Why do I need a Tempe AZ IRS Tax Attorney when I can’t pay what I owe the IRS?

Tempe AZ IRS Tax Attorney

First, your inability to pay the IRS is not a legal matter needing a Tempe AZ IRS Tax Attorney. Most clients that owe the IRS will have a problem or inability to pay what the IRS says they owe them before the debt is fully paid off. Some of the options available include:

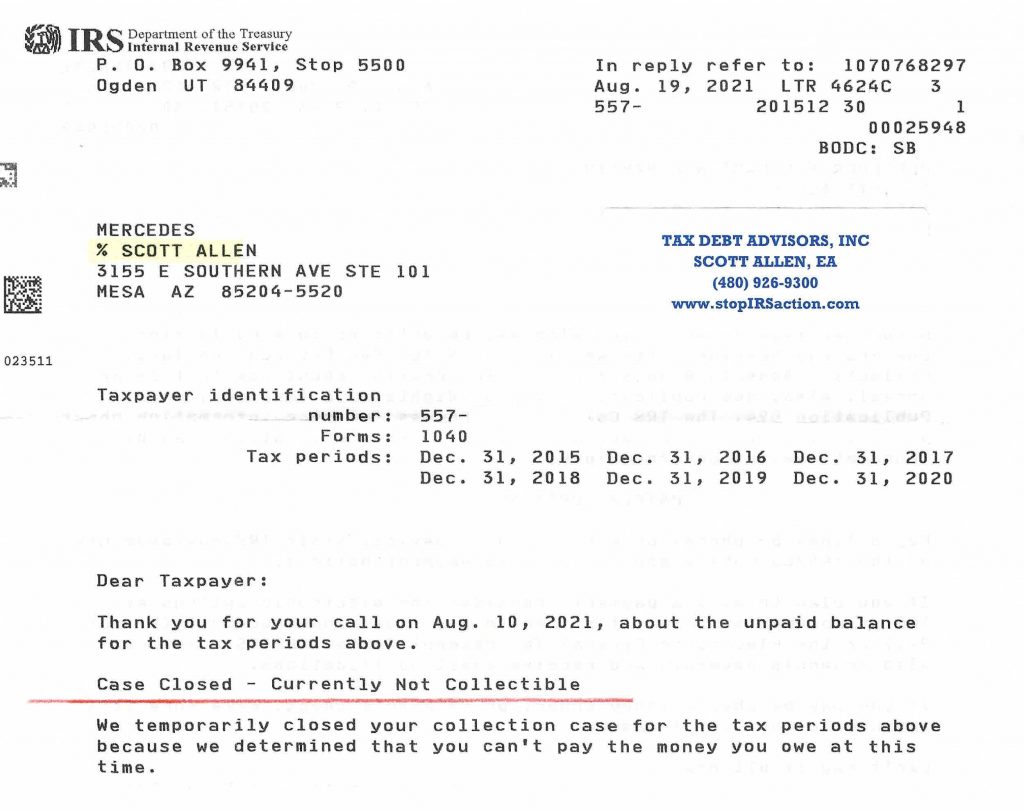

- Determine if you qualify for a non-collectible status.

- Determine if you qualify for an Offer in Compromise.

- Determine if you qualify to have your tax liability discharged in a bankruptcy.

- Determine if any of your interest or penalties can be abated.

- Determine if you should amend a previously filed tax return.

- Determine if you should request an audit reconsideration on a return that was audited—especially if you did not attend the audit and were denied all of your legitimate deductions.

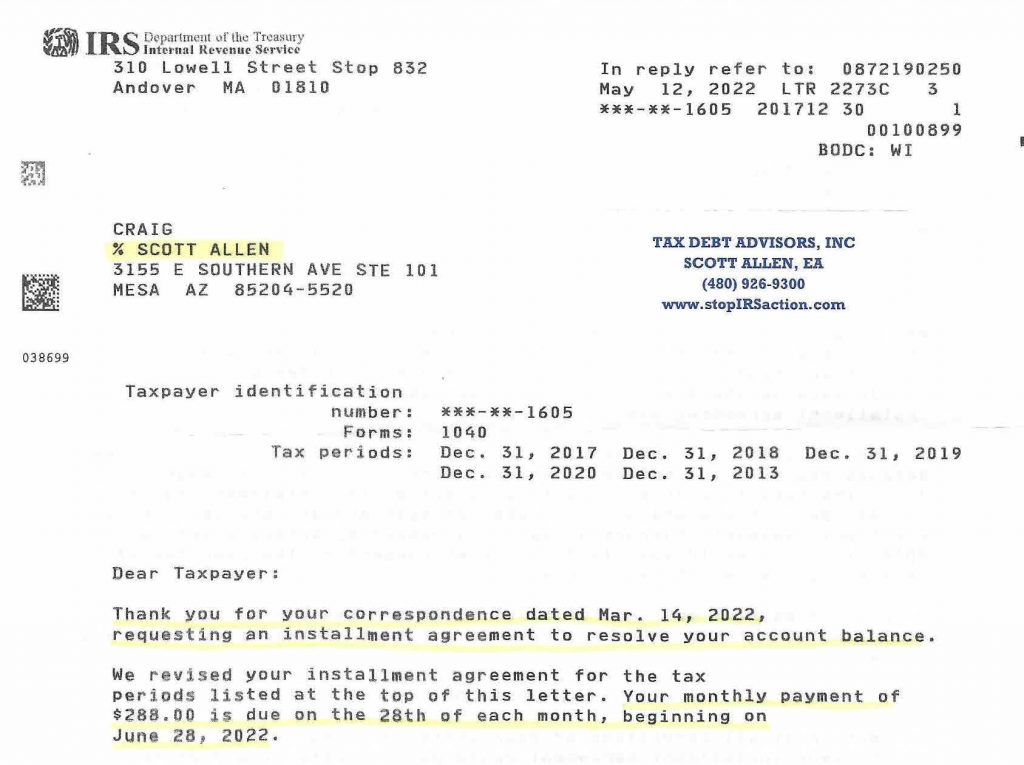

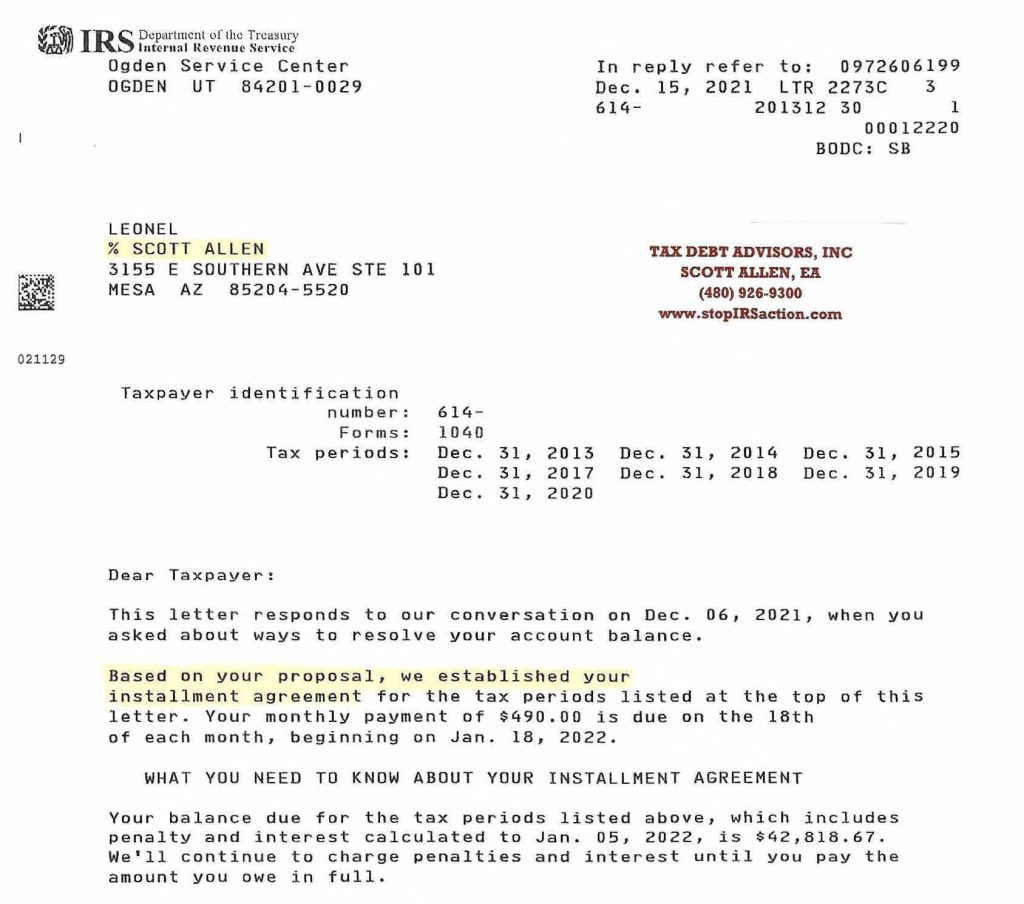

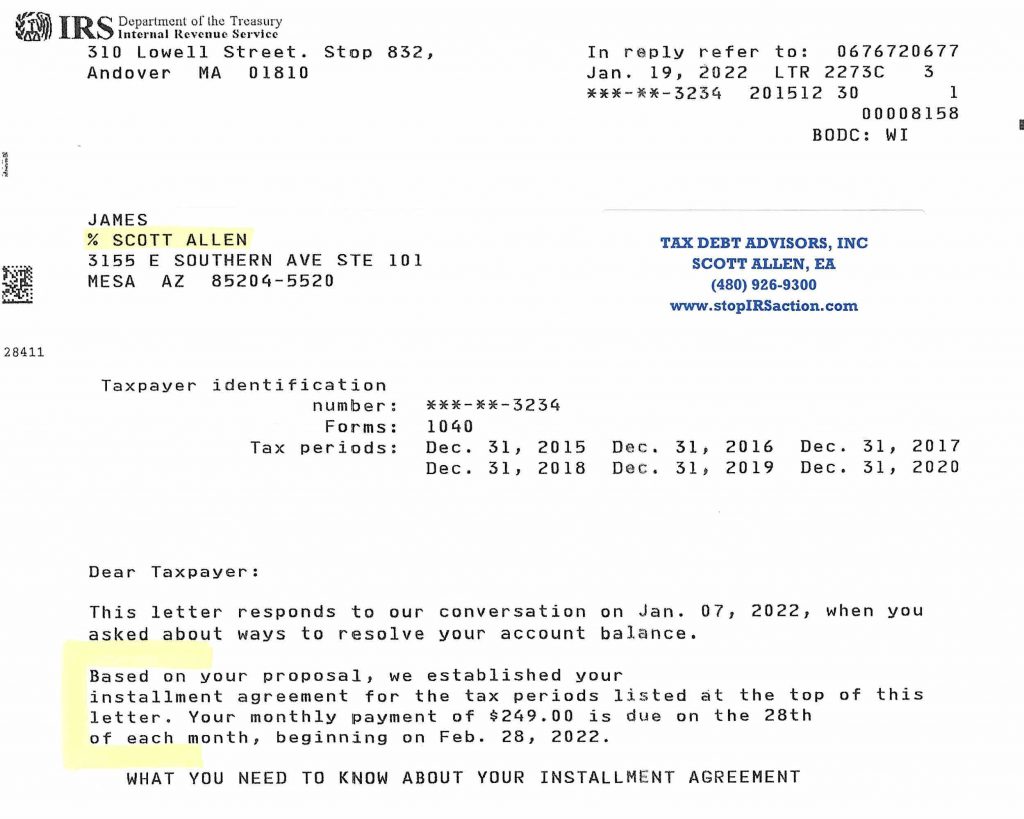

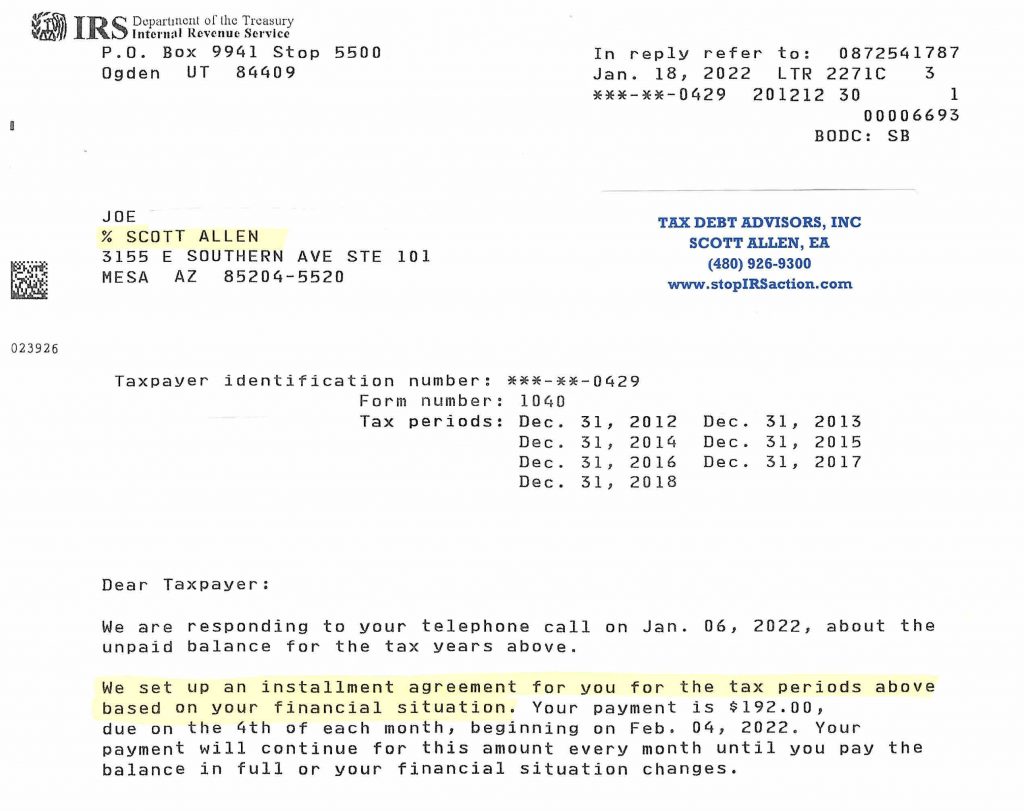

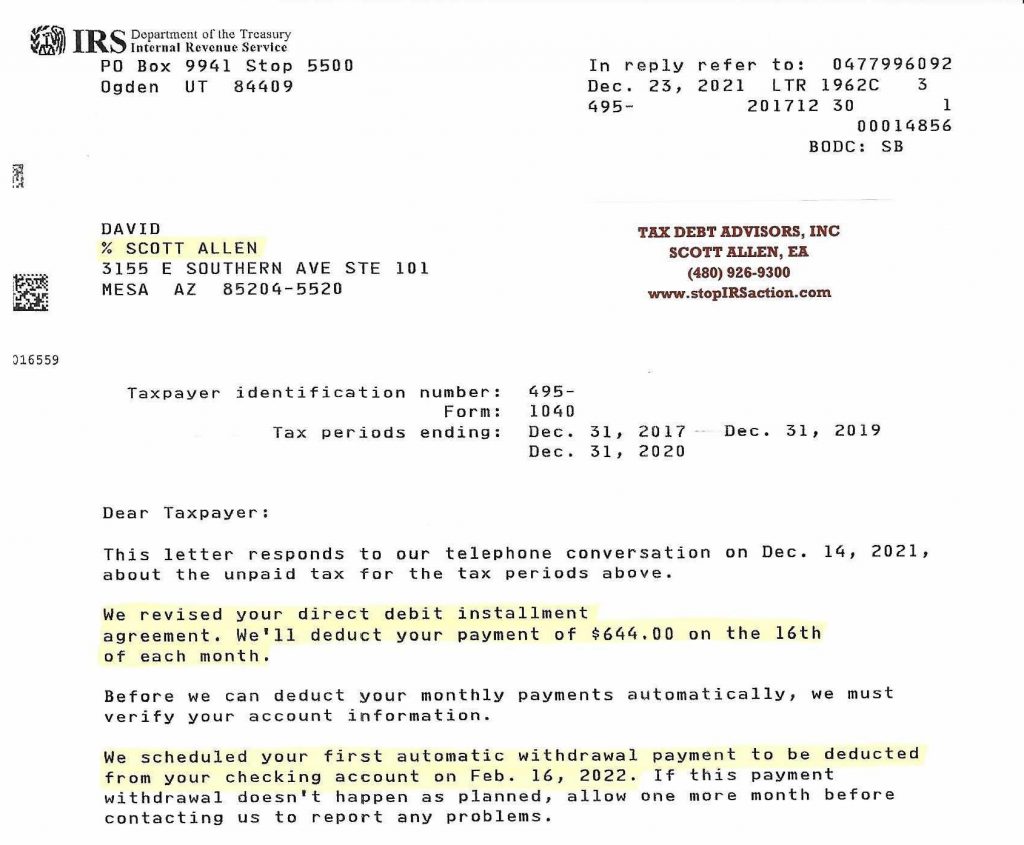

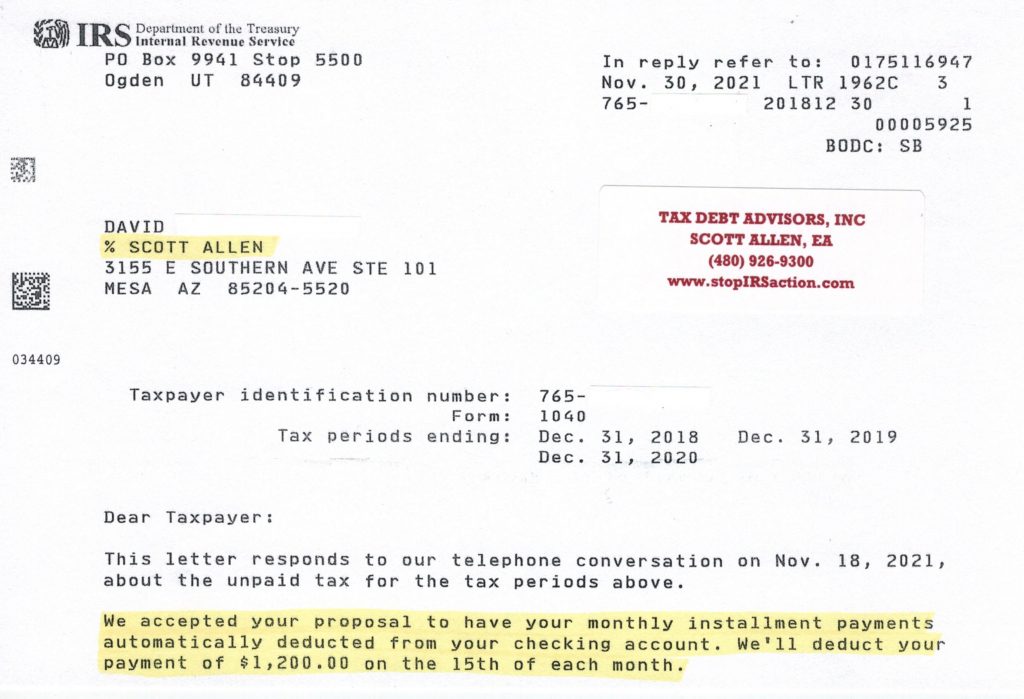

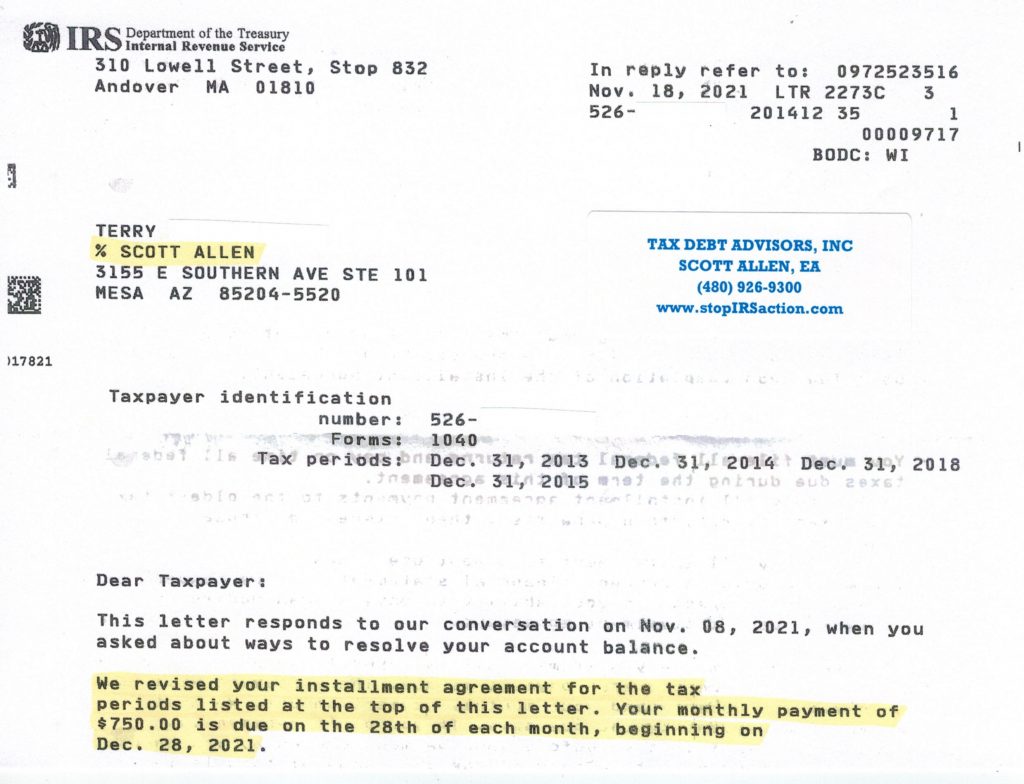

- Determine if you qualify for a reduction in your monthly IRS Installment Arrangement.

- Determine if you qualify for innocent spouse relief.

All of these options should be considered if you cannot pay the IRS what you owe. Scott Allen E.A is well versed in all of these IRS procedures and is available for a free consultation. He can be reached at 480-926-9300.

Tax Debt Advisors vs. Tempe AZ IRS Tax Attorney: It’s your choice.

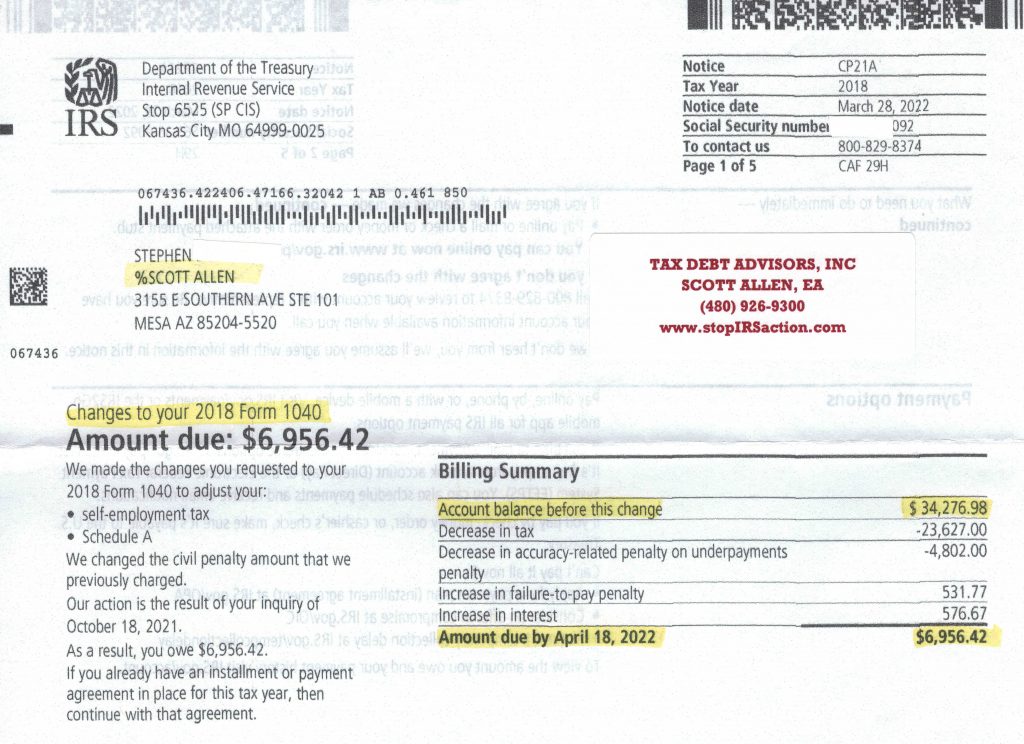

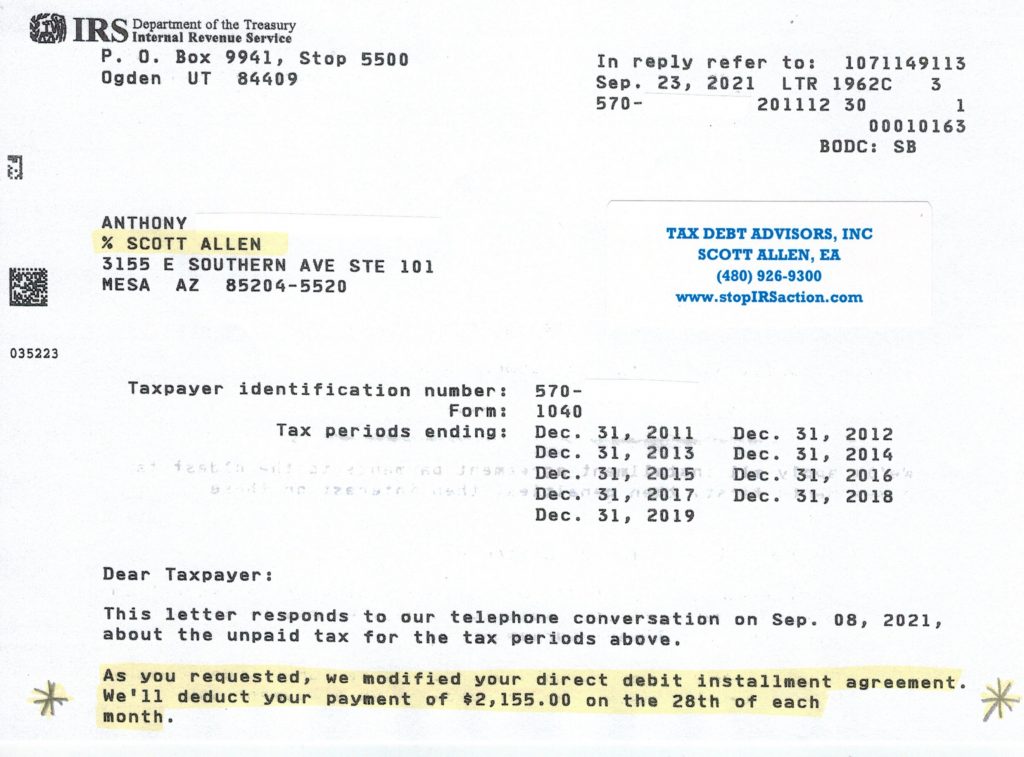

Tax Debt Advisors amended a clients tax return

Sometimes the best method is reviewing past tax return filings to see if anything can be amended. Scott Allen EA did that for his client Stephen and found out that he was being charged taxes on his gambling winnings but had not deducted his gambling losses. The IRS will allow a taxpayer to deduct their losses up to their winnings. After gathering up all the necessary documentation the return was amended and the client saved $27,000 in taxes. Check out the IRS notice below. After this was handled then the remaining amount was negotiated into a monthly payment plan to get it paid off as quickly as possible.