Help with IRS Payment Plan in Gilbert Arizona

Tax Debt Advisors, Inc.: The Best Way to Get an IRS Payment Plan in Gilbert, Arizona

If you’re facing a tax debt, you’re not alone. Millions of Americans owe money to the IRS every year. And while it can be a daunting task to try to figure out how to pay off your debt, there is help available.

Tax Debt Advisors, Inc. is a leading tax resolution firm that can help you get an IRS payment plan in Gilbert, Arizona. They have over 44 years of experience helping taxpayers just like you get the relief they need.

They understand that dealing with a tax debt can be stressful and overwhelming. That’s why they offer a free consultation so that they can assess your individual situation and create a customized plan to help you get back on track.

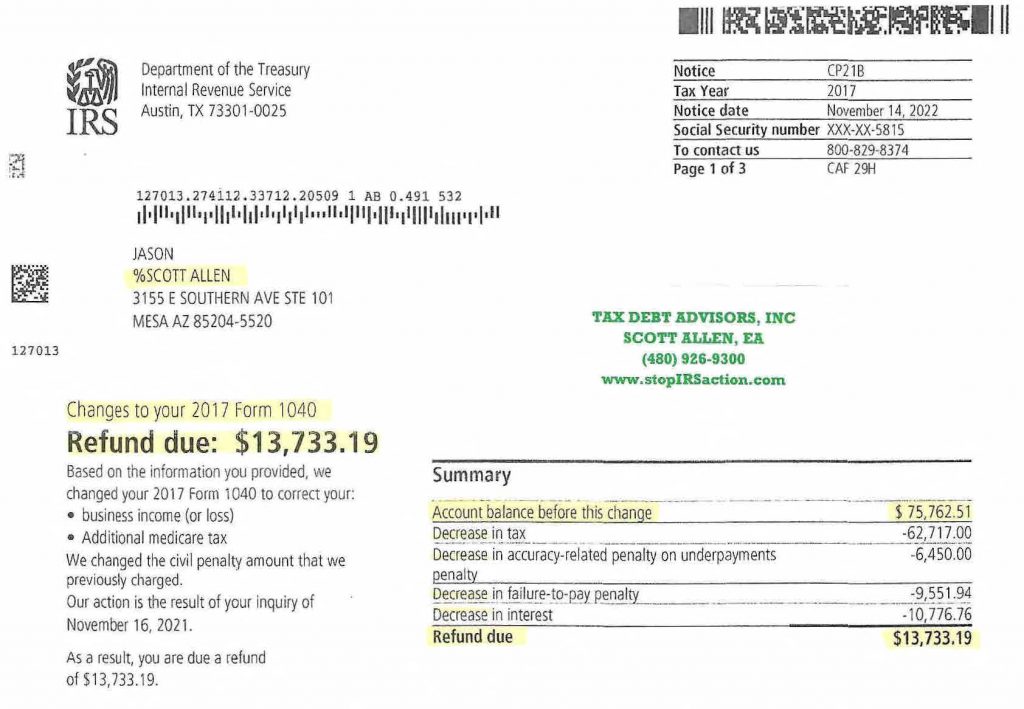

Their team of experienced tax professionals will work with you every step of the way to ensure that you get the best possible outcome. They will negotiate with the IRS on your behalf to get you the lowest possible payment amount and the most favorable terms.

They also offer a variety of other services to help you get your finances back in order, including:

- Audit representation

- Offer in Compromise

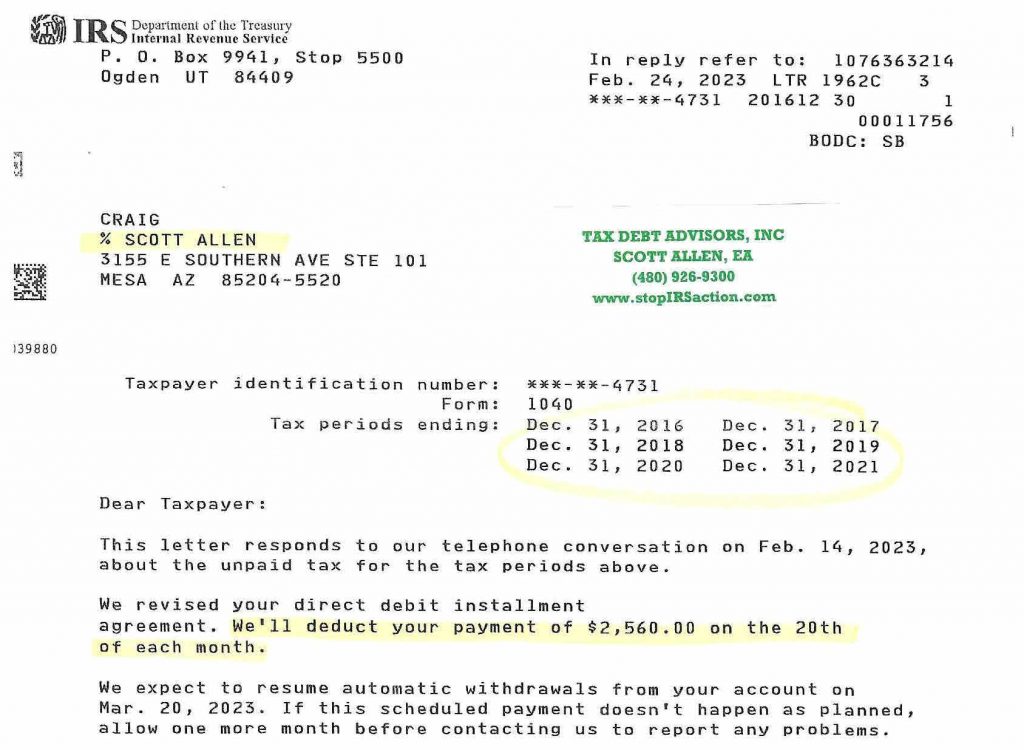

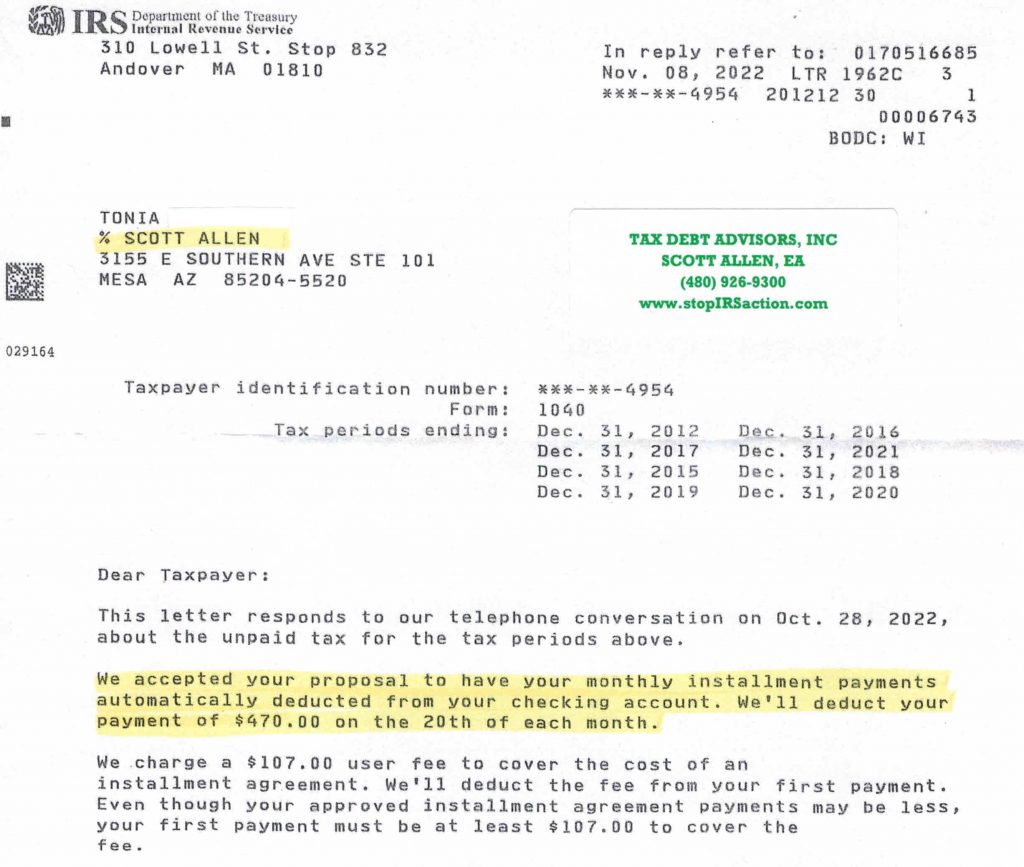

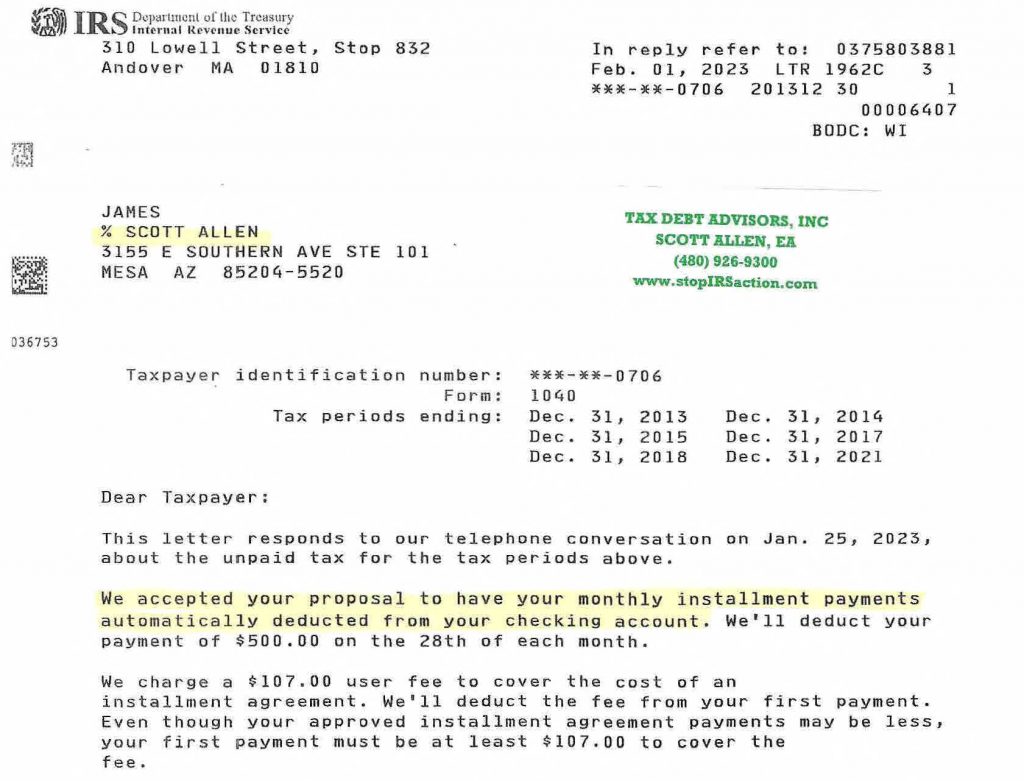

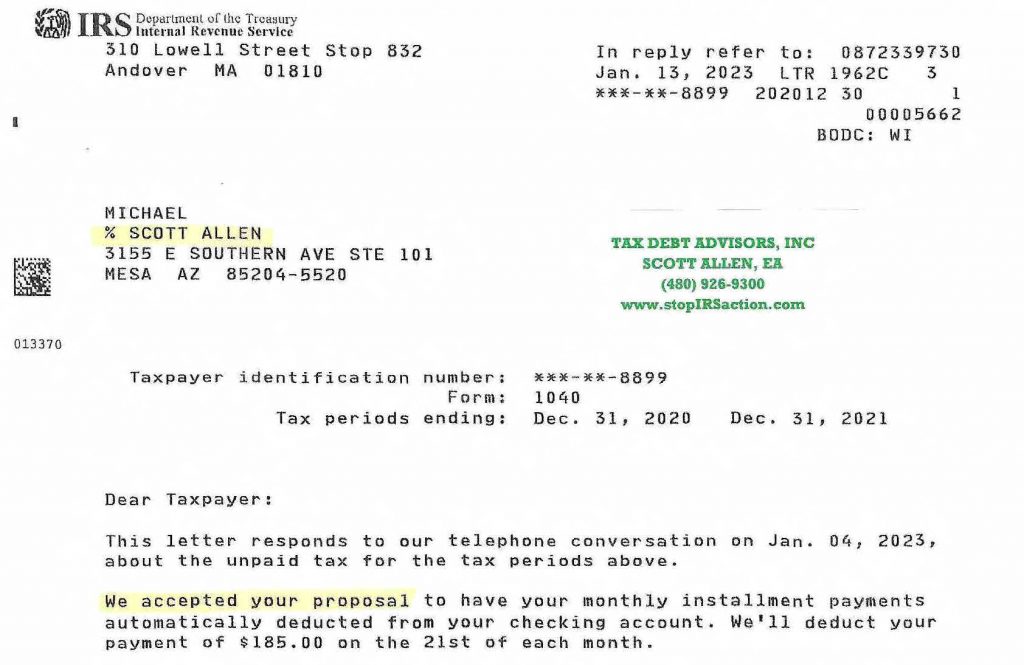

- Installment Agreements

- Penalty Abatement

- Wage Garnishment Relief

If you’re struggling with a tax debt, don’t wait any longer. Contact Tax Debt Advisors, Inc. today to get the help you need.

How to Get an IRS Payment Plan in Gilbert, Arizona

If you owe money to the IRS, you may be eligible to get an IRS payment plan in Gilbert, Arizona. A payment plan is an agreement with the IRS to pay off your debt over time.

To get an IRS payment plan, you must first file all of your back taxes. Once your taxes are filed, you can contact the IRS to request a payment plan.

Here are two examples of ways to request a payment plan:

- Online: You can request a payment plan online at the IRS website.

- By mail: You can request a payment plan by mail by filling out Form 433-D and mailing it to the IRS.

When you request a payment plan, you will need to provide the IRS with information about your income and expenses. The IRS will use this information to determine how much you can afford to pay each month.

The IRS offers a variety of payment plans, including:

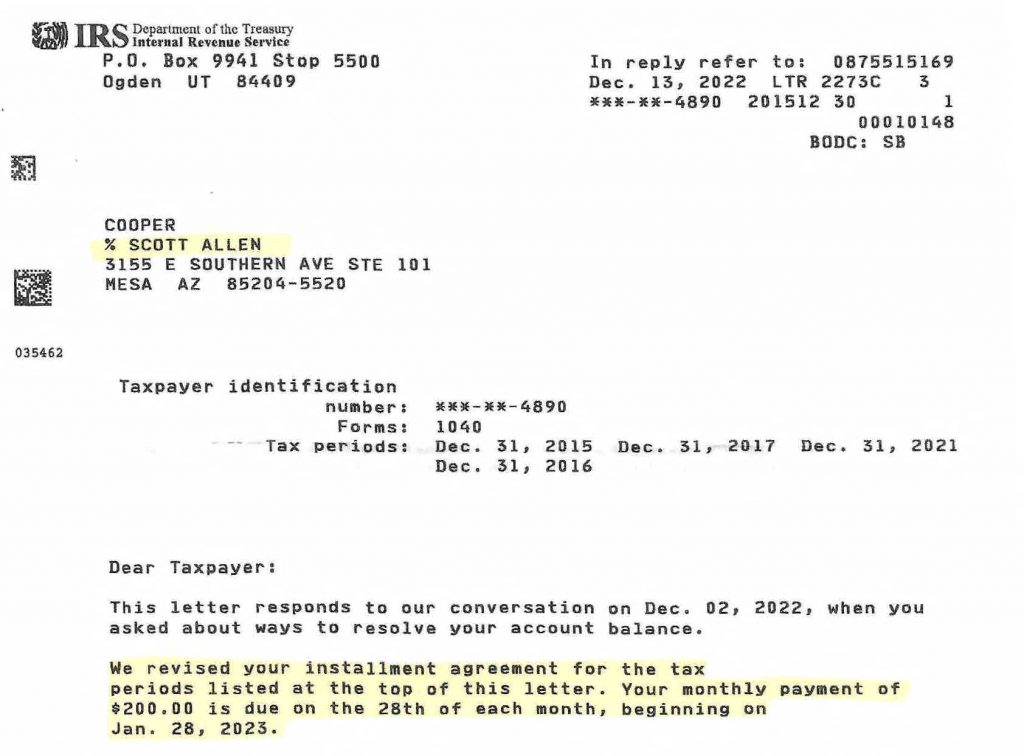

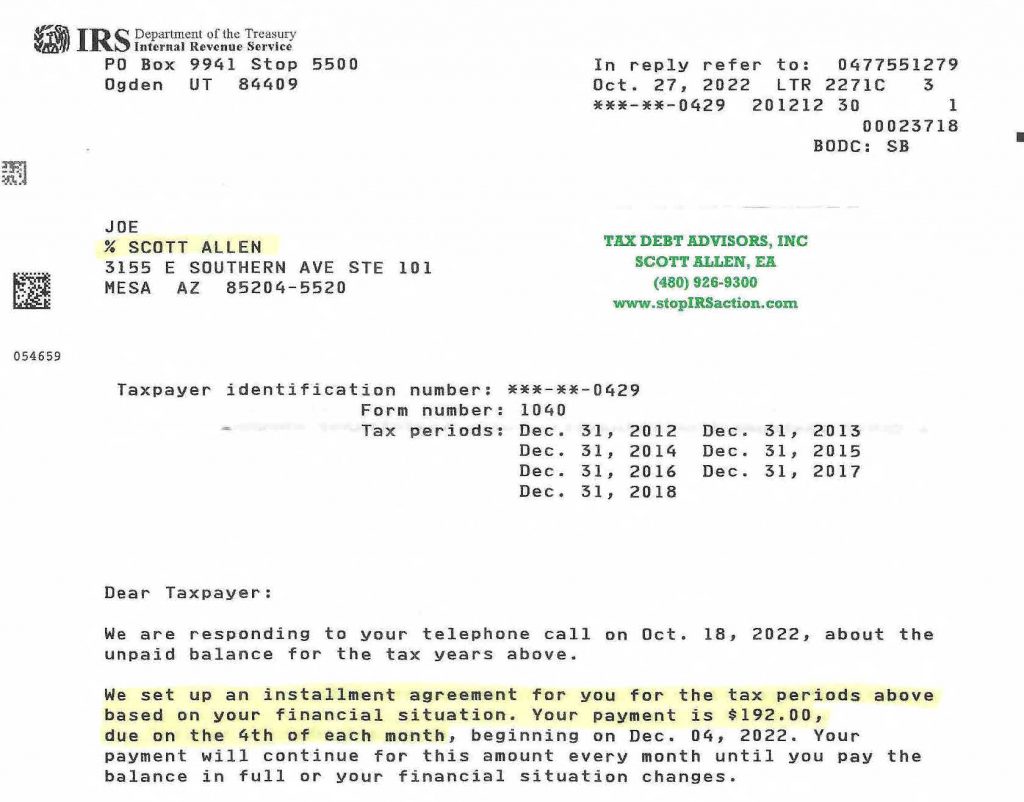

- Installment Agreement: This is the most common type of payment plan. You will make monthly payments to the IRS until your debt is paid off.

- Offer in Compromise: This is a type of payment plan that allows you to pay less than the full amount of your debt. You must meet certain requirements to qualify for an Offer in Compromise. Some Offers are also done as a lump sum settlement as well.

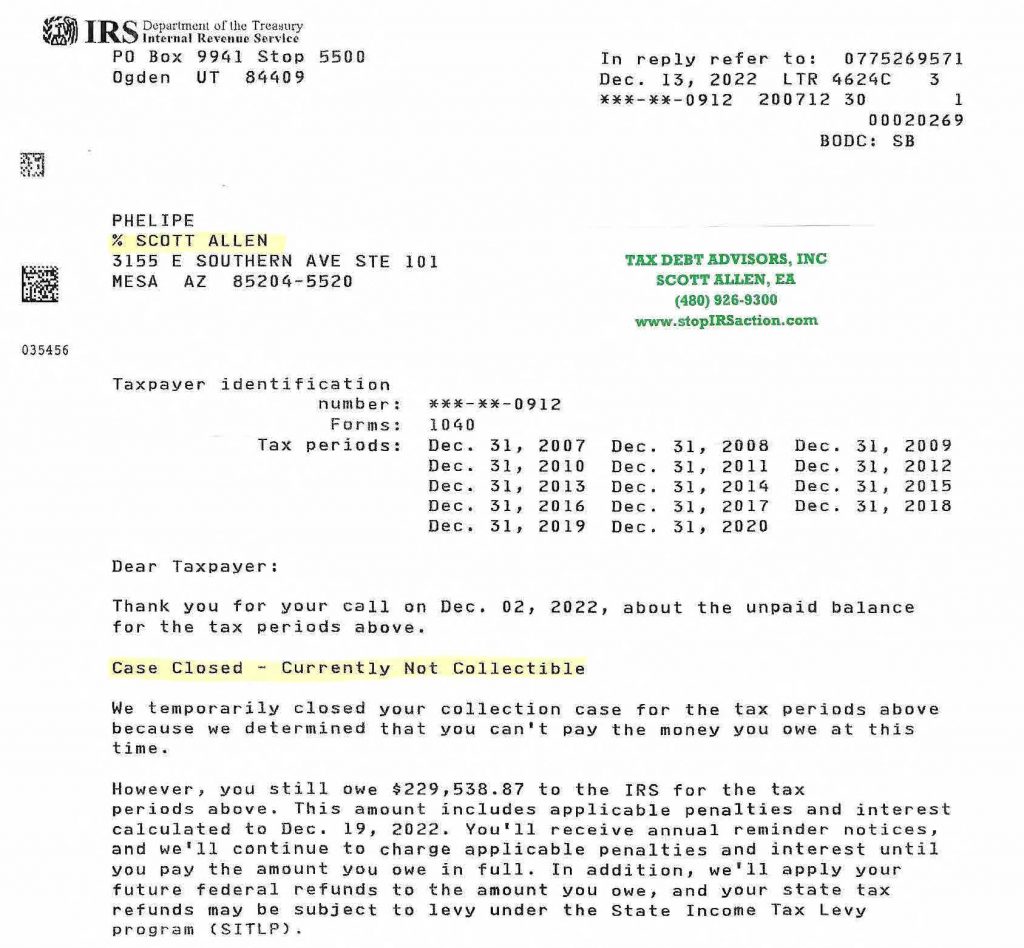

- Currently Not Collectible: This is a type of payment plan that allows you to stop making payments to the IRS if you can show that you are unable to afford to pay.

If you are approved for an IRS payment plan in Gilbert, Arizona, you will be required to make monthly payments. If you miss a payment, you may be subject to penalties and interest.

The Benefits of Hiring Tax Debt Advisors, Inc.

There are many benefits to hiring Tax Debt Advisors, Inc. to help you get an IRS payment plan.

- They have over 44 years of experience helping taxpayers just like you get the relief they need.

- They offer a free consultation so that we can assess your individual situation and create a customized plan to help you get back on track.

- Their team of experienced tax professionals will work with you every step of the way to ensure that you get the best possible outcome.

- They offer a variety of other services to help you get your finances back in order, including:

- Audit representation

- Offer in Compromise

- Installment Agreements

- Penalty Abatement

- Wage Garnishment Relief

If you’re struggling with a tax debt, don’t wait any longer. Contact Tax Debt Advisors, Inc. today to get the help you need.

Contact Tax Debt Advisors, Inc. Today

If you’re ready to get help with your tax debt, contact Tax Debt Advisors, Inc. today. They will work with you to create a customized plan to help you get back on track.

Call us at (480) 926-9300 or contact us online to schedule a free consultation.