Don’t Use a Peoria AZ IRS Tax Attorney When You Get a CP-2000 Letter

Peoria AZ IRS Tax Attorney

A CP-2000 letter is an IRS computer generated notice of income not reported on your tax return for that year. If you agree with the income items, you can agree to the tax assessment on the notice and mail it in. If some of the items on the CP-2000 notice are items such as stock sales, it is important that you get “credit” against the income by claiming the cost of the stock sale on the IRS notice. This is an item that can be done by Scott Allen E.A. (Enrolled Agent). Scott Allen E.A. knows how to respond appropriately and aggressively to CP-2000 notices. Scott Allen E.A. is available for a free consultation regarding all IRS notices and can give you the best strategy to resolve the IRS dispute. Call Scott Allen E.A. at 480-926-9300 and schedule your appointment today. A CP-2000 notice is not an item that requires legal representation from a Peoria AZ IRS tax attorney.

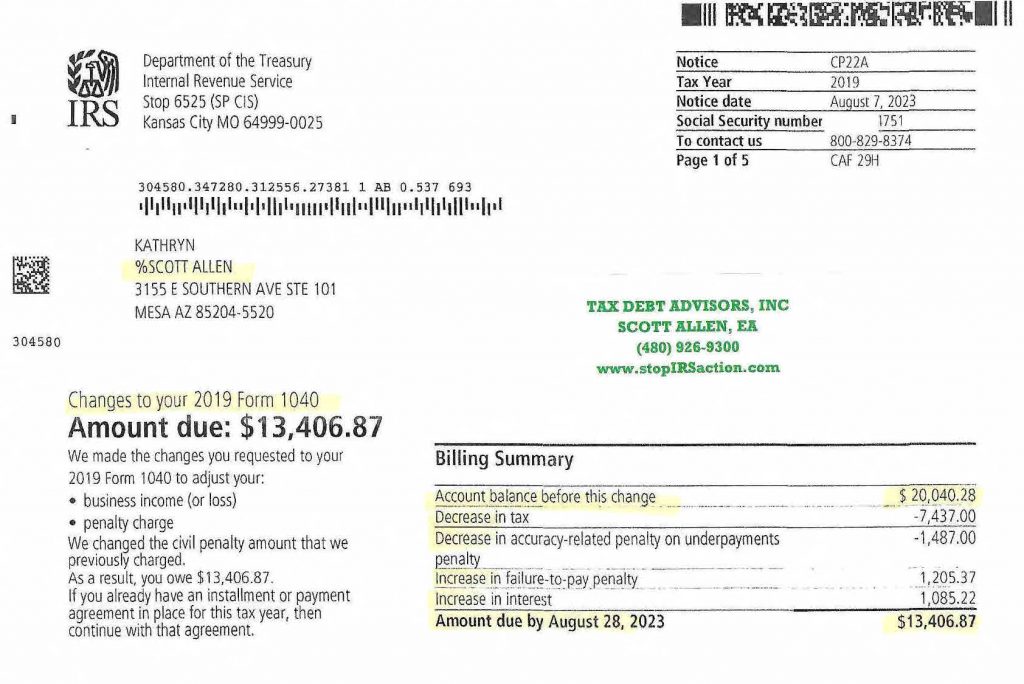

As a local Arizona company Tax Debt Advisors, Inc can represent clients before the IRS in Peoria Arizona and all surrounding cities. Kathryn was a client who hired Scott Allen EA to represent her before the IRS in her CP-2000 case. Because she did not respond timely to the IRS’s initial letter, they went ahead and assesed additional taxes owed and it now needed to be protested. Upon proper preparaton of gathering up the information from the IRS and tax records from Kathryn, Scott was able to package up a response to the IRS and get $7,000 of the taxes owed reduced. You can see that info highlighted below in the IRS letter attached. Don’t go at the IRS alone or with an expensive Peoria AZ IRS tax attorney. Instead, meet with Scott Allen EA for a consultation if you have late tax returns to file or old taxes owed. You will not regret the visit.