Scott Allen E.A. has the right experience for your Scottsdale AZ IRS Tax Problem

Scottsdale AZ IRS Tax Problem ?

Scott is licensed to represent you before the IRS in all 50 states. His family tax business near Scottsdale AZ, which he now owns, has been in business since 1977 and resolved over 113,000 IRS tax debts. That is over 44 years of building up a reputation with IRS Agents, Officers and the Appeals Office that comes from demonstrating his expertise and negotiating abilities. IRS personnel trust Scott and that is critical when it comes to grey areas that are normally do not go in favor of the taxpayer.

The best way to know if you have the right person representing you is to invest the time to have a face to face consultation. Many taxpayers take a short cut and turn over their IRS problem to someone they have never met personally. This is a big mistake. May I suggest that you schedule a free consultation with Scott Allen E.A.? You will be glad you did. Scott can be reached at 480-926-9300 and his office is 10-15 minutes from Scottsdale AZ. Let Scott make today a great day for you and solve your Scottsdale AZ IRS tax problem!

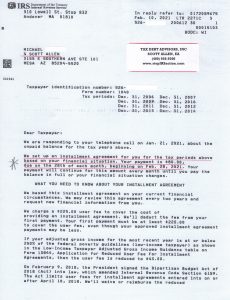

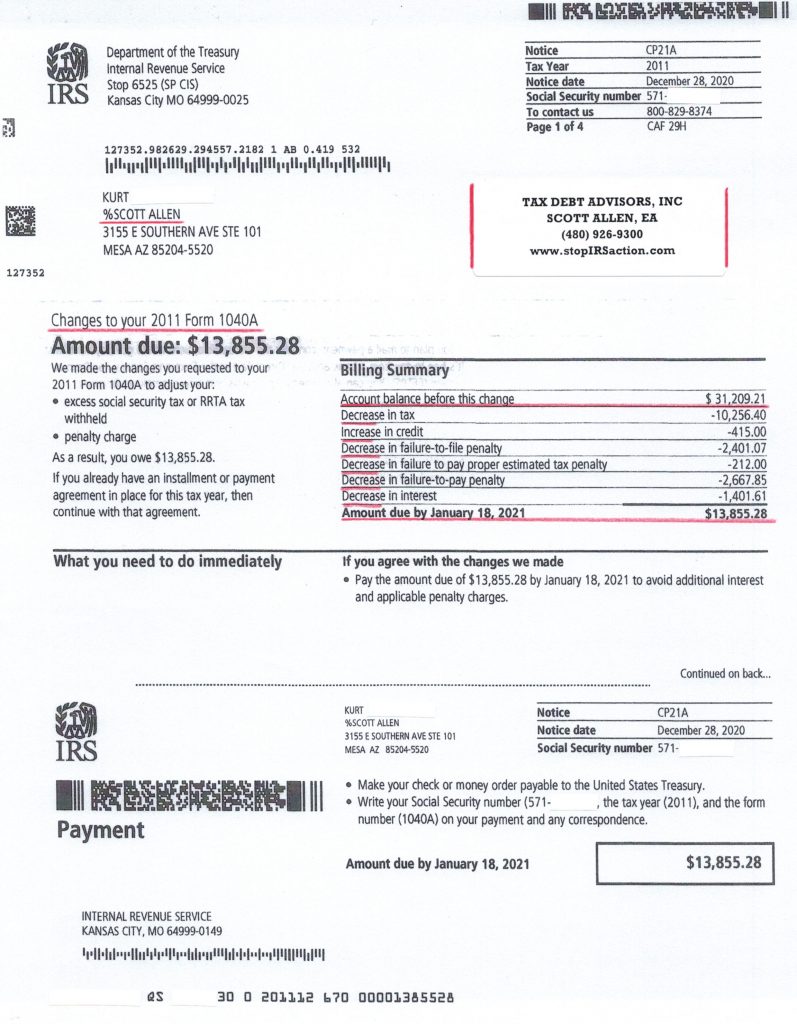

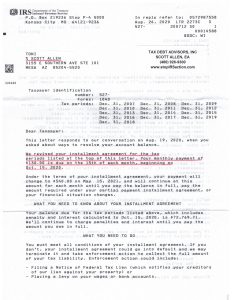

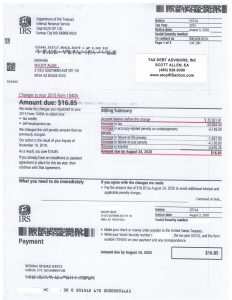

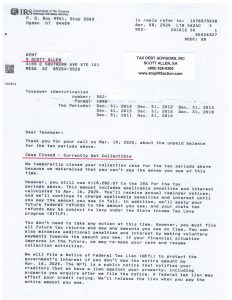

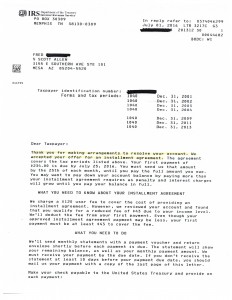

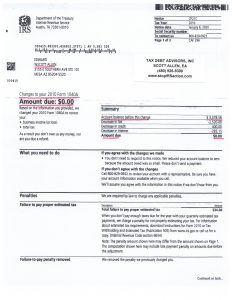

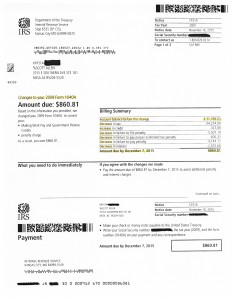

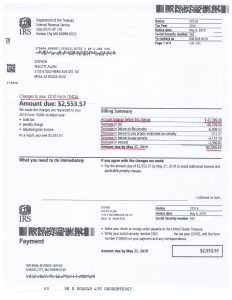

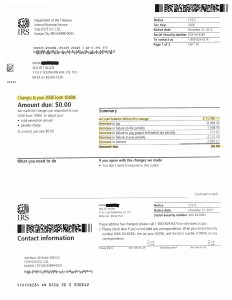

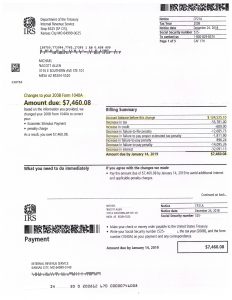

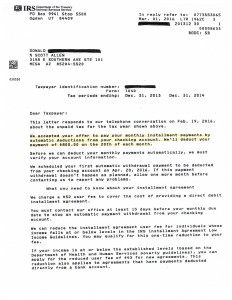

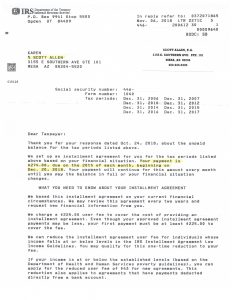

Mike used Scott Allen E.A. to help him with his IRS tax debt. As you can see from the notice below, he owes for several years dating back to 2006. He owes the IRS more than he could ever pay back. Upon evaluating his financial situation we determined that the best solution was getting Mike into a very low monthly payment plan. We knew this would not pay the debt off. It doesn’t even cover the interest the IRS is charging him. Why would Scott Allen E.A. negotiate an agreement like this? Most of the years he owes for expire within the next 1-2 years. Yes, IRS debt expires. The IRS only has ten years to collect a debt from when a debt is assessed. So Mike will gladly pay his $80/month and just let his IRS debts expire. Talk about a great deal, right!?

Scottsdale AZ IRS Tax Problem