Find out how you can settle IRS debt in Phoenix AZ

What ways can you settle IRS debt in Phoenix AZ?

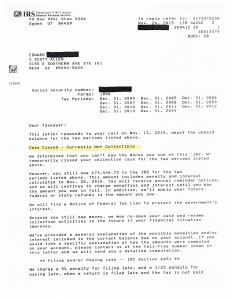

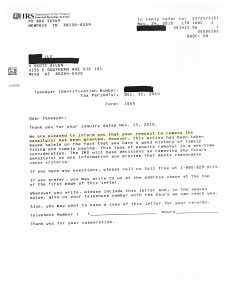

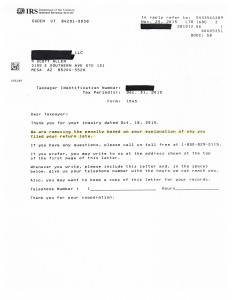

Edward utilized currently non collectible status as his way to resolve his IRS debt. By using the services of Scott Allen EA, Edward was able to stop all collection activity from the IRS, file his back tax returns, and aggressively negotiate a currently non collectible status. View the document below to see the actual approval letter directly from the IRS.

Scott Allen EA meets with clients on a daily basis who want to settle IRS debt in Phoenix AZ. They share, “Scott, I owe the IRS $30,000, I am paying $500 a month and this debt doesn’t seem to be going anywhere. I just want to settle it”.

While it may seem at $500 a month your debt is not going anywhere; in actuality it is. It is just going to take four or five years. The IRS has 10 years to collect a debt from when the debt was assessed. According to the IRS guidelines, if you can pay your IRS debt back within a reasonable period of time you are not going to see a reduction of that debt in most cases. For those taxpayers that do, the program is called an offer in compromise. If accepted, the IRS has determined that the taxpayer cannot pay off the debt within the remaining statute of limitations and they would be better off accepting a lump sum settlement today. For those that qualify this is a fantastic deal. Based upon recent statistics only about 3% of taxpayers qualify for this offer in compromise program. For the other 97% of us, we are left with the rest of the settlement options available. Scott Allen EA has successfully negotiated installment arrangements and currently non collectible status’s for the past 10 years. Many clients have been able to qualify their taxes to be discharged in bankruptcy as well.

To be evaluated in ALL the ways to settle IRS debt in Phoenix AZ give Scott Allen EA a call today. This is his niche and his expertise. He can be reached at 480-926-9300.

Thank you.