Information to Stop IRS Levy in Phoenix AZ

Stop IRS Levy in Phoenix AZ

The Internal Revenue Service (IRS) has a variety of tools at its disposal to collect unpaid taxes. One of the most powerful tools is the levy. A levy is a legal process that allows the IRS to seize your property to satisfy your tax debt.

If you are facing an IRS levy, it is important to take action immediately. There are a number of steps you can take to stop IRS Levy in Phoenix AZ, and the sooner you act, the better your chances of success.

What is an IRS levy?

An IRS levy is a legal process that allows the IRS to seize your property to satisfy your tax debt. The IRS can levy a variety of assets, including your wages, bank accounts, and even your home.

How do I know if I am facing an IRS levy?

If you are facing an IRS levy, you will receive a notice from the IRS. The notice will inform you of the type of asset that is being seized, the amount that is being seized, and the date that the seizure will take place.

What can I do to stop an IRS levy?

There are a number of steps you can take to stop IRS levy in Phoenix AZ. These steps include:

- File your tax return. If you have not filed your tax return, the IRS will not be able to assess your tax debt. Once you file your return, the IRS will be able to calculate your tax debt and determine if a levy is necessary.

- Pay your tax debt. If you can afford to pay your tax debt, the best way to stop an IRS levy is to pay it in full. You can pay your tax debt online, by mail, or in person at a local IRS office.

- Make arrangements to pay your tax debt. If you cannot afford to pay your tax debt in full, you may be able to make arrangements to pay it in installments. The IRS offers a variety of payment plans, including the Installment Agreement and the Offer in Compromise.

- Challenge the levy. If you believe that the IRS has incorrectly assessed your tax debt or that the levy is excessive, you may be able to challenge the levy. You can challenge the levy by filing a petition with the United States Tax Court.

How can I get help stopping an IRS levy?

If you are facing an IRS levy, you should seek professional help. A tax professional can help you assess your options and develop a plan to stop the levy.

What are the consequences of an IRS levy?

An IRS levy can have a number of negative consequences, including:

- Damage to your credit. A levy will appear on your credit report, which can make it difficult to get a loan or a credit card.

- Loss of assets. If the IRS seizes your assets, you may lose them. This could include your car, your home, or your bank account.

- Legal action. If you do not comply with an IRS levy, the IRS may take legal action against you. This could include garnishing your wages, seizing your assets, or even filing a criminal charge against you.

If you are facing an IRS levy in Phoenix, AZ, Scott Allen EA can help you stop an IRS levy and get back on your feet.

Scott Allen EA and his company have over 45 years of experience helping people with IRS problems. He has a proven track record of success in stopping IRS levies. He can help you assess your options and develop a plan to stop the levy.

Scott Allen EA is an Enrolled Agent (EA). He is also a licensed tax preparer in Arizona.

Scott Allen EA is committed to helping his clients get the best possible outcome. He will work with you to understand your situation and develop a plan that meets your needs. He will also keep you informed of your progress throughout the process.

If you are facing an IRS levy in Phoenix, AZ, contact Scott Allen EA today to learn more about how he can help you.

Here are some of the services that Scott Allen EA can provide to help you stop an IRS levy:

- Assess your options: Scott Allen EA will assess your financial situation and your tax debt to determine the best way to stop the levy.

- Develop a plan: Scott Allen EA will develop a plan to stop the levy that meets your needs and budget.

- Negotiate with the IRS: Scott Allen EA will negotiate with the IRS on your behalf to stop the levy.

Scott Allen EA is a qualified and experienced tax professional who can help you stop an IRS levy in Phoenix, AZ. Contact him today to learn more about how he can help you.

Here are some of the reviews of Scott Allen EA from his past clients:

- “Scott Allen EA was very helpful and knowledgeable. He was able to stop my IRS levy and get me back on my feet. I would highly recommend him to anyone who is facing an IRS problem.” – Daniel S.

- “Scott Allen EA was very professional and helpful. He was able to stop my IRS levy and get me a payment plan that I can afford. I would highly recommend him to anyone who is facing an IRS problem.” – Robin W.

- “Scott Allen EA was very patient and understanding. He was able to answer all of my questions and help me understand my options. I would highly recommend him to anyone who is facing an IRS problem.” – Roxanne G.

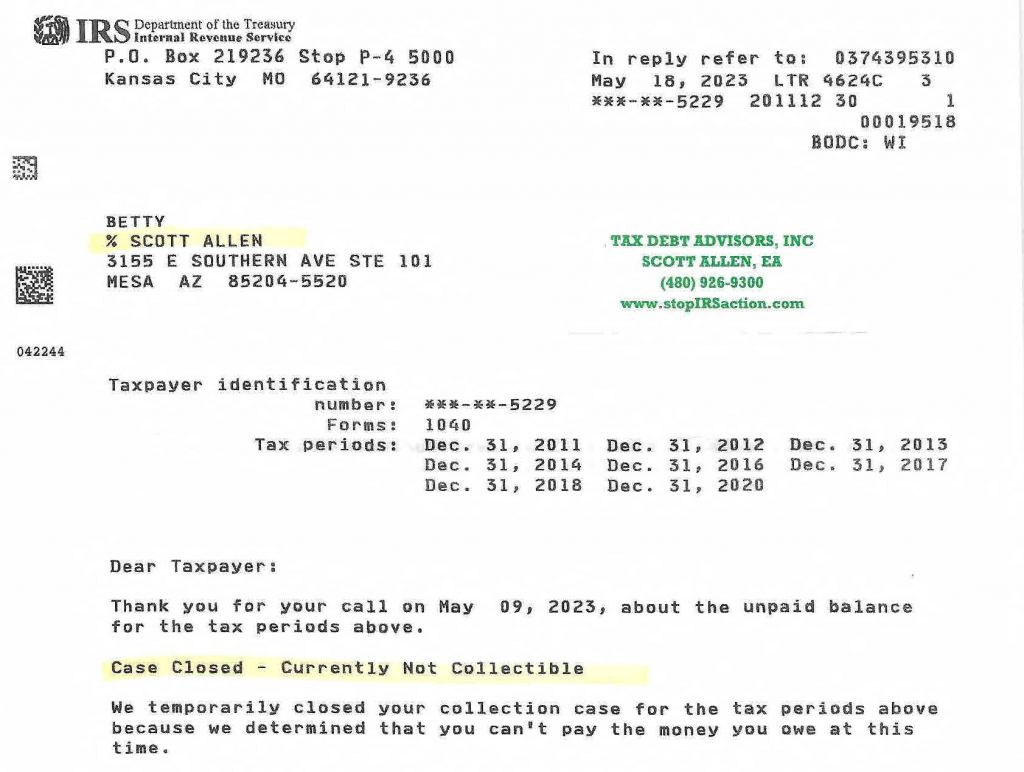

View the IRS letter below to see how he helped his client Betty stop IRS Levy in Phoenix AZ by negotiating a currently non collectible status for her.