Settle IRS Debt Tempe AZ: Pay IRS nothing

Settle IRS Debt Tempe AZ

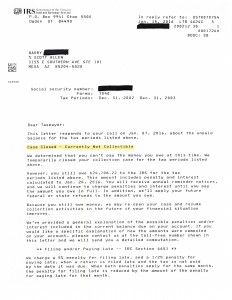

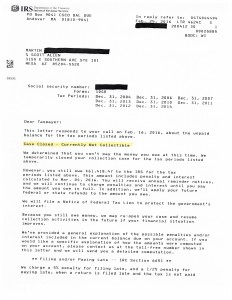

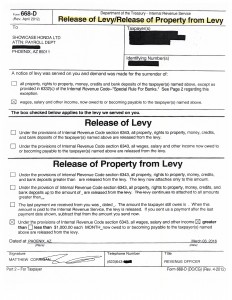

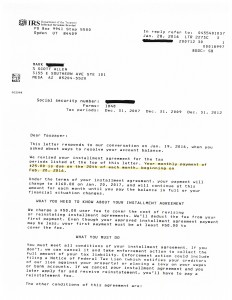

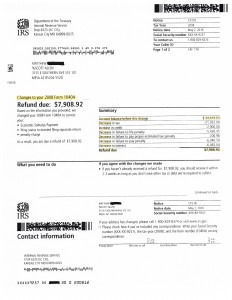

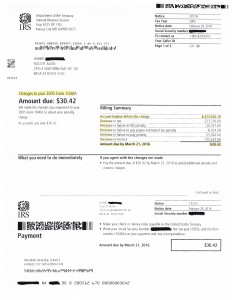

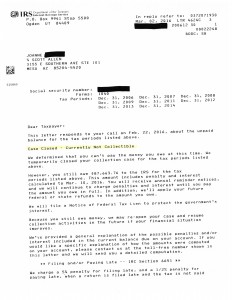

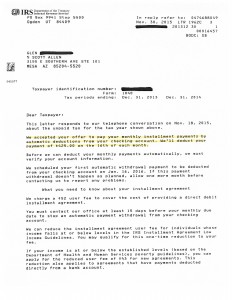

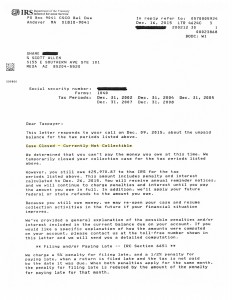

Is is possible to pay the IRS nothing on your back tax debt? See if you qualify to settle IRS debt Tempe AZ in a currently non collectible status. Barry was someone who qualified for a great negotiation of his IRS debt. He hit a rough patch in his life where is health circumstances changed to a point where he could not work as he used to. His hours had to drop to take care of his health. Due to this change they were able to negotiate a $0.00/month “payment plan” to settle his debt.

Whats the catch?

The good news is there really isn’t a catch. Many taxpayers qualify for this option and not even realize it. The only requirement is that he has to remain in good standing with the IRS on his future tax filings. He can’t owe again in the future. If so, then the arrangement will default.

To explore currently non collectible status and the other options with Scott Allen EA contact him today.