Chandler, AZ IRS Tax Attorneys: What to watch out for..Must Read!

Avoid Getting Ripped off by Chandler AZ IRS Tax Attorneys on your IRS Problem

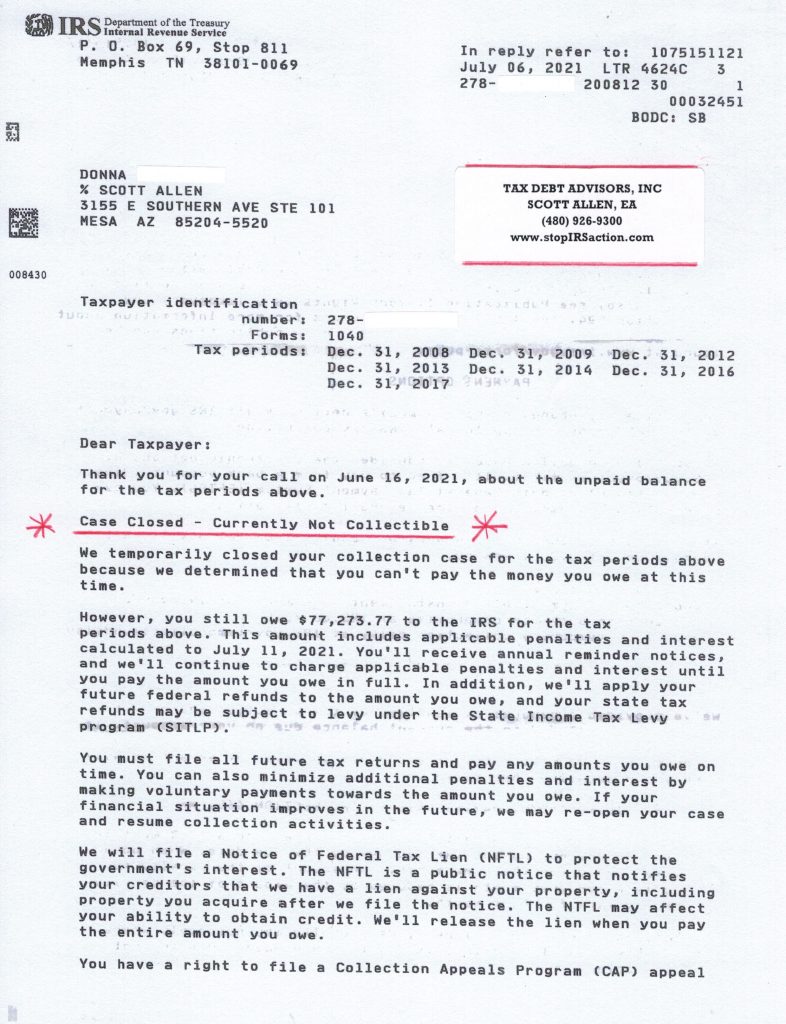

Most taxpayers have a fear of being a victim of IRS collection procedures. This does occur on occasion but the real fear is being ripped off by Chandler AZ IRS Tax Attorneys who have the advantage of using intimidating scare tactics. Over the last 45 years we have seen this occur thousands of times. One example might be representative of what occurs all too often. We had a client who received a letter in the mail regarding a “Collection Due Process Hearing.” Those four words scared our client to call an IRS Tax attorney in Chandler Arizona who took advantage of our client by charging her $2,500 to handle the matter. All that was involved was signing a one page form and mailing it in. Then a few weeks later he called her to tell her of the date of the hearing and asked for more money. She didn’t have any more money and contacted us. When we checked into it there was no reason at all for the Chandler AZ Tax attorney to file for a collection due process hearing. There was no reason to dispute the tax due and we promptly put our client into a non-collectible status for less than $585. Clients often think because they have an IRS problem they have committed a crime. This is not the case in almost 100% of the time. So why burden yourself financially and emotionally with someone who will take advantage of your using scare tactics and making you feel that you are a criminal. The reverse is often true–the Chandler Tax IRS attorney who is scamming you out of your hard earned money.

If she had continued working with this Chandler IRS tax attorney, and the story is the same with most IRS tax attorneys Chandler AZ, she would have ended up spending over $8,000 and possibly not have ended up not needing to pay the IRS a monthly amount. Our company has resolved over 113,000 IRS debts. We are a family business and it is owned and operated by the second generation, Scott Allen E.A. Contact Scott and get a straight answer. If he can help you, you can be assured that he will do the job right the first time at a fair fee. Scott can be reached at 480-926-9300 and can generally schedule you for an appointment within 48 hours and if you leave a message, he will promptly return the call within the hour. We have represented tax clients all over Chandler, AZ including such zip codes as 85286 and 85224. Remember, before calling a Chandler Arizona IRS Tax Attorney please allow Scott Allen, E.A. with Tax Debt Advisors, Inc. to meet with you for a free 1 hour consultation.

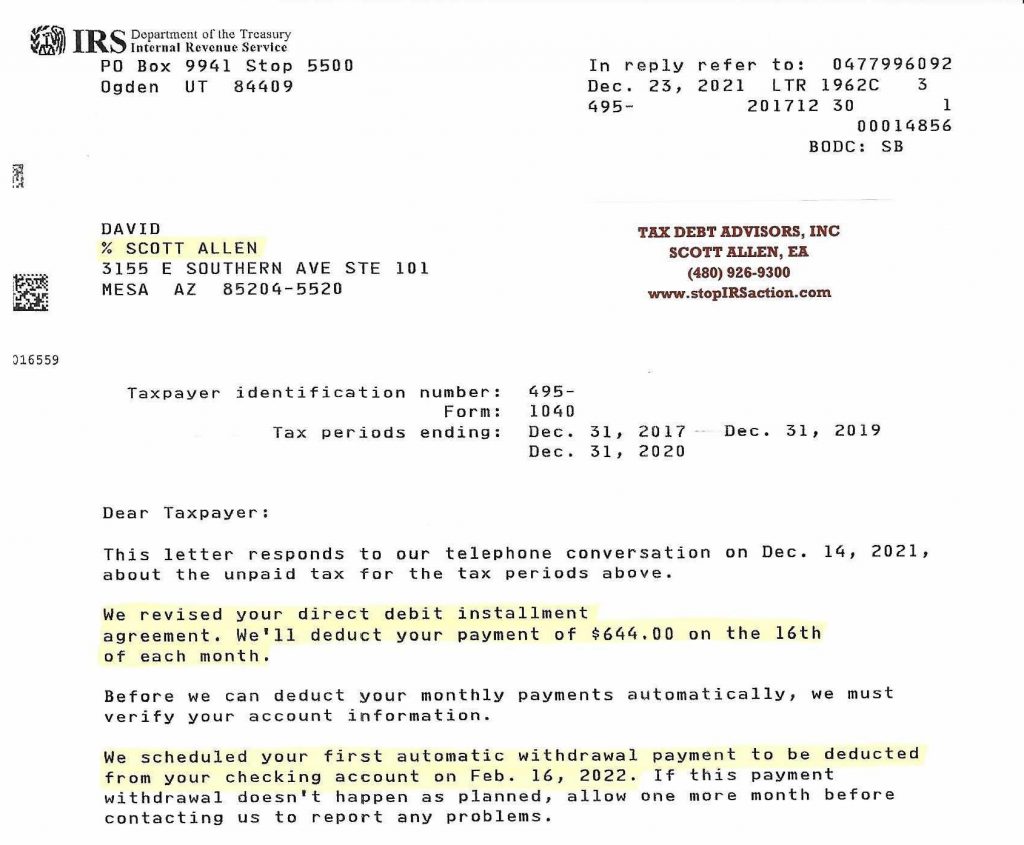

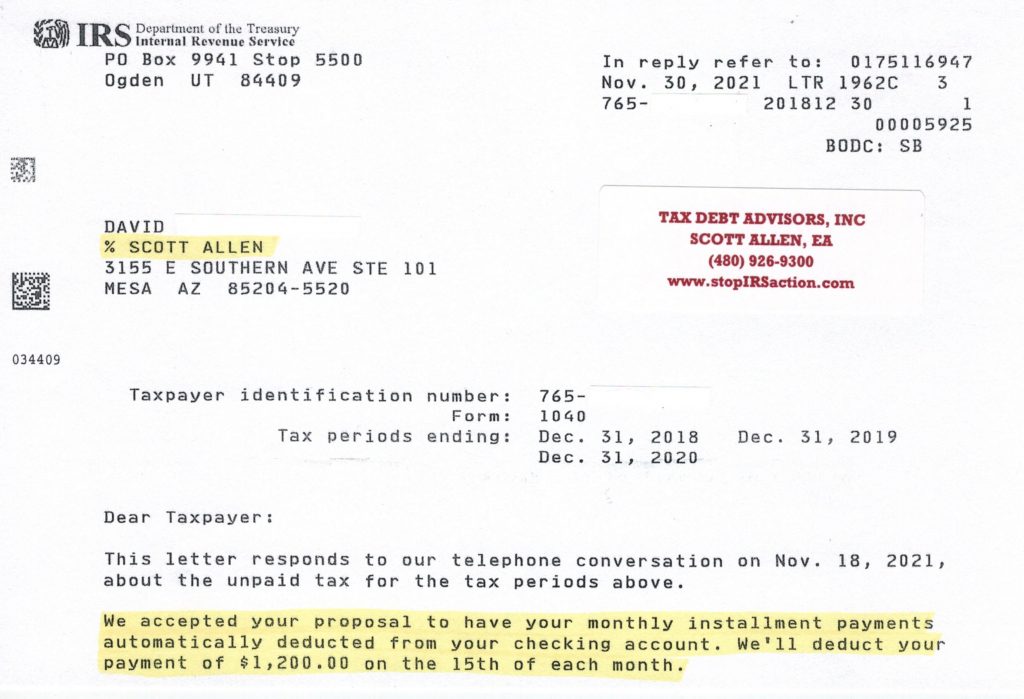

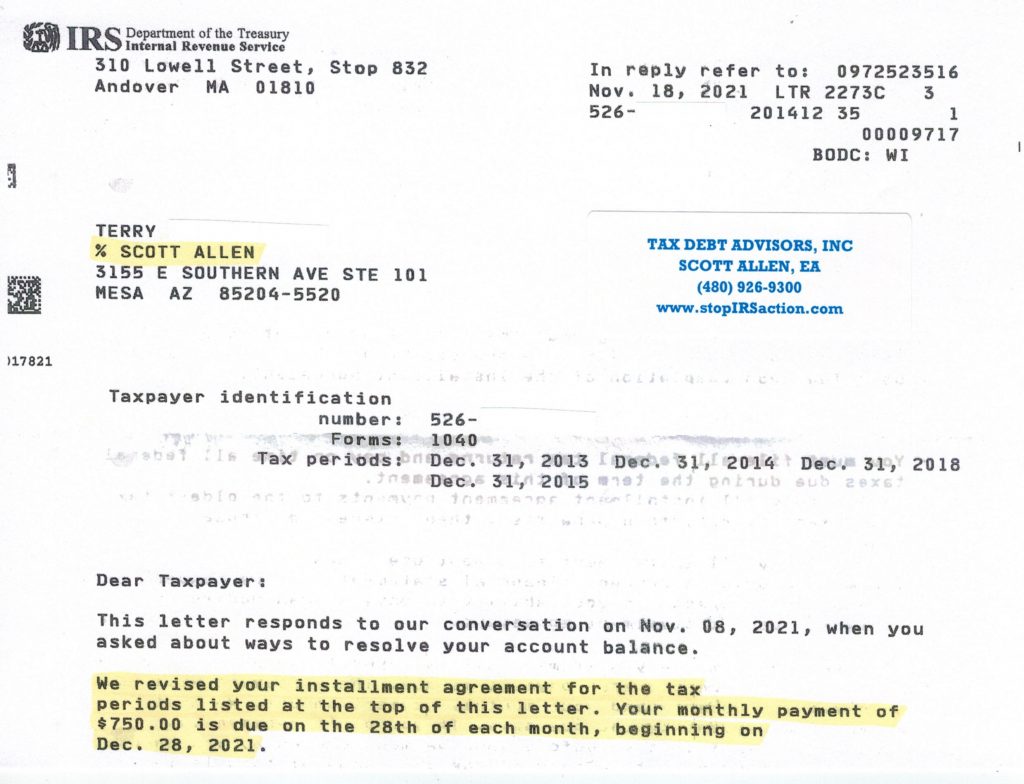

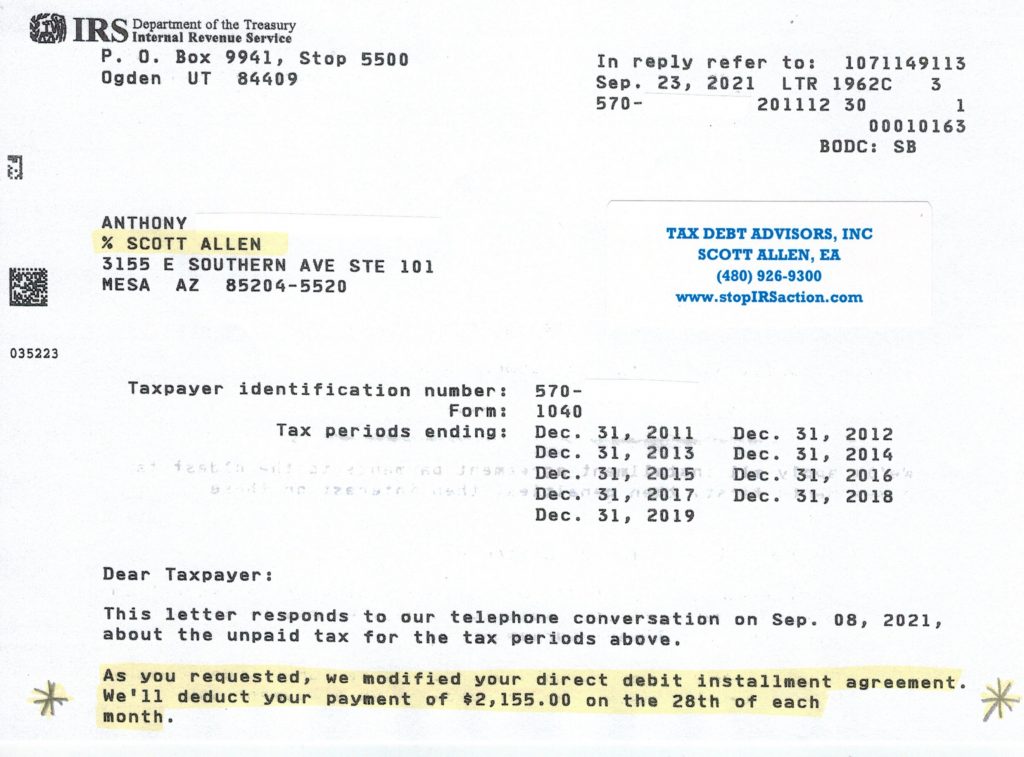

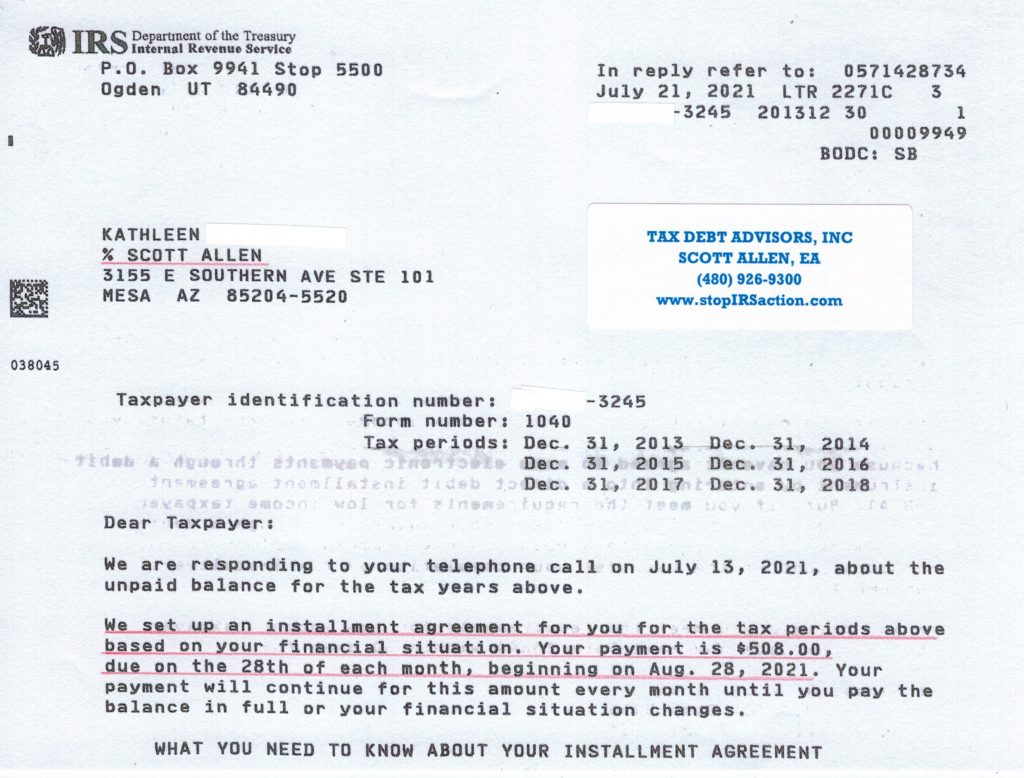

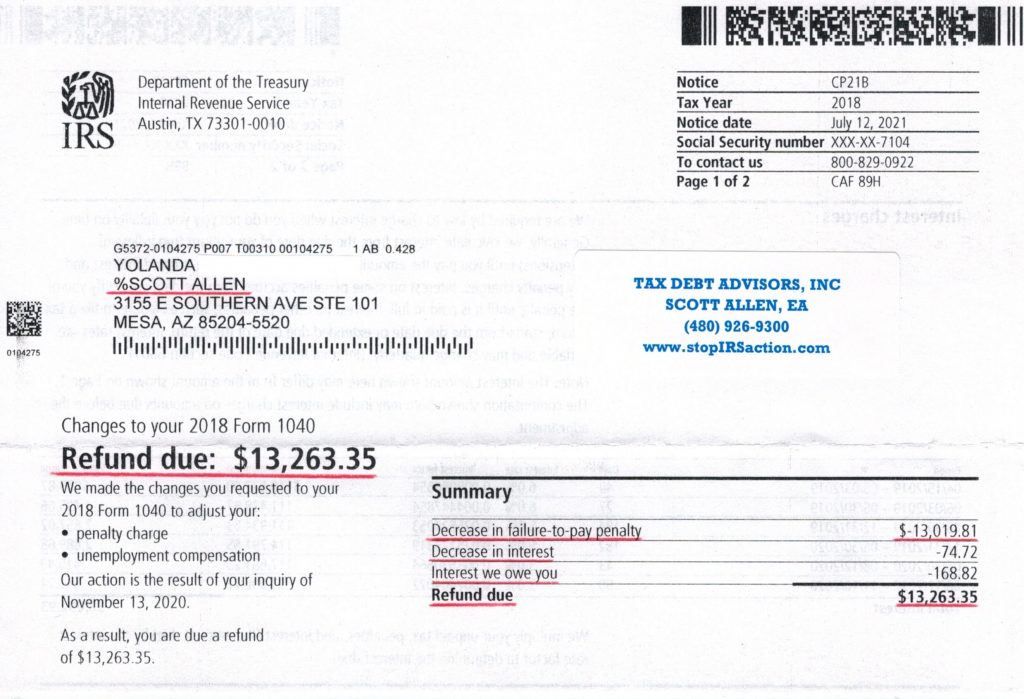

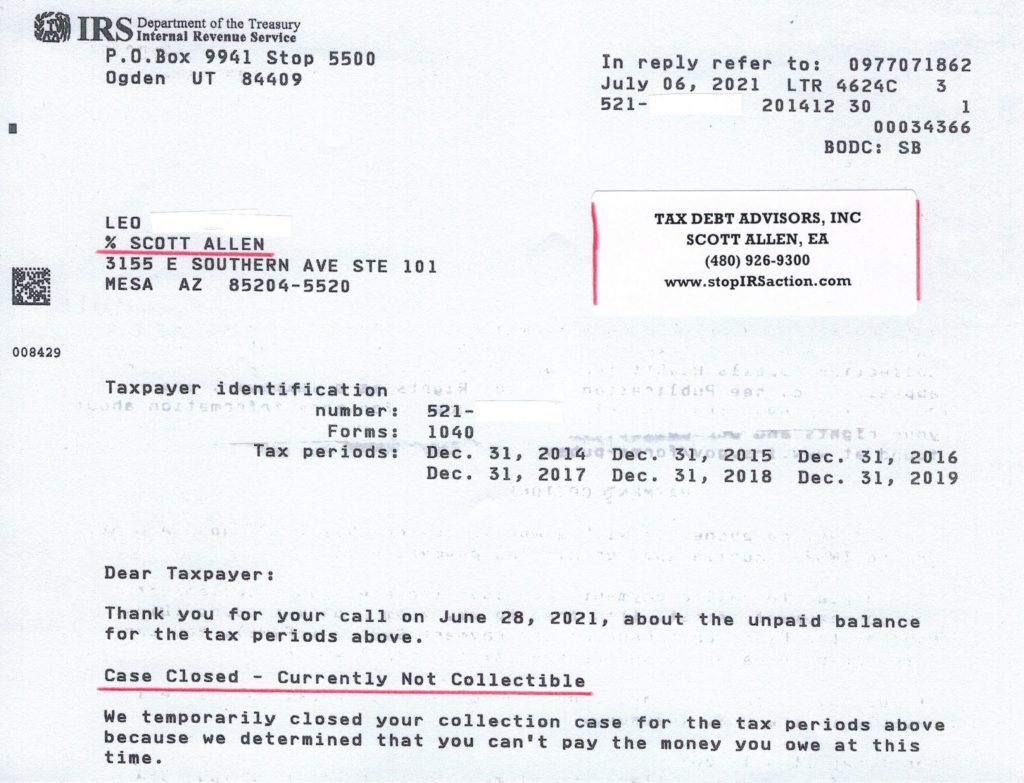

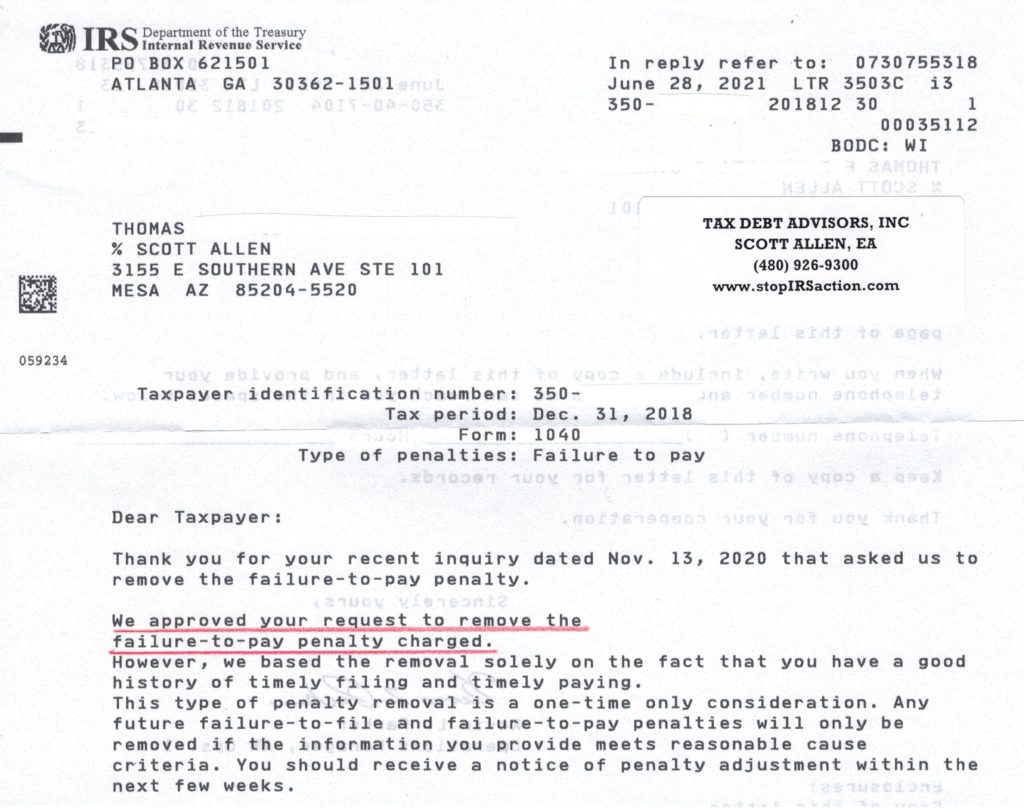

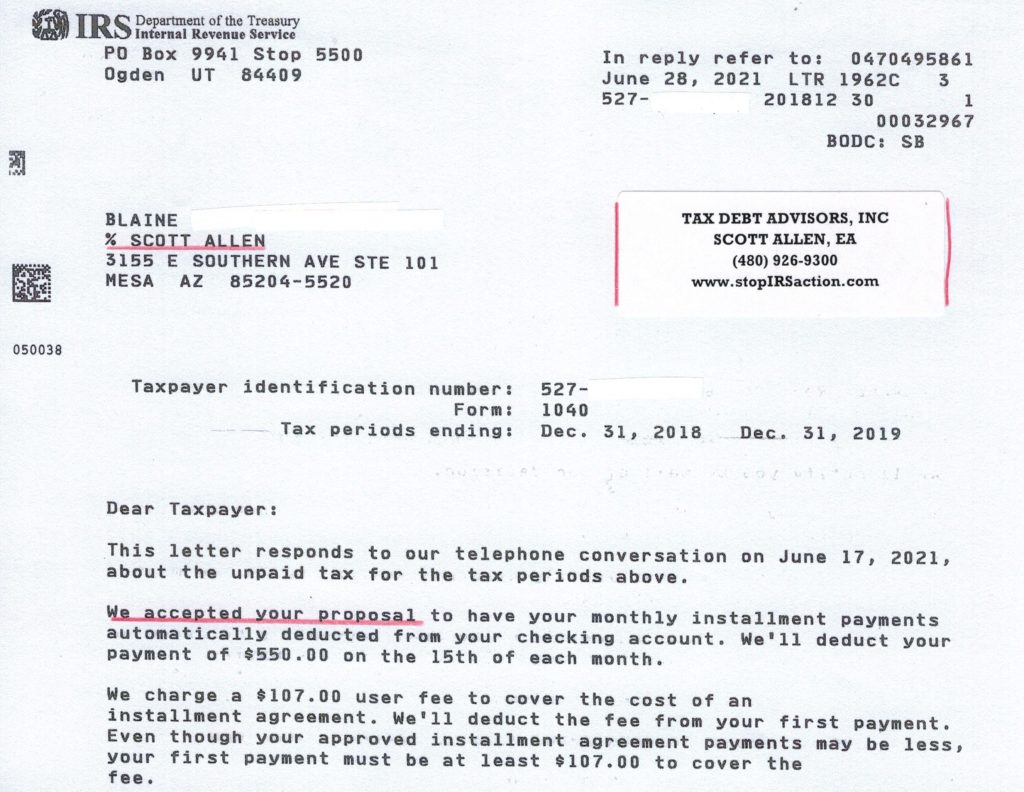

See a recent example of work completed by Tax Debt Advisors, Inc

David and his wife did not need to hire a tax attorney either. Scott Allen EA of Tax Debt Advisors was able to navigate his IRS problems for him. He corrected a couple of tax filings and entered them into a very reasonable payment plan. Review the IRS notice below. Mission completed right before Christmas!