Who needs to negotiate IRS debt Mesa AZ?

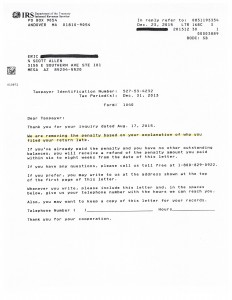

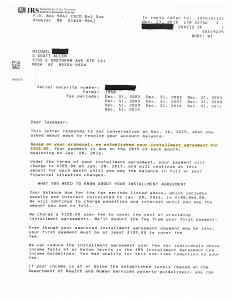

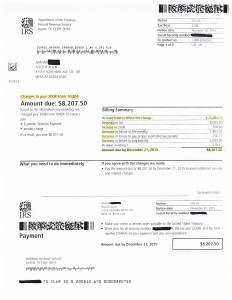

Eric used Tax Debt Advisors to negotiate IRS debt Mesa AZ

If you have an IRS issue that requires you to negotiate IRS debt Mesa AZ please consider Scott Allen EA of Tax Debt Advisors. His company is locally and family owned right here in Mesa AZ. Do what Eric did and utilize his experience.

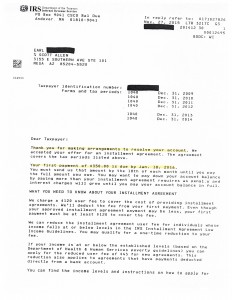

When the average person think of settling IRS debt they only thing of one option. However, there are actually six different ways to negotiate IRS debt. Scott Allen EA clearly lists and explains what those six options are. To read further details on those different option click here. What are the available options to you?

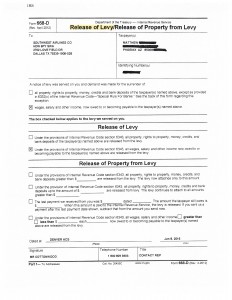

1. Let it expire

2. Suspend it

3. Adjust it

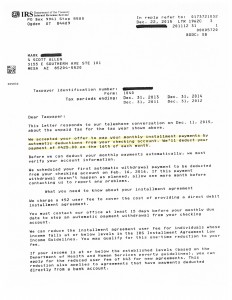

4. Pay it

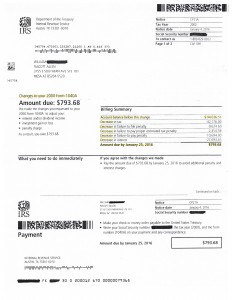

5. Compromise it

6. Discharge it

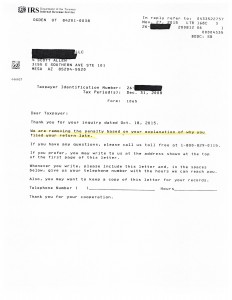

If the person you hire to be your IRS power of attorney does not have experience in all six options or does not go over all six with you then he/she is not out for your best interest. Even when clients tell Scott Allen EA they have zero desire to discharge their taxes in a chapter 7 bankruptcy he will still review it with them. This way they can make an informed decision and will know they will not have any “buyer remorse” in the option he negotiates with them. Each option has something good about it and something not so good about it. It is important to knows about these.

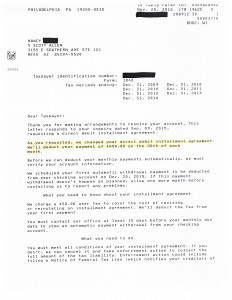

Be informed! This will allow you to feel good about what is negotiated and you know you have the best that the law will allow for you. The biggest key is to make sure you are in compliance with your taxes…and stay in compliance with your future taxes.

To set up a time to meet with Scott Allen EA about your tax issues contact him today @ 480-926-9300. He will make today a great day for you.