Chandler Arizona IRS Tax Attorneys Rely on Your Fear of the IRS

Don’t be afraid of the IRS

If you are afraid of the IRS, you could be putting yourself in harms way by using Chandler Arizona IRS Tax attorneys. During the last 40+ years of representing clients, our company has seen literally thousands of taxpayers go from panic when they get a letter from the IRS to suicidal after visiting IRS tax attorneys who uses fear as a way of intimidating taxpayers into thinking they have to hire one or they will lose everything they have worked for or worse go to jail or prison. It is not too harsh to say that IRS tax attorneys prey on vulnerable taxpayers who put far too much confidence in legal representation when they actually only need IRS representation. There is a big difference. Legal representation is only needed when a taxpayer has committed a crime. It is not criminal that you did not file back tax returns or pay your taxes. In these two cases and many others you need IRS representation.

Contact Scott Allen E. A. for IRS representation and let go of the fear and replace it with anticipation that your IRS problem with successfully resolved without being emotionally vulnerable. Scott can be reached for a free no obligation evaluation of your IRS problem at 480-926-9300.

Example of a client using IRS representation

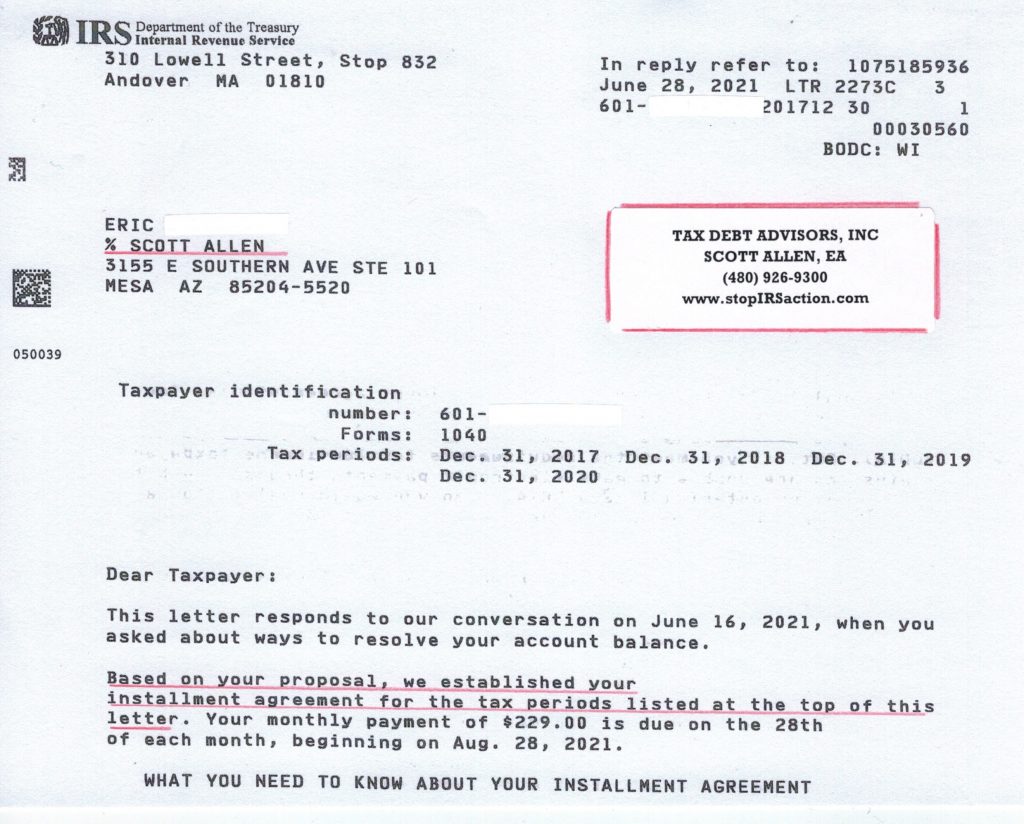

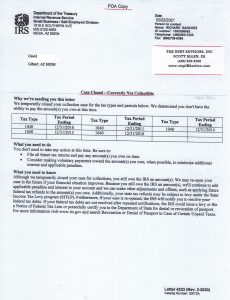

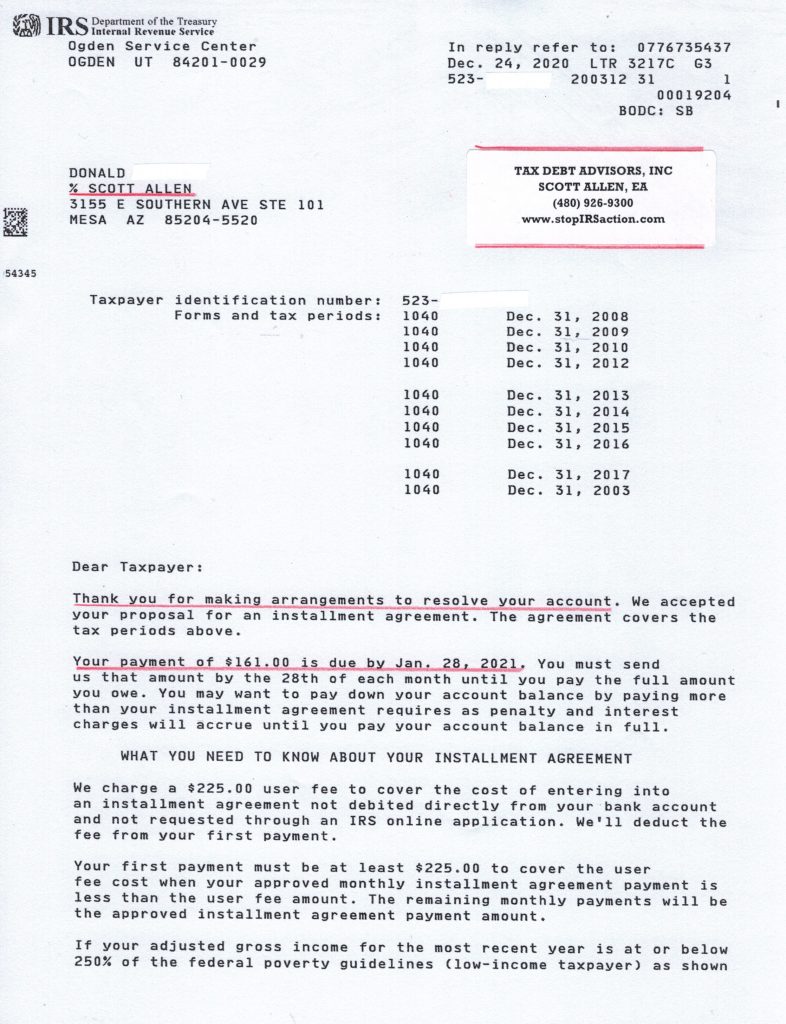

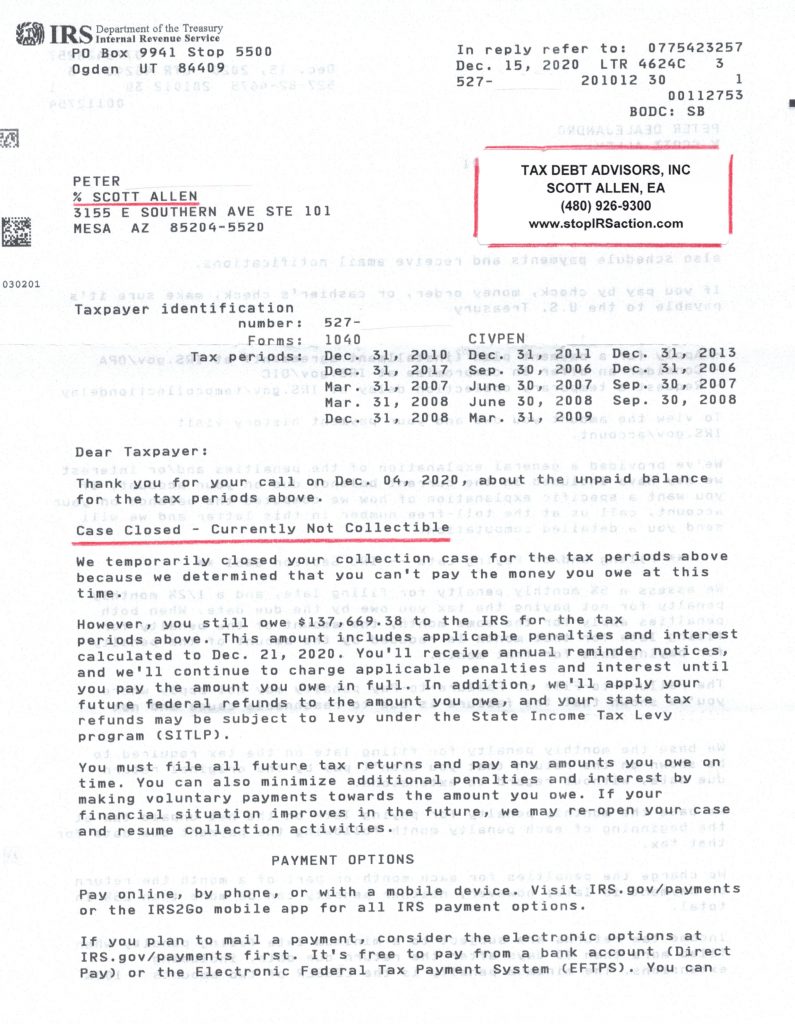

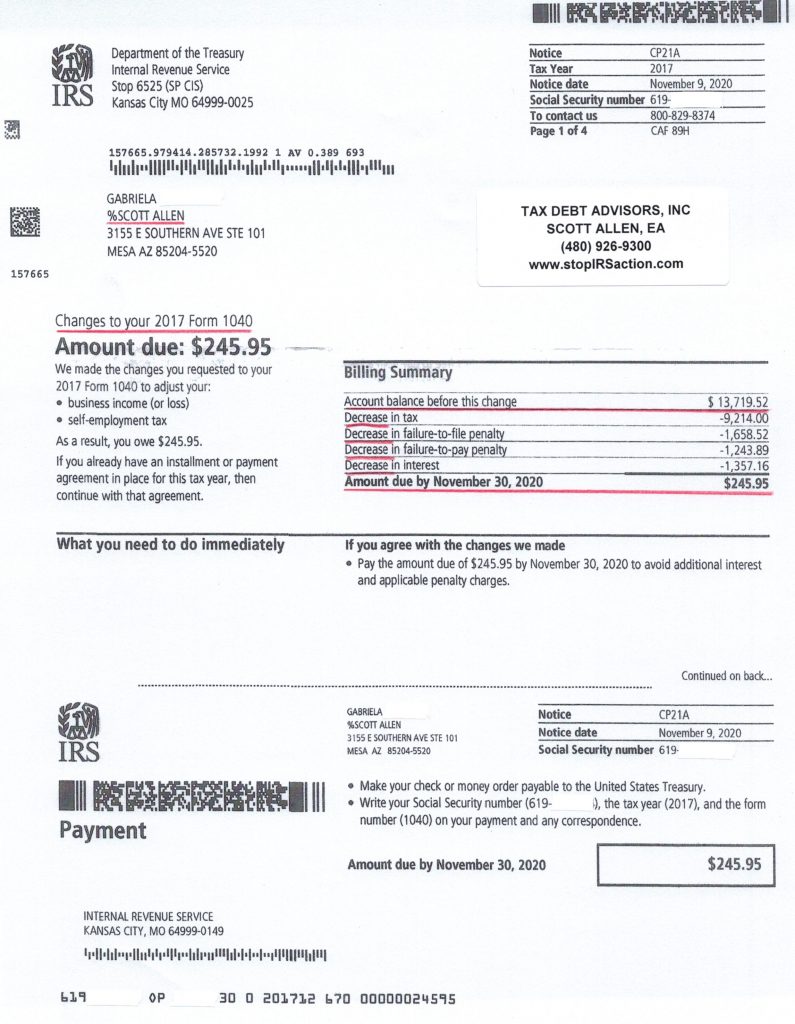

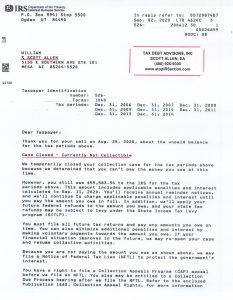

Eric was behind on his taxes and needed to negotiate an IRS settlement with them. He put his trust in Scott Allen E.A. and hired him rather then Chandler Arizona IRS tax attorneys. See the success for yourself, below is the IRS letter of approval.