Stop IRS Levy in Phoenix

What is one way to stop IRS levy in Phoenix?

First off, there are many options to stop IRS levy in Phoenix. The quickest but not always easiest way is to pay the liability in full. Now why would someone want to do that? Well, if they know they owe the tax, have assets or income to justify paying the debt off it could be in their best interest to do so. If a tax lien has not been filed against your credit; full payment will prevent that. If you are under a levy, the levy will be release immediately.

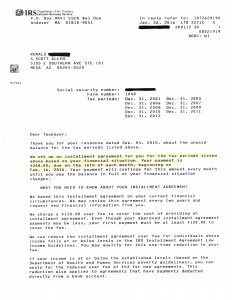

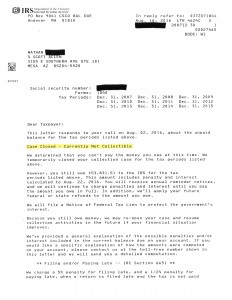

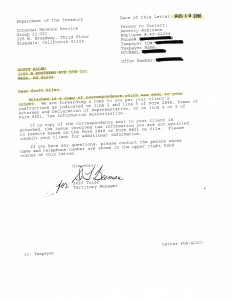

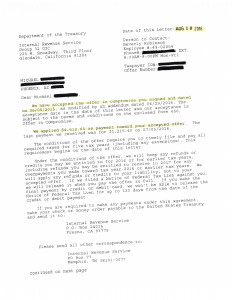

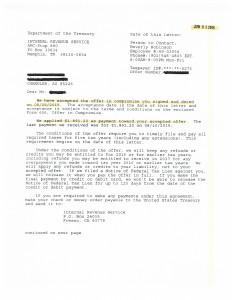

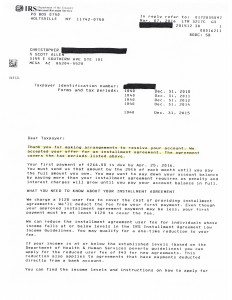

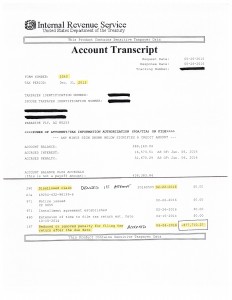

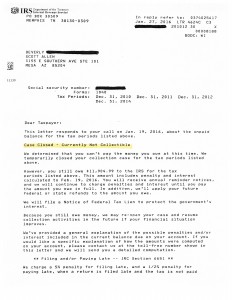

However, for those of us that cannot full pay the liability or doubt the IRS’s claim in tax debt owed their are other options. Agreeing to a monthly payment plan will also stop IRS levy in Phoenix. Depending on your proposal and size of IRS debt will determine the length and complexity of the process. Financial information most likely will need to be provided to substantiate your income and expenses. To get help with a payment plan negotiation to stop (or prevent) an IRS levy contact Scott Allen EA with Tax Debt Advisors. This is exactly what he did for his client mentioned in the notice attached below. Ron came in to meet with Scott to discuss the IRS levy notice he received. Working together they were able to put a stop of the IRS levy, file some back tax returns and get a payment plan with the IRS setup.

To get help with you back tax return filings, stop IRS levy, prevent a tax lien, or to settle your debt once and for all speak with Scott Allen EA to discuss your options.