December 2015 Tax Debt Advisors Reviews

Are you looking for Tax Debt Advisors Reviews?

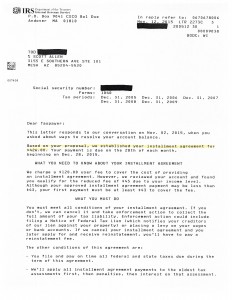

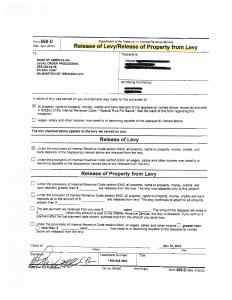

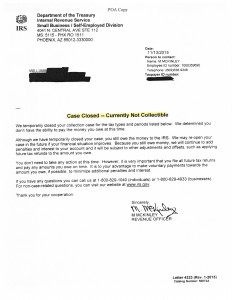

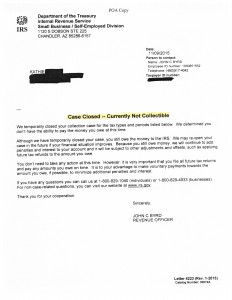

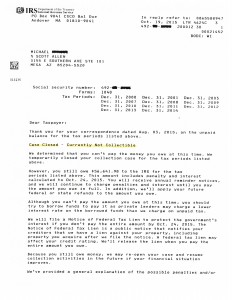

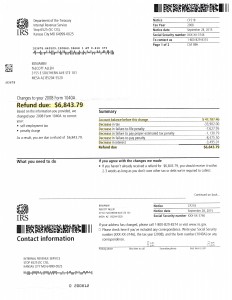

Please view the notice below to see an actual notice from the IRS that Tax Debt Advisors negotiated for their client Tod. Click here to view other recent successes.

If you are looking for an IRS settlement whether you be in Mesa, Gilbert, or another Arizona city look no further then Scott Allen EA of Tax Debt Advisors. Tax Debt Advisors began business in 1977 and specializes in dealing with IRS problems. Scott Allen EA purchased the business in 2007 from his father and has been operating it ever since.

If you had a need for, filing back tax returns, settling IRS debt, or audit representation please give Scott Allen EA a call today to discuss. He will give you the time to evaluate your case to see how he can assist you. Before you make a decision on who you should hire as your representation check the background of who you will be using. How long have they been doing the work? Can you see actual proof that they have a reputation of following through? Are they local? Those are just a few examples of some things to consider.

Call 480-926-9300 to meet with and interview Scott Allen EA to see if he is the right choice for you. I promise you it will be worth your time.