IRS settlement in Gilbert AZ: Case Closed

Are you wanting your case closed with the IRS?

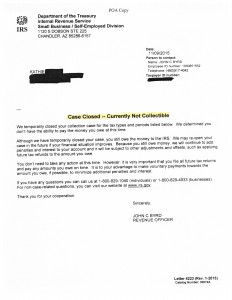

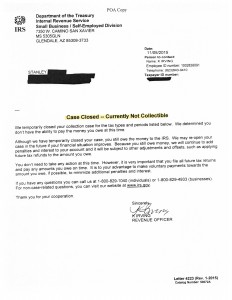

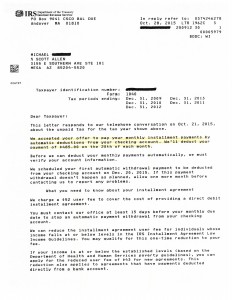

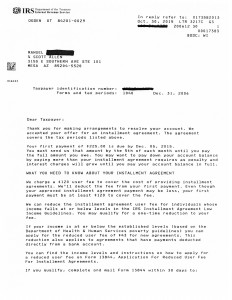

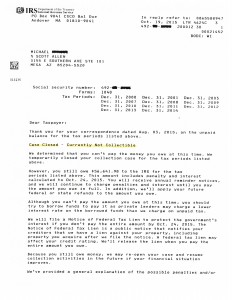

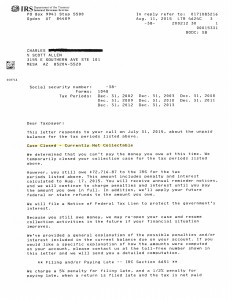

Many taxpayers struggle on where to begin when it comes to getting their IRS settlement in Gilbert AZ? If you google ‘IRS Settlement’ you will find over a million resources pointing you in all different directions. If you contact the IRS directly on a question you may find them to not be the most useful or giving you multiple answers. How do you know what is true and what isn’t? Scott Allen EA of Tax Debt Advisors is here to put an end to that confusion for you. He promises straight direct answers and follow through service. His guarantee is simple and understandable. Upon speaking with him over the phone or for an office consultation you will know you came to the right place. He will not put you down; but rather lift you up. He wants to get you that “Victory” you are trying to get with the IRS so you can move on with your life. This is exactly what he did for Kathie. Katie came into see Scott Allen EA with several unfiled tax returns and a debt she cannot pay back. She is on a limited fixed income. Scott Allen EA was able to get her caught up on the unfiled tax returns and negotiate an IRS settlement in Gilbert AZ by getting all of her IRS debts into a currently non collectible status. Click on the image below to see an actual IRS approval notice of that.

Scott Allen EA of Tax Debt Advisors, Inc will not make promises he cannot keep but, he will negotiate the best that the law will allow. Everyones situation is different and outcomes may vary. Consider giving Scott Allen EA a call today to have him evaluate your IRS matter to see if and where he can assist. He is experienced in representing Arizona taxpayers as their IRS Power of Attorney. He will only take on your case if it is in your best interest.