Do I Need an IRS Tax Attorney Mesa AZ if I get an IRS CP 2000 Letter?

Scott Allen EA or an IRS Tax Attorney Mesa AZ

No, this is not a legal matter. This letter is responding to income items not on your return that third parties have reported as paid to you. If you agree with the amounts not reported you can simply sign the letter and mail it in. The IRS will send a bill for the amount of tax owed on the items not reported. If the items not reported have a cost basis such as stock sales you need to disagree with the CP 2000 letter and send in documentation showing the cost of the stock that was sold—in other words what you paid for the stock. This will reduce the tax liability or if you had a lost on the sale of stock, it would result in a refund instead of a balance due. There are a number of other things that can cause the IRS to issue a CP2000 notice and its worth having a tax professional look into the matter.

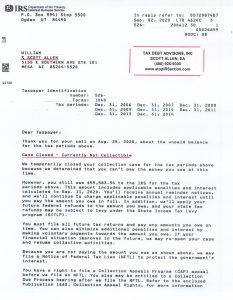

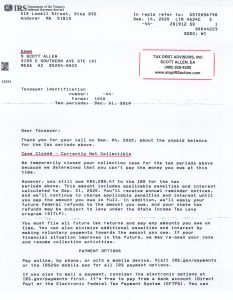

Scott Allen E.A. is available for a free consultation if you have questions about your CP 2000 letter or need assistance in responding back to the IRS. Scott can be reached at 480-926-9300. He has come across many of these notices and has been successful in response to them. I don’t believe using an IRS Tax Attorney Mesa AZ is necessary to get this type on mater resolved. These IRS notice letters have deadlines associated with them so it is important to response timely to them.

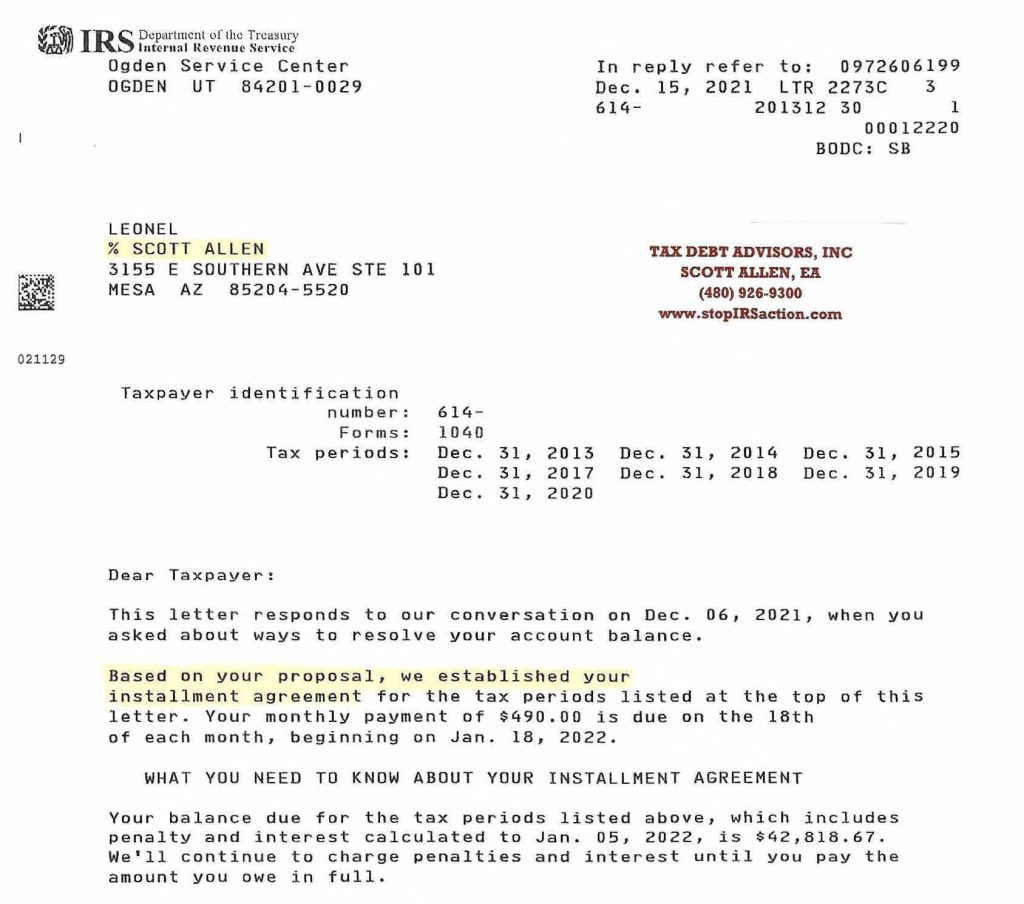

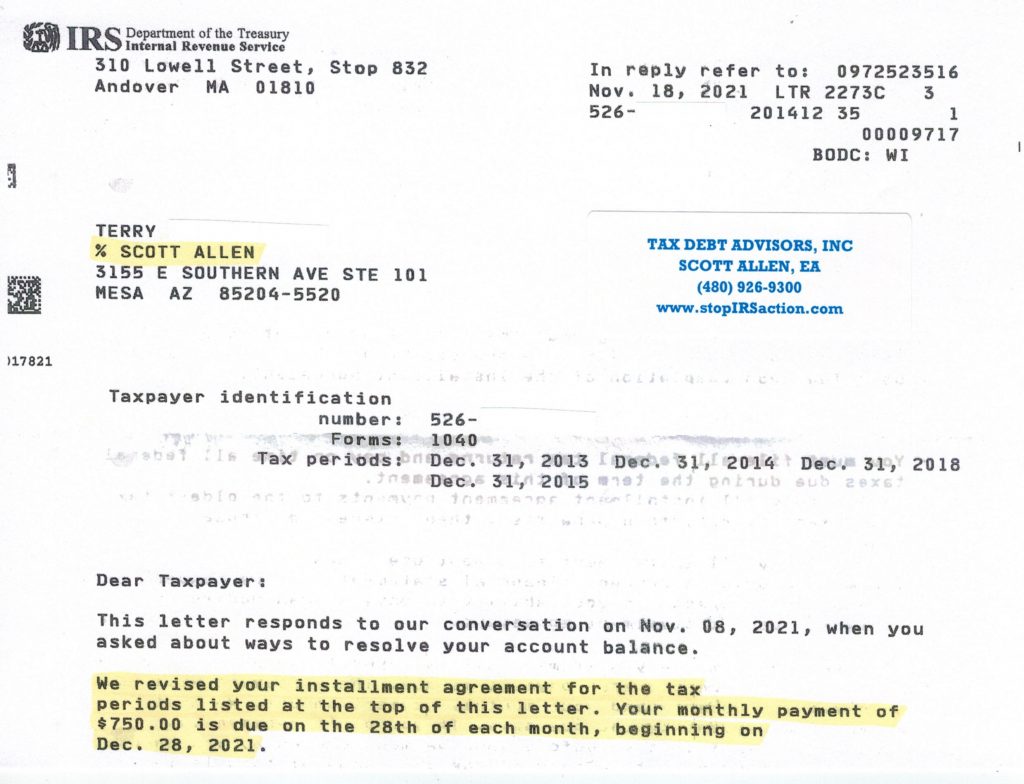

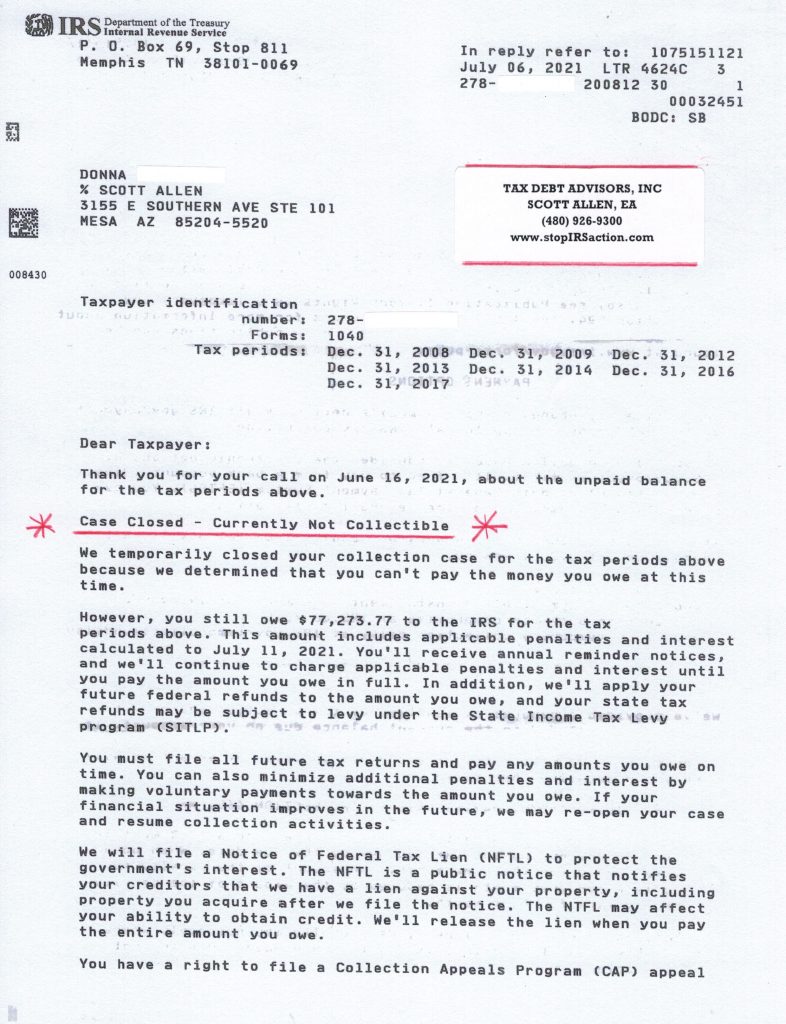

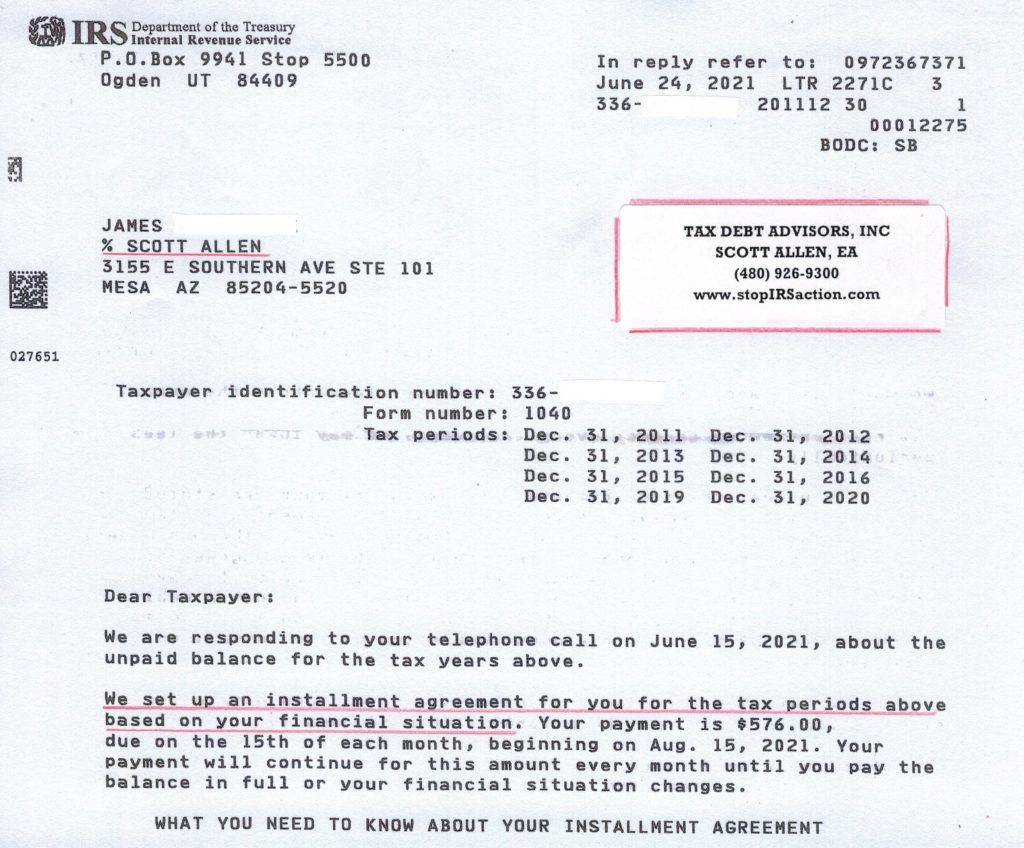

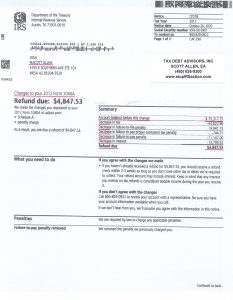

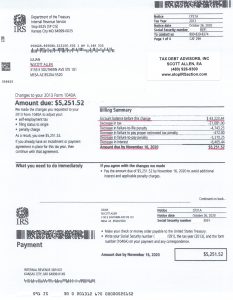

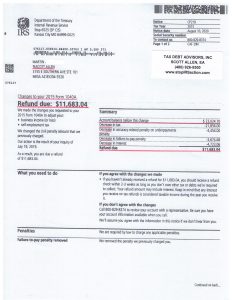

Need help with a payment plan? After you get your IRS debt as low as legally possible consult with Scott Allen EA to discuss your payment plan options. See a recent example of a taxpayer who used Scott for his representation rather than an IRS Tax Attorney Mesa AZ. View the approval notice below.