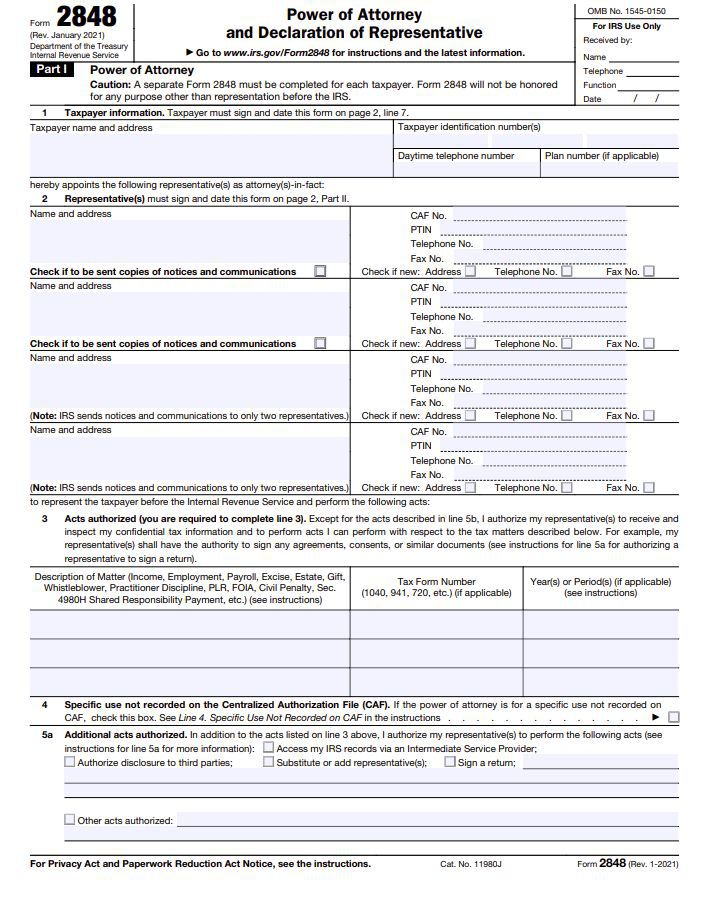

IRS Form 2848

Internal Revenue Service Form 2848

This IRS form is used to give permission for someone else to represent you before the IRS. It is referred to as an IRS Power of Attorney. It is limited to the items described on the form and those areas of representation are limited to IRS matters. Typically the form will state what type of tax—individual income tax, form number—1040, and tax years covered—2002-2022. If there is a problem with any years outside of those mentioned, the IRS will not allow your representative to work on those years. If you have a payroll tax problem in addition to an individual income tax problem, it too must be separately mentioned. Before we begin any work on resolving a tax problem, we require a power of attorney. A power of attorney allows us to get information needed to resolve successfully your current IRS problem. It is time to stop IRS action against you and hire Scott Allen EA to be your IRS power of attorney. He will put your mind at ease.

Scott Allen E. A.

Tax Debt Advisors, Inc