Do I Need a Scottsdale AZ IRS Tax Attorney if I have an IRS tax problem?

Scottsdale AZ IRS Tax Attorney

No, having an IRS tax problem is not a legal matter and does not require a Scottsdale AZ IRS tax attorney. There are serious consequences if you do not deal properly with your IRS matter but in reality you do not need a tax attorney unless you have committed a criminal act. There is no better way to get value for IRS resolution services than using Scott Allen E.A. He has the expertise to represent you fairly, aggressively and at a cost that you can afford—unlike expensive legal billings. Scott will never tell you he can do a better job than you can for yourself. No one can know what your skill level and determination to do tax research on your own. What Scott will tell you is that you will not be able to get a better settlement of your tax debt than what he can do. A Scottsdale AZ IRS tax attorney will often make you feel inadequate to the task. That is their modus operandi (their method of operation). But if you are not well versed in IRS resolution options, very likely you will not perform at the level that Scott Allen E.A. can, and consequently put yourself in a terrible situation which many times you or your tax representative cannot correct.

A few things to remember about IRS tax resolution work in Scottsdale AZ. If someone promises seem too good to be true they probably are. If you hear the words, “No Problem”—you can expect a problem. May I suggest you call Scott Allen E.A. and schedule a free consultation? He can be reached at 480-926-9300. I know you will be glad you did.

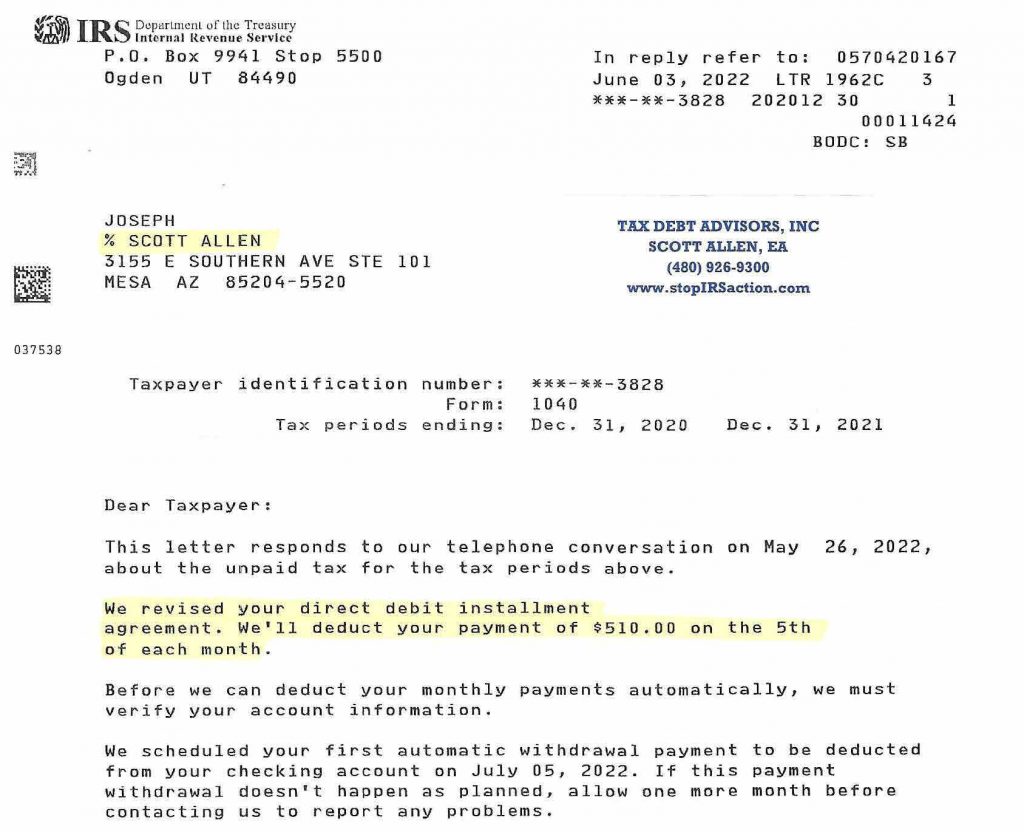

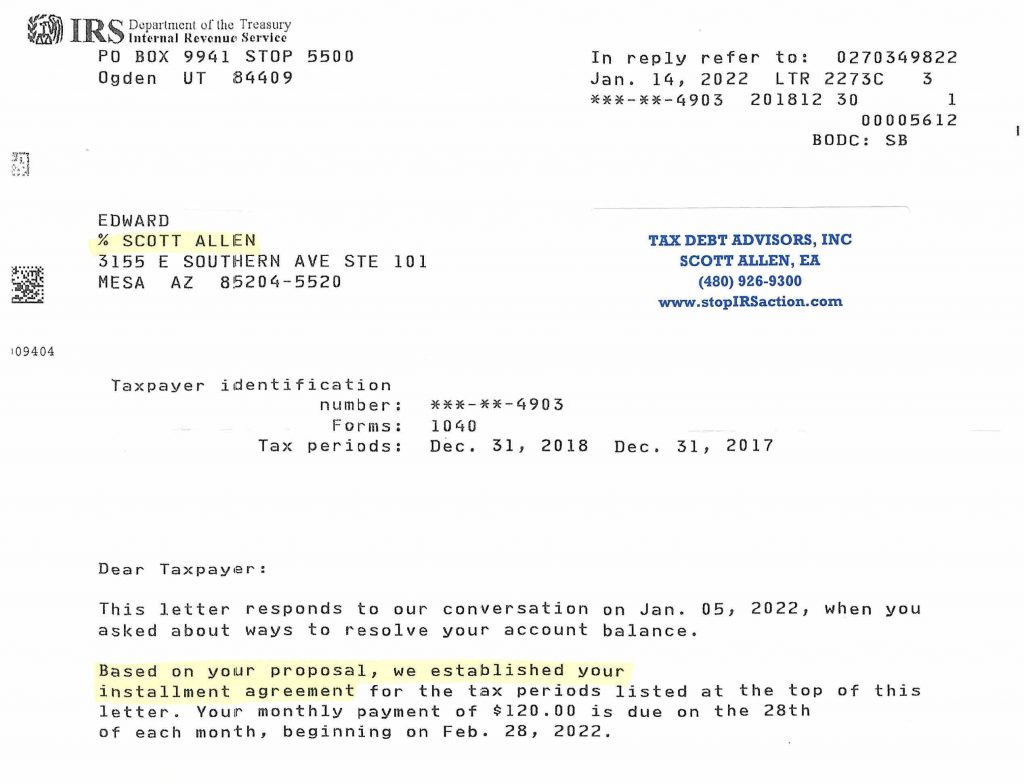

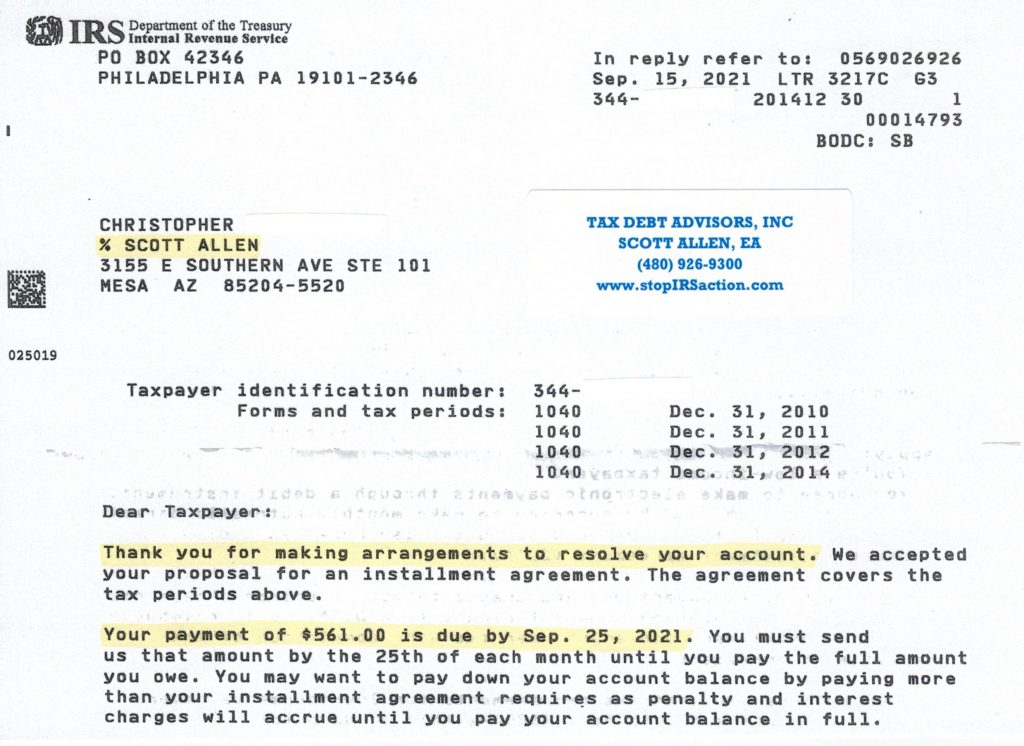

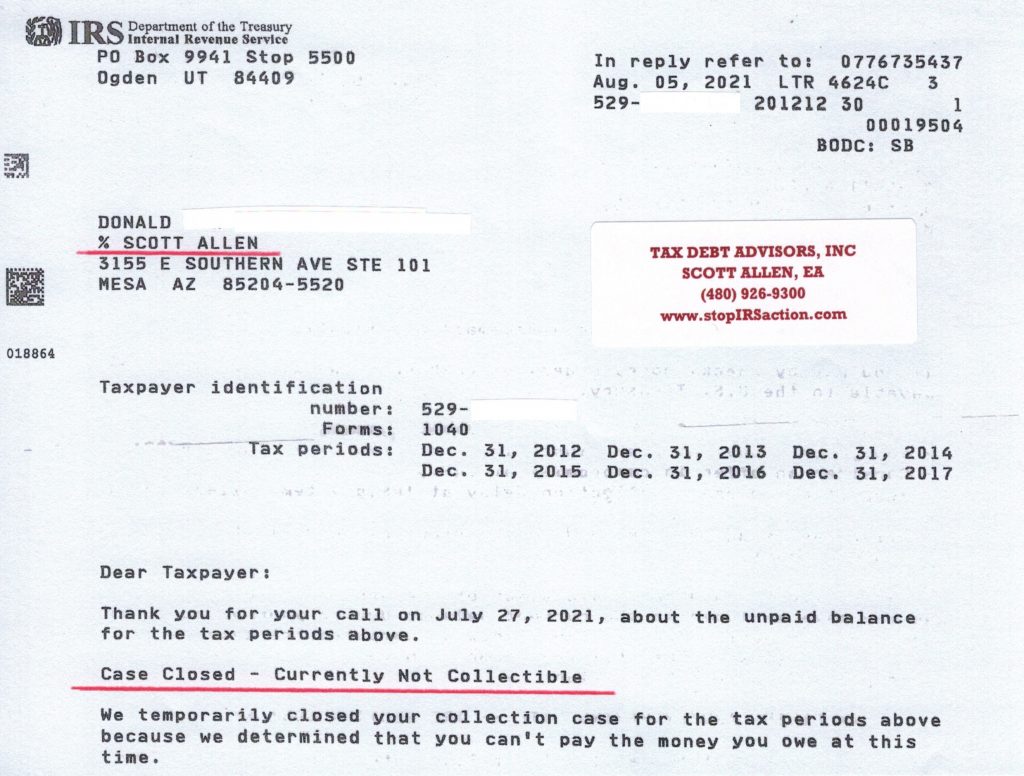

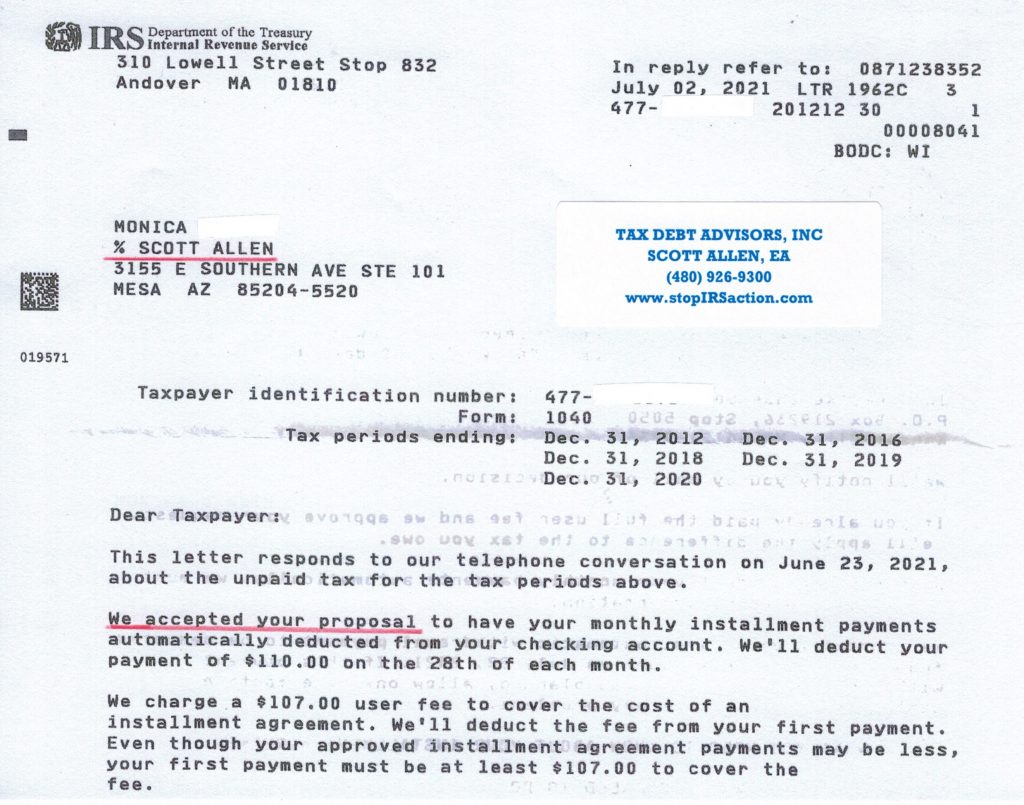

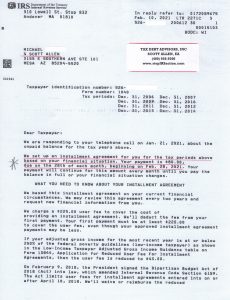

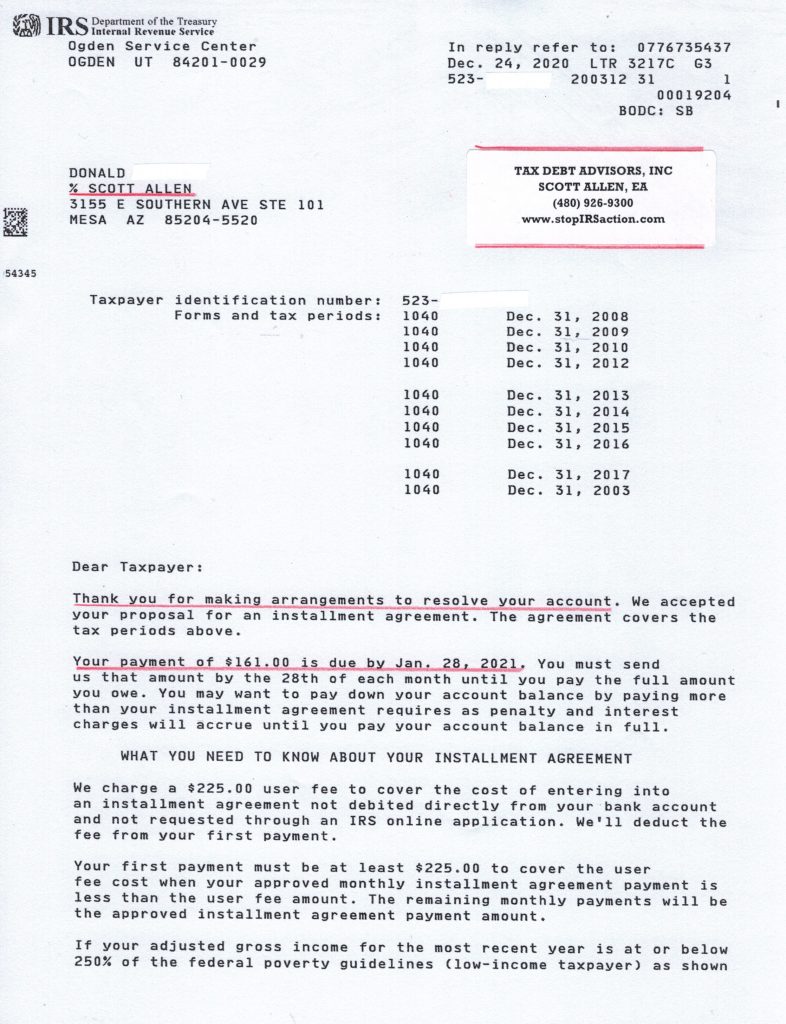

Scott Allen E.A. was able to help out his client Joseph with his tax problem without using a Scottsdale AZ IRS tax attorney. He has fallen behind with his estimated tax payments for a couple of years and was afraid to file his taxes thinking the IRS was going to levy or garish his income or bank accounts. Scott Allen E.A. was able to calm the situation down, represent him before the IRS and take care of the matter for him. Scott prepared his 2020 and 2021 returns and negotiated them into one low monthly payment plan with the IRS. For $510 a month the IRS will stay out of his bank accounts and not file a tax lien on his credit. Attached is a a copy of that agreement to see for yourself.