IRS help in Mesa AZ

If you live in or near Mesa, Arizona and have an IRS Problem you owe it to yourself to have a free initial confidential consultation with Scott Allen E. A.

Consider the following:

- Tax Debt Advisors, Inc has been providing IRS help since 1977—that is over 45 years.

- Tax Debt Advisors, Inc is a family owned and operated second generation business.

- Tax Debt Advisors, Inc has successfully settled over 113,000 IRS tax debts.

- We can provide referrals of past clients you can talk to—we don’t make up testimonials with initials and cities that don’t exist.

- Our fees are competitive and fairly priced for the work we provide. You pay as you go along so you are confident that you are getting what you paid for from the very first day.

- We can provide referrals to an Attorney if you need to file a bankruptcy or are dealing with criminal issues.

- You will always meet with Scott Allen and he returns calls promptly—usually within 45 minutes during normal business hours.

- Our office is conveniently located with easy freeway access if you live outside of Mesa.

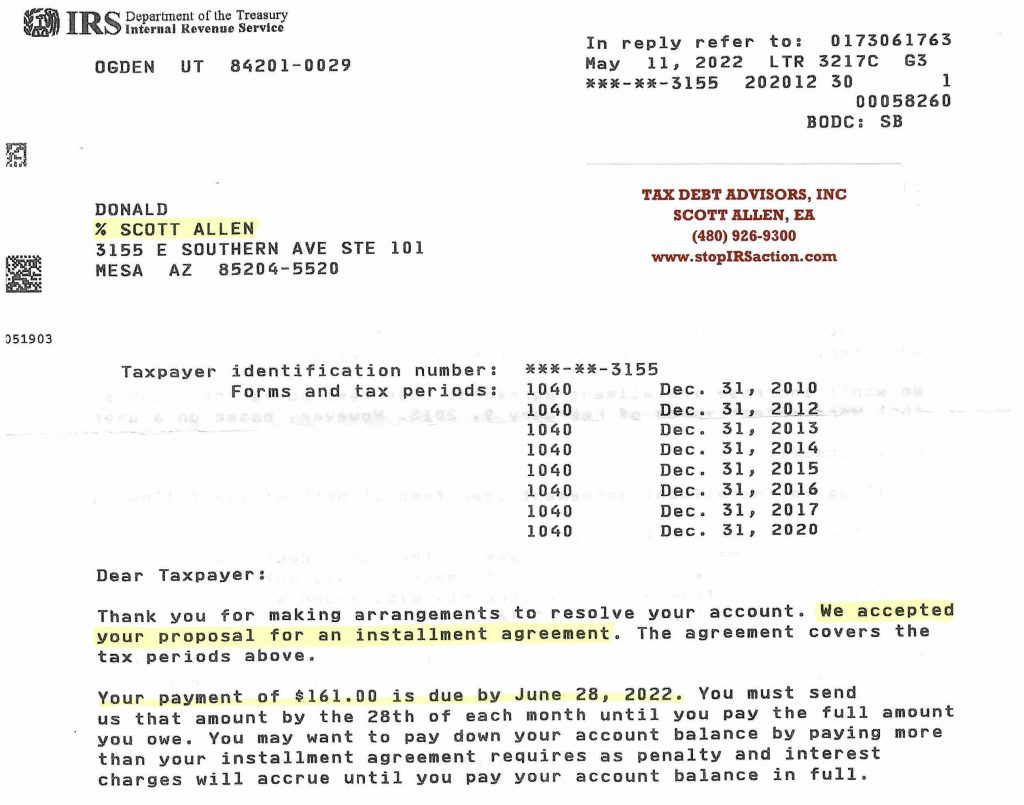

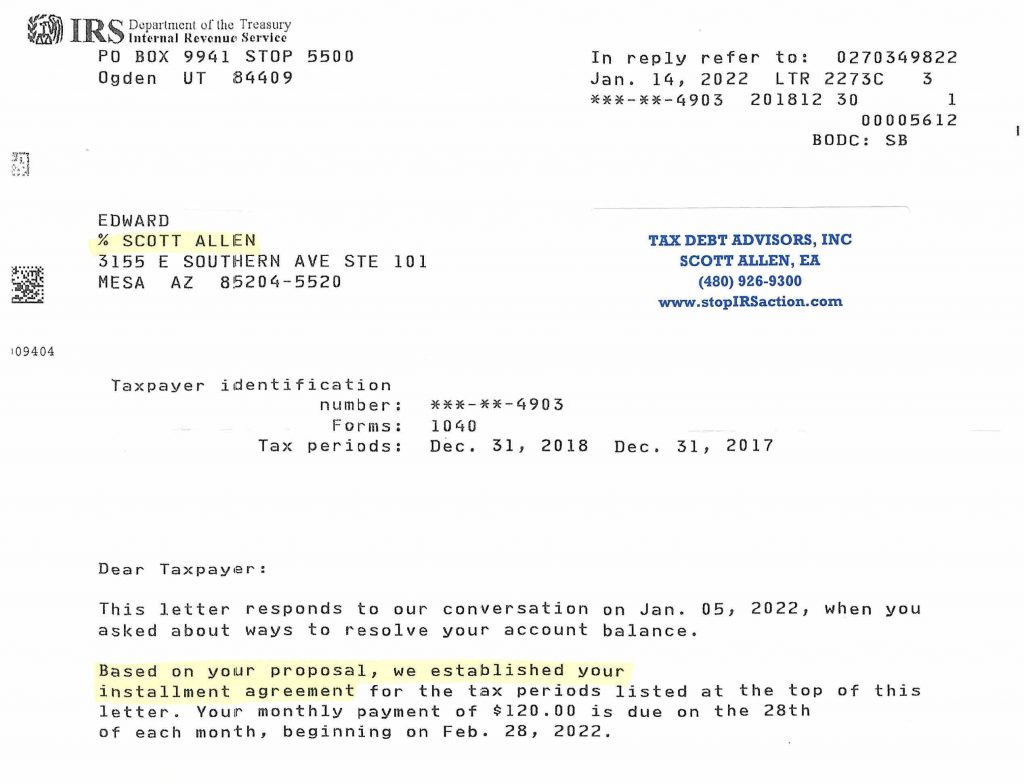

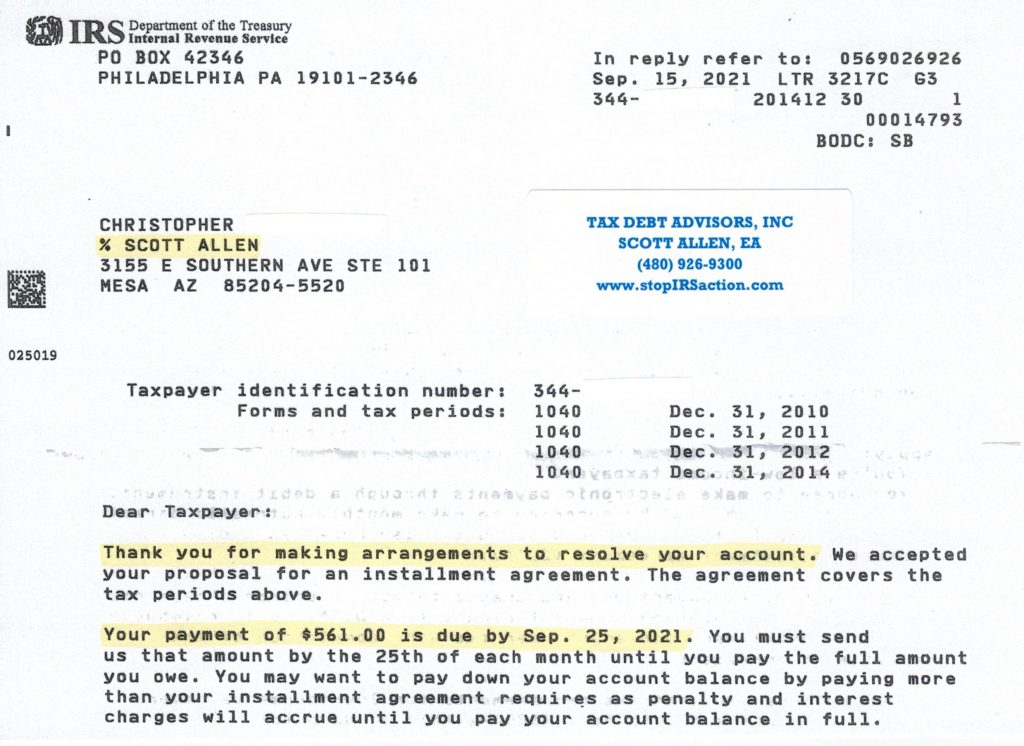

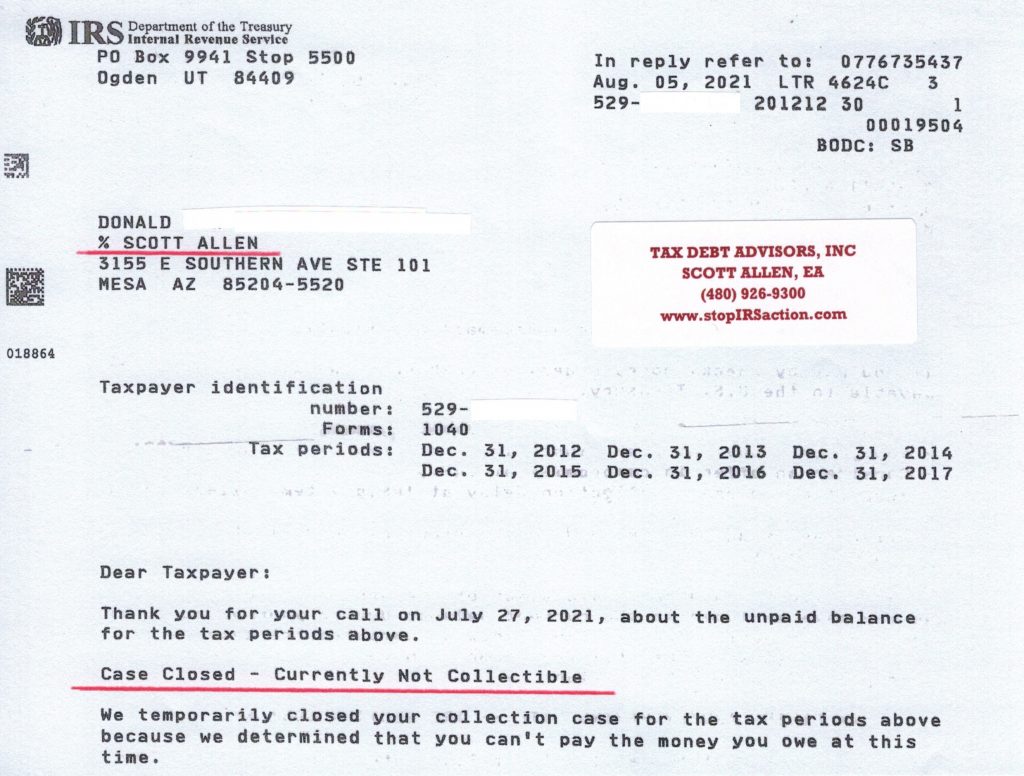

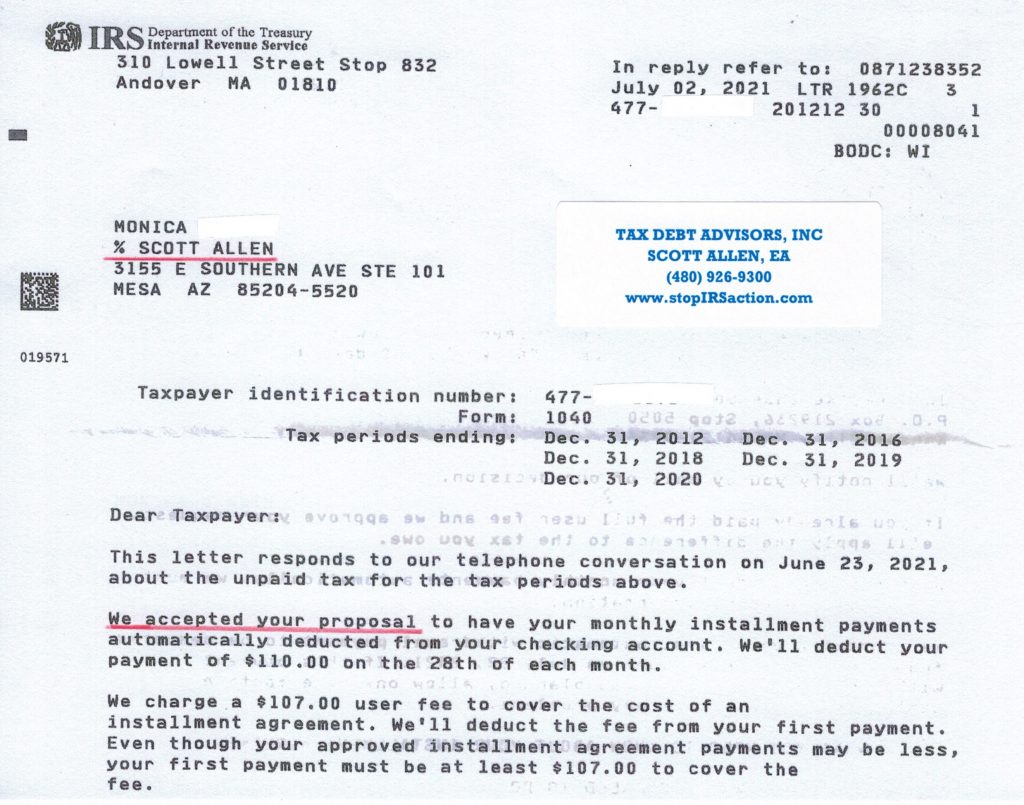

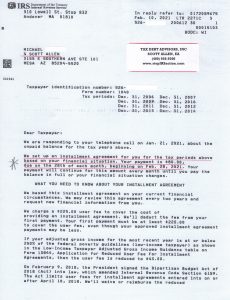

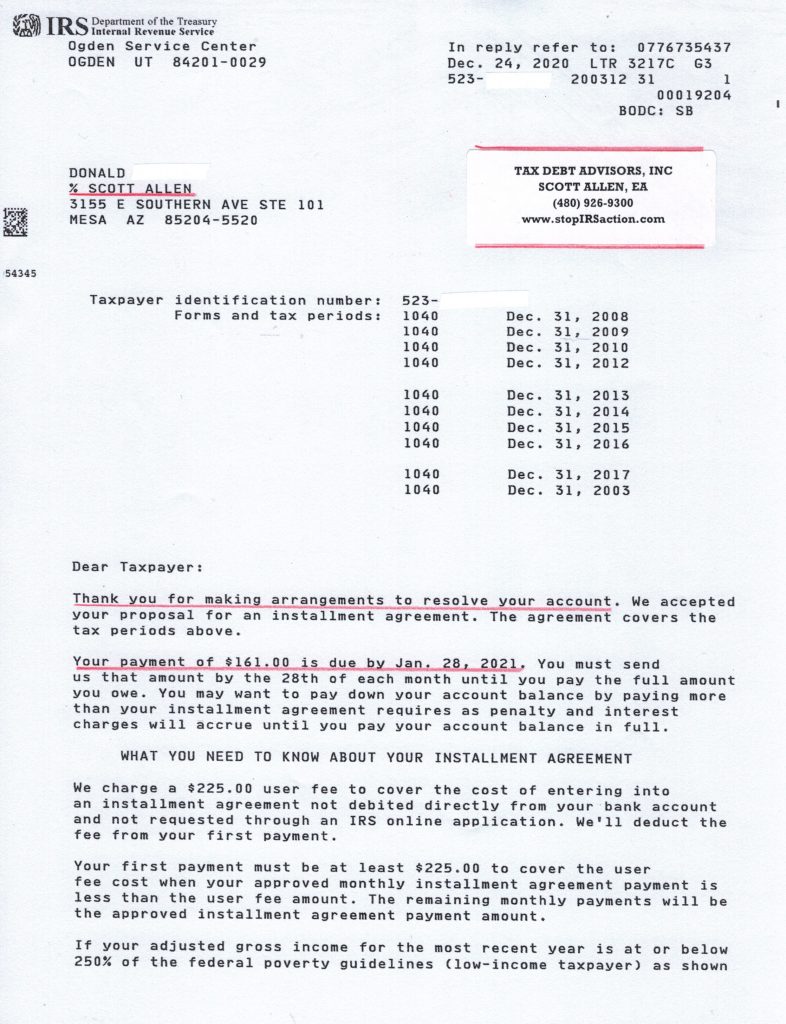

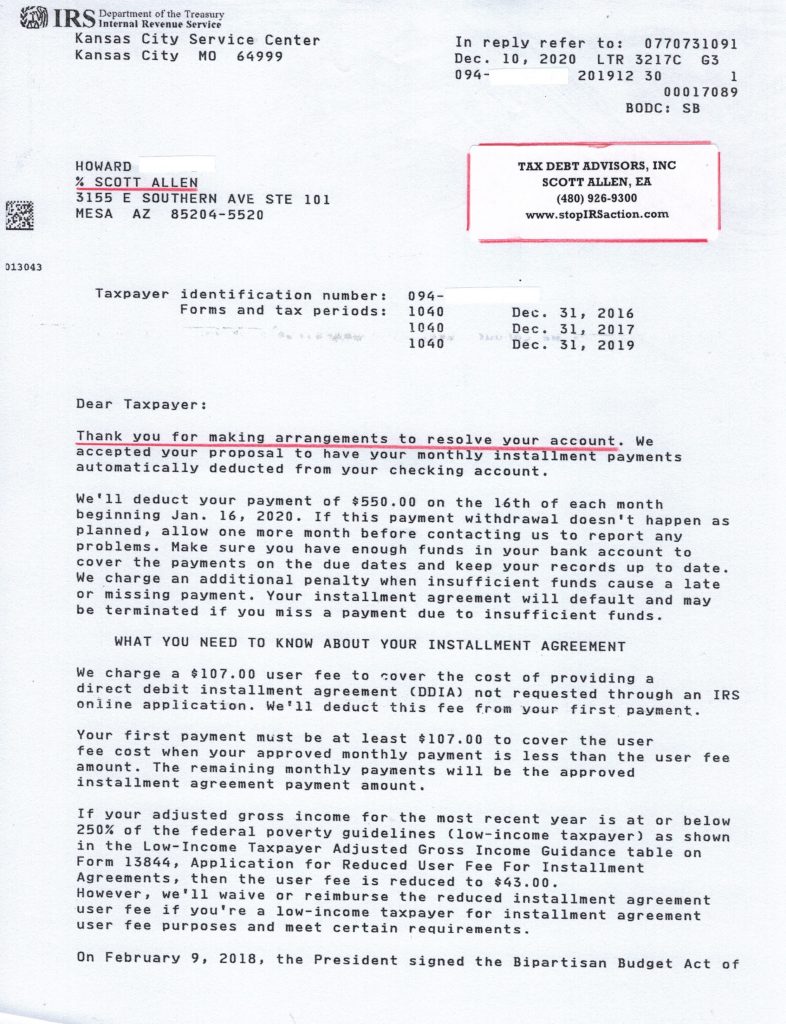

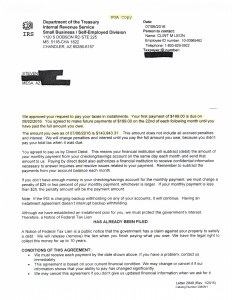

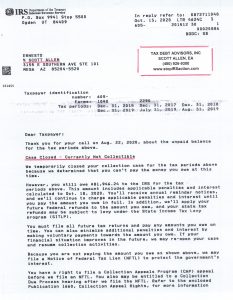

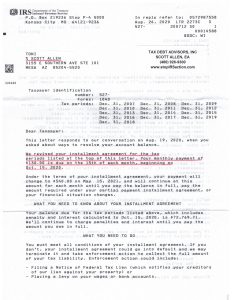

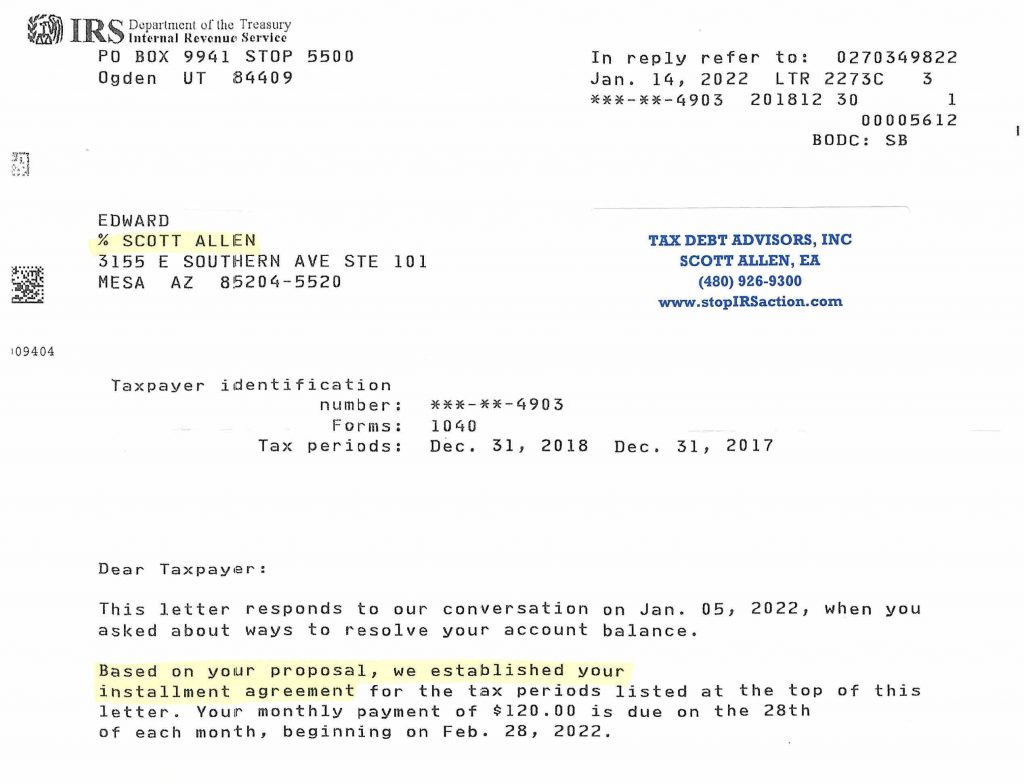

Below is an example of actual proof of a successful negotiation by Tax Debt Advisors, Inc. Edward owed on a couple years for back taxes and the IRS was garnishing is social security income. Upon representing him as his power of attorney they were able to stop the garnishment and negotiate the total IRS debt into a low monthly payment plan of $120 per month. If you need help with an IRS payment plan or another settlement option contact Tax Debt Advisors, Inc today.

Mesa Arizona IRS help from Tax Debt Advisors

Call Scott Allen E. A. if you have questions about any of these issues:

IRS Help, IRS Representation, IRS Problem, Tax Problem, IRS Negotiations, IRS Settlements, IRS Tax Debt Settlements, IRS Tax Settlements, IRS Audit, Guarantee of IRS Services, IRS Attorney, IRS Tax Discharged, IRS Statute of Limitations, IRS Installment Arrangements, IRS Abatement of Interest, IRS Abatement of Penalties, IRS Offers, IRS OIC, IRS Offers in Compromise, IRS POA, IRS Power of Attorney, IRS Form 2848, IRS Forms, IRS Offices, IRS Phone Numbers, IRS Filing Back Taxes, IRS Back Taxes, Copies of Old Tax Returns, Filing Old Returns, Filing Amended Returns, Filing 1040X, Filing 140X, Arizona Department of Revenue, AZDOR, IRS Estimated Taxes, IRS Withholdings, IRS Form W-4, IRS Amnesty, IRS Tax Amnesty, Tax Amnesty, IRS Not Collectible Status, IRS Currently Not Collectible Status, Not Collectible Status, IRS Non-Collectible Status, IRS Currently Non-Collectible Status, Non-Collectible Status, IRS Bankruptcy, IRS Tax Bankruptcy, Tax Bankruptcy, IRS Chapter 7 Bankruptcy, Tax Chapter 7 Bankruptcy, IRS Payment Plans, Defaulting IRS Payment Plans, Defaulting IRS Installment Arrangements, IRS Levy, Tax Levy, IRS Tax Levy, IRS garnishment, IRS Tax Garnishment, Tax Garnishment, IRS Wage Levy, IRS Bank Levy, IRS Wage Garnishment, Levy Bank Account, IRS Lien, Tax Lien, IRS Tax Lien, IRS Form 433-A, IRS Form 433-B, IRS Notices, IRS Form CP 501, IRS Form CP 503, IRS Form CP 504, IRS Form CP 2000, IRS Tax Court Petition, IRS Appeals, Tax Appeals, IRS Collection Due Process, IRS Collection Appeals Program, IRS CAP, IRS Collection Due Process Appeal, IRS Collection Due Process Hearing, IRS Audit Appeals, IRS Taxpayer Advocate Office, IRS Tax Preparation, IRS Help for Medical Professionals, IRS Help for Construction Workers.