement in Tempe AZ.

Kenneth owed the IRS on some back taxes. One of those years being 2014. 2014 was a return that the IRS filed for him referred to as a Substitute For Return (SFR). The IRS will file a SFR return when a taxpayers fails to do so in a timely manner. Kenneth could have just accepted this and moved on OR he could have looked into it further and see if there were any possible ways to reduce the liability. Obviously, he chose the latter option. Scott Allen EA knew he could protest the IRS SFR return and reduce his liability. From the notice above from the IRS you can see that his IRS Settlement in Tempe AZ went from $4,588 all the way down to ZERO. In most cases it never too late to protest IRS SFR tax return filings.

Call and make an appointment today to meet with Scott Allen EA face to face.