IRS Penalty Abatement

If at first you don’t succeed, at least try one more time: IRS Penalty Abatement

Scott Allen EA will be the first to admit that IRS penalty abatement isn’t for everyone. If the IRS did not issue penalties then no one would file or pay timely. With that being said if Scott Allen EA determines are are a viable candidate he will fight for you. This is what he did for a recent client on a large tax bill on the 2013 tax return. The penalty for filing your taxes late is 5% a month up to five month or 25%. This becomes a rather large number especially when you tax bill is over $350,000.

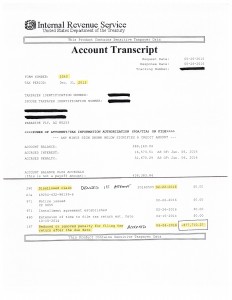

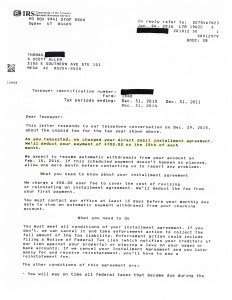

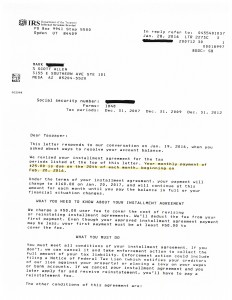

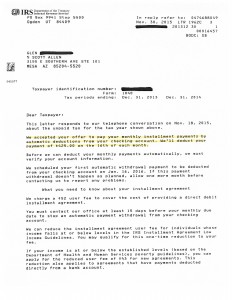

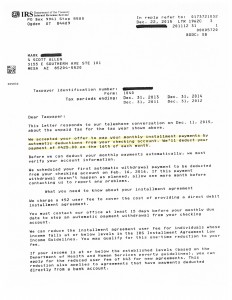

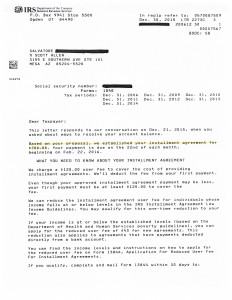

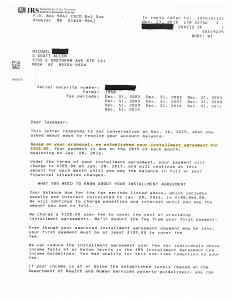

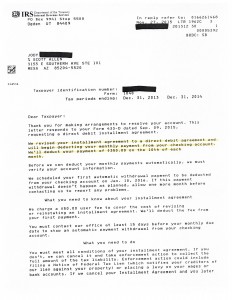

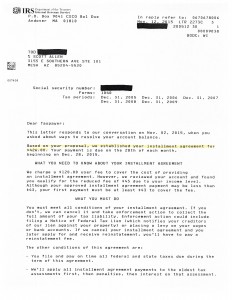

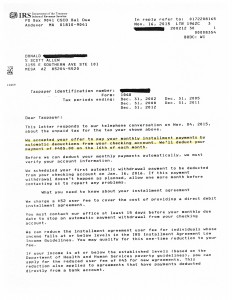

These taxpayers were under the assumption that a tax extension had been prepared and filed by their CPA, and that the taxes were filed within the extension deadline of Oct 15, 2014. Long story short it become known to the taxpayers later on that the ball was dropped and a 25% (or $77,710.27) penalty was assessed. Scott felt a success could be had with this case and that there was a viable shot at getting the $77,710.27 late filing penalty removed. Worst case scenario is they deny us; which they did actually back in February 2016. Scott applied again using form 843 and this time was successful. About two years past the deadline and five hours of work was worth about $$77,710.27. By viewing the IRS account transcript below you can see the IRS removed the late filing penalty April 2016. There is still a large debt to be paid but today its a little bit lighter. Scott Allen EA was also able to negotiate that debt into a reasonable payment plan for the taxpayers. Mission accomplished.

Scott Allen EA’s office is located in Mesa AZ at 3155 E Southern Ave #101 Mesa AZ 85204 and can be reached at 480-926-9300