Gilbert Tax Debt Advisors Reviews

Gilbert Tax Debt Advisors Reviews are here

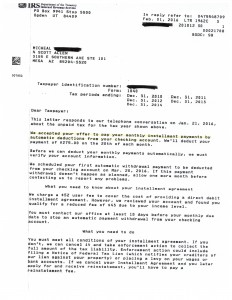

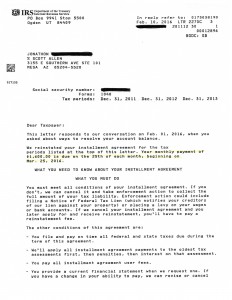

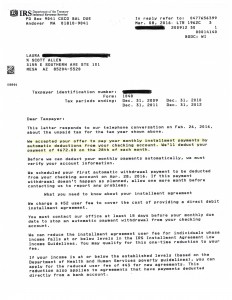

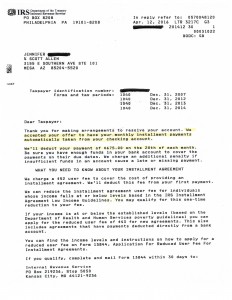

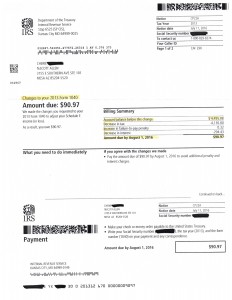

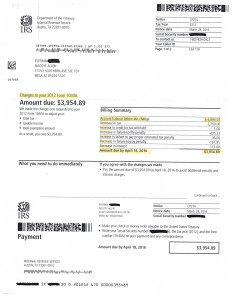

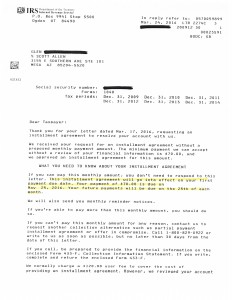

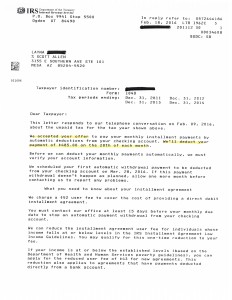

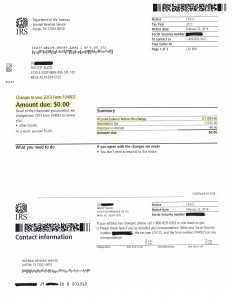

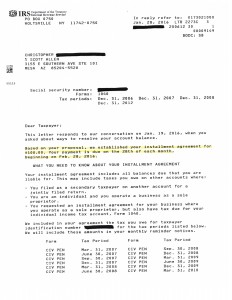

Michael used the services of Scott Allen EA to represent him in his IRS problem. Decide if Scott Allen EA can be the right choice for you by viewing Gilbert Tax Debt Advisors Reviews. Tax Debt Advisors is a local Arizona company that specializes in filing back tax returns and negotiating IRS debts. After completing all of the missing tax returns an installment arrangement was successfully negotiated in behalf of Michael. View it below.

Today Michael is in full compliance with the IRS, a tax lien is not on his credit report, and he is paying his estimated tax payments so he will not not owe when filing his 2016 tax return next April. If you want to get your life in compliance with the IRS speak with Scott Allen EA today.