Let Tax Debt Advisors prepare your Mesa AZ back tax returns.

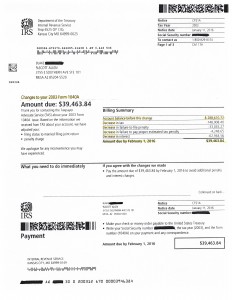

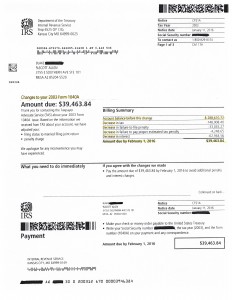

Blake saved $249,147 in filing his Mesa AZ back tax returns. Tax Debt Advisors was able to navigate their way through getting Blake out of the collections division of the Internal Revenue Service. Blake was delinquent on his tax preparation. Pertaining to the notice below he had not filed his 2003 tax return. Several years had passed. The IRS eventually decided that they needed to prepare that tax return for him. As you can see by viewing the notice below that their number totaled over $288,000 in taxes, interest, and penalties.

Mesa AZ Back Tax Returns

It is a lot more common then people think to have the IRS file tax returns in the taxpayers behalf. They call this process ‘substitute for return’. By going through these measures they can now file tax liens and wage garnishments against you. They do not necessarily want to do this but they are left to no other choice at times. They know that this will usually get the taxpayers attention.

If the IRS filed Mesa AZ back tax returns in you behalf, all is not loss. We can protest the IRS’s decision; its not a matter of WILL they accept but rather WHEN they accept them. At Tax Debt Advisors they do whats required to get them protested correctly and accurately.

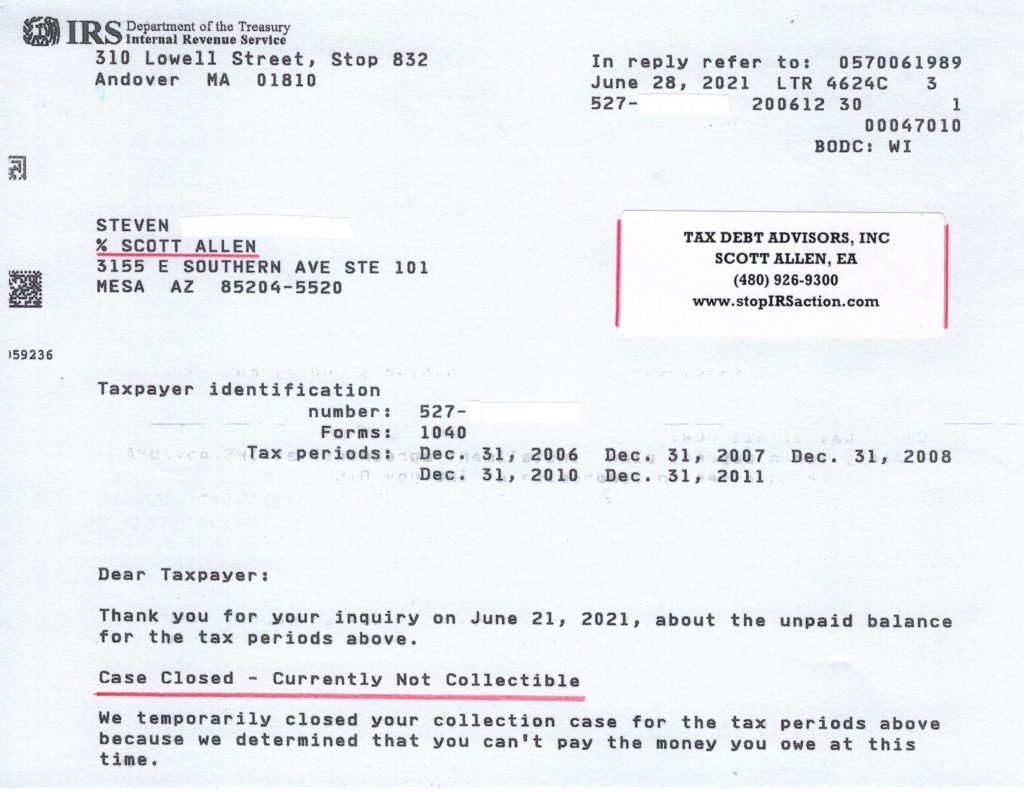

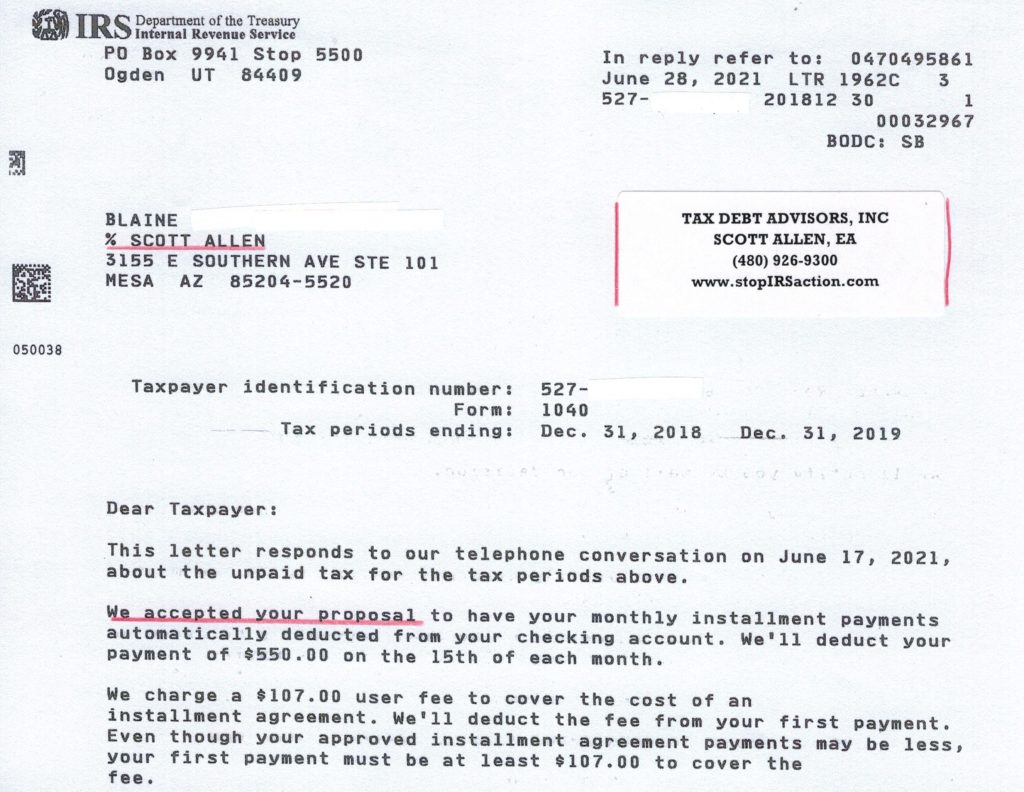

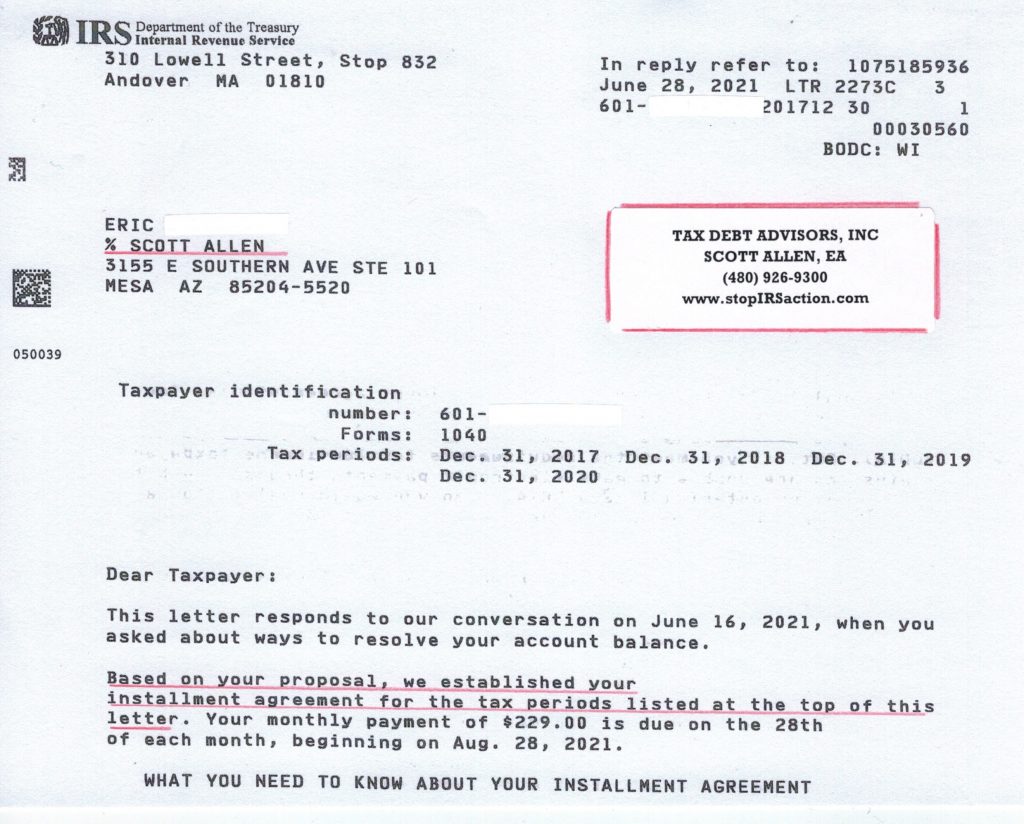

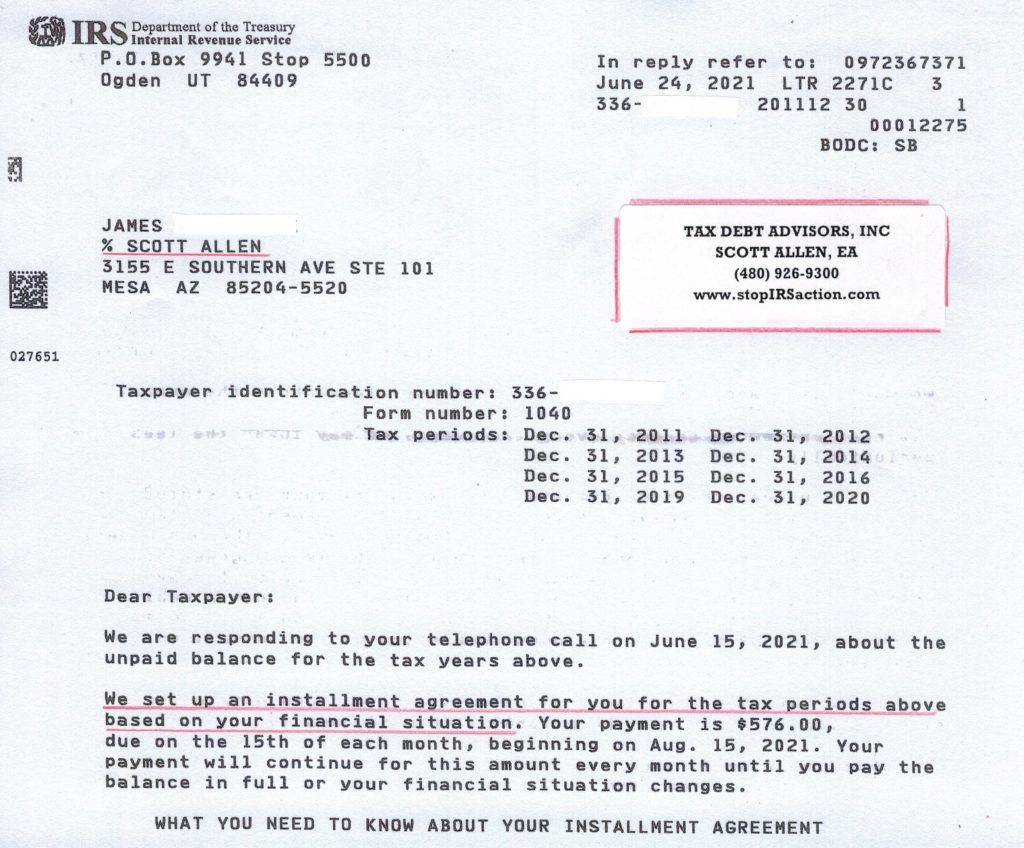

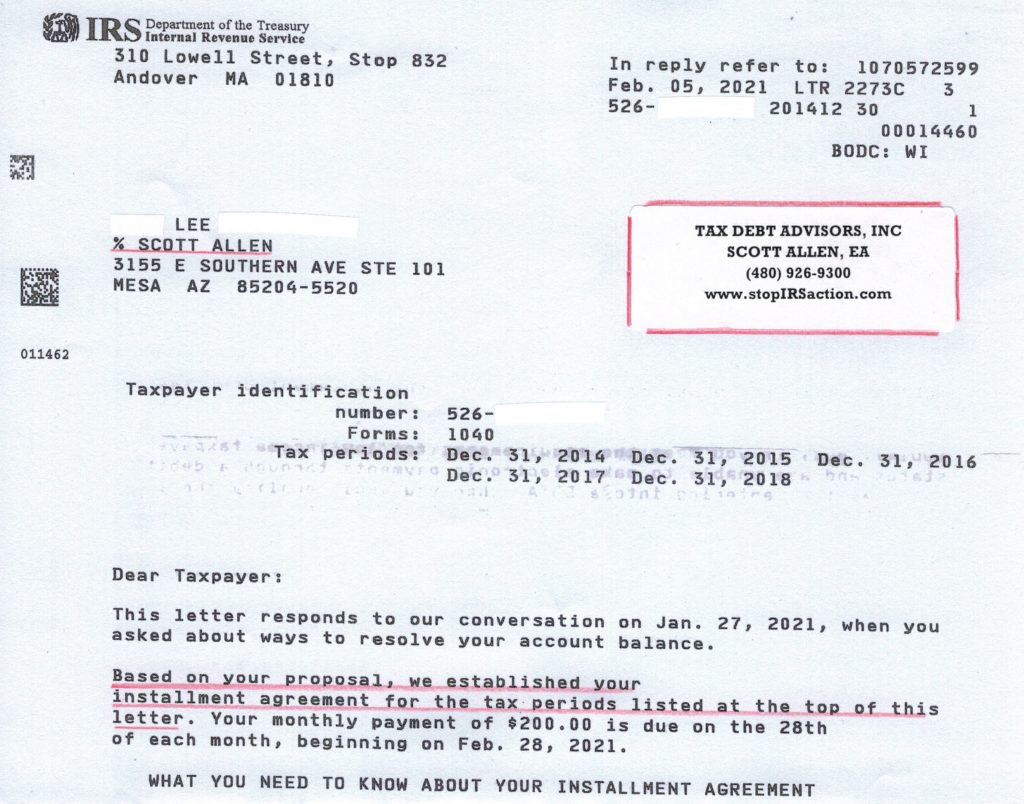

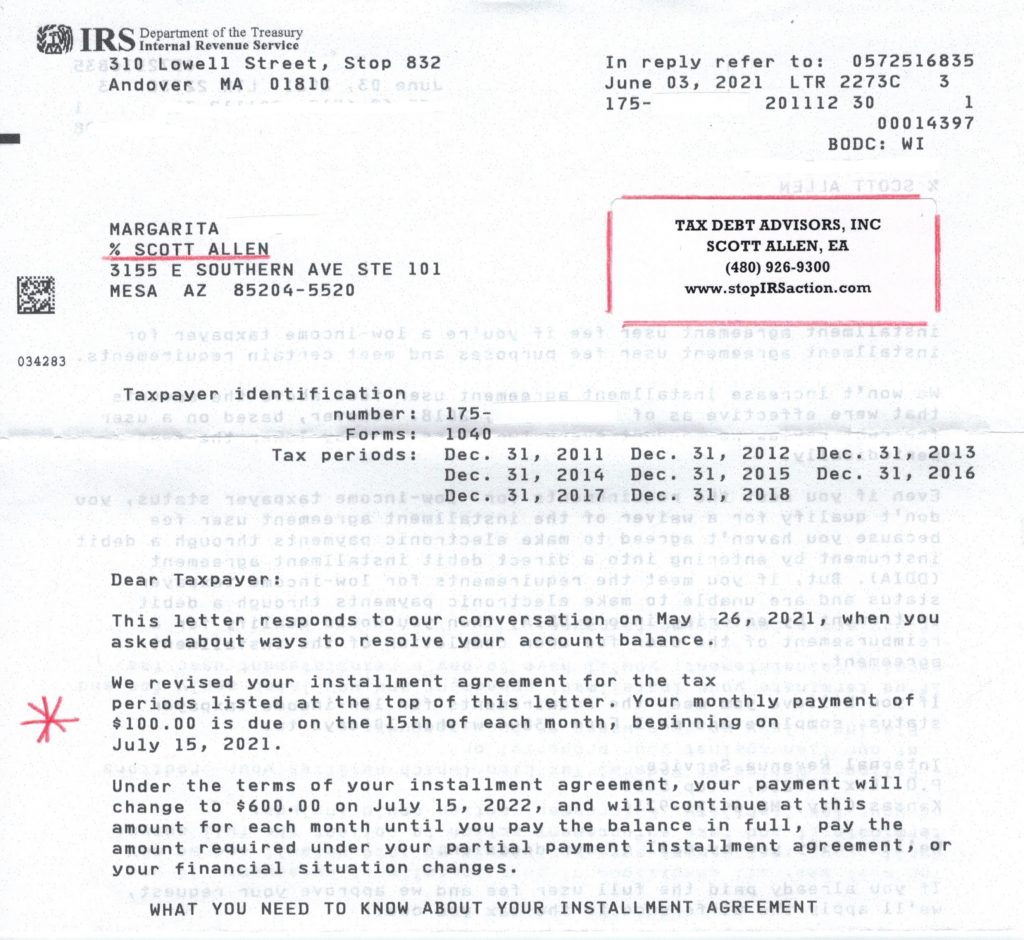

Scott Allen EA at Tax Debt Advisors specializes in filing back taxes and negotiation IRS settlements. He can do anything an attorney or CPA in these matters. His average client has not filed in 4-7 years and/or owes the IRS over $50,000. Put him to work today for you. He will meet with you for a free initial consultation and during that appointment he will outline the three-step plan towards a resolution.

Thank you.

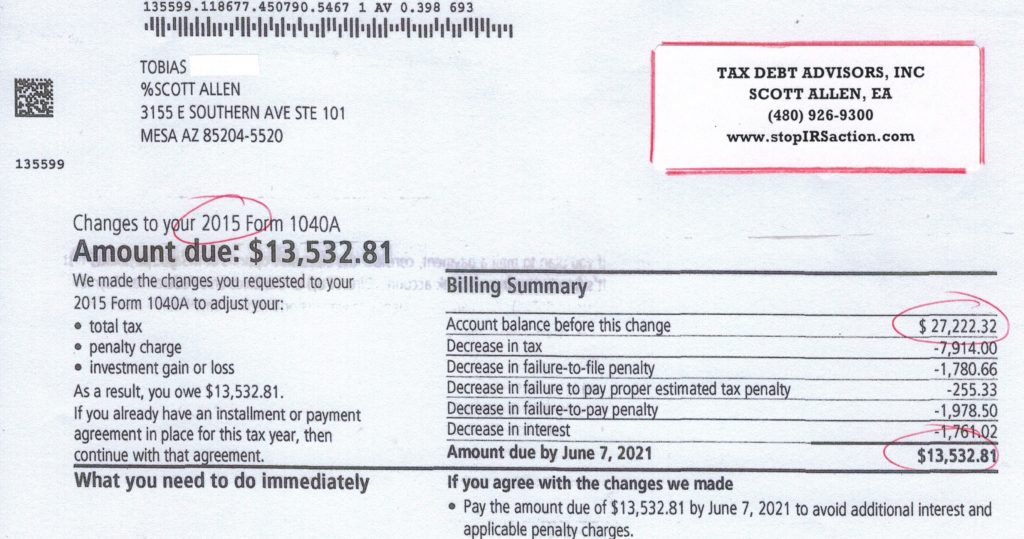

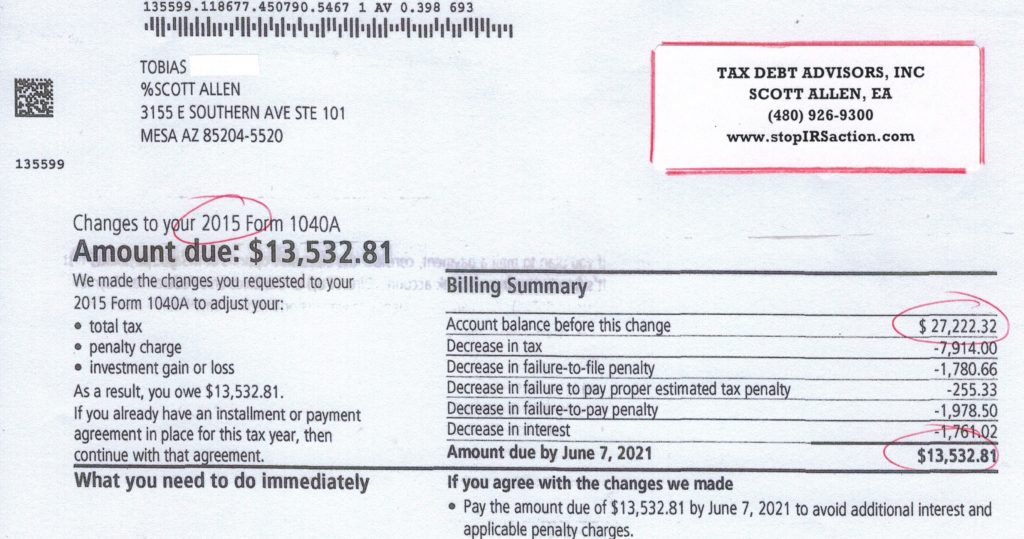

Mesa AZ Back Tax Returns can save a client $13,690

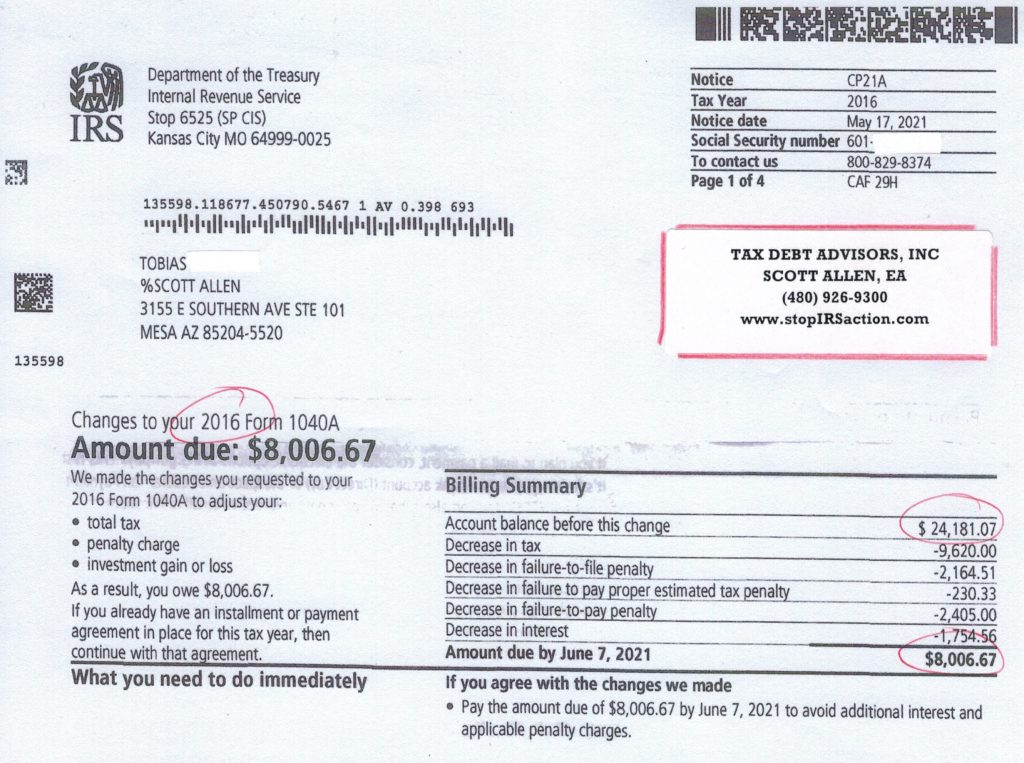

Tobias also had some serious Mesa AZ back tax returns that needed some correcting. Just like Blake, he also went through Scott Allen EA of Tax Debt Advisors to get his matter resolved. It took several months of work (mostly due to delays with covid-19) but it was accomplished. If you look at the notice below from the IRS on the 2015 tax year you will see what was removed from his debt with the IRS. Don’t pay back more to the Internal Revenue Service then you legally have to.

- Decrease in tax of $7,914

- Decrease in failure to file penalty of $1,780

- Decrease in failure to pay proper ES tax penalty of $255

- Decrease in failure to pay penalty of $1,978

- Decrease in interest of $1,761

Mesa AZ Back Tax Returns