Don’t let unfiled tax returns in Phoenix AZ get you down

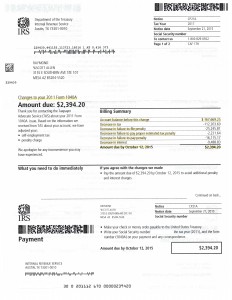

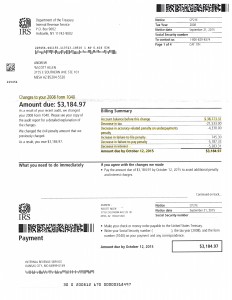

If you have unfiled tax returns in Phoenix AZ please read the following article. Just because you have not filed the tax back tax return does not mean the IRS cannot levy or garnish your wages. The IRS has the power to file what they call SFR returns. They take what limited information they have and prepare a simple high balance due tax return in your behalf. Don’t thank them just yet. Our client, Raymond came in to meet with Scott Allen EA a few months back. What the IRS had done was filed his Phoenix AZ unfiled tax return for him giving him a balance due of $167,669 for the year 2011. That is a lot of money for a taxpayer who made less then $50,000 for the year. When Raymond came in, Scott Allen EA contact the IRS with a signed power of attorney authorization. With this he discovered how they came up with their numbers, got contact and address information on how to protest their filing, and secured a hold on ALL collection activity to give time to prepare the unfiled tax return and to get it accepted by the IRS. When the IRS prepares SFR tax returns they are generated out of specific IRS offices and the protest return needs to be sent to that specific address. That is key to getting the return accepted and accepted quickly. What was the result of Scott Allen EA’s accurately prepared protest return? Only $2,394. Below is a copy of the acceptance letter secured by Scott Allen EA.

If you have unfiled tax returns near Phoenix Arizona call Scott Allen EA. His company Tax Debt Advisors has settled over 105,000 IRS debts since 1977. That is two generations of family tax debt service. He will meet with you for a free evaluation of your unfiled tax returns and go through the process that will get this issues behind you as quickly as possible. The best part is when you are happy with his services he can be your “regular tax preparation guy” year in and year out.

Click here to contact Scott Allen EA today.