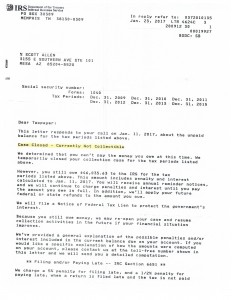

Are you searching for “Tax Attorney Chandler” while looking for someone to help you fix your tax troubles with the IRS? First of all, you don’t actually need a tax attorney to fix your tax problems with the IRS, you just need someone experienced in tax debt and tax law. Tax Debt Advisors Inc has been handling tax debts in Arizona since 1977. Help get things straight with the IRS by calling Scott Allen at Tax Debit Advisors, Inc. today at 480-926-9300 to help you get right with the IRS today!

Common Reasons To Hire A Tax Attorney

Below are the most common reasons to hire a tax attorney. Although, these are also services provided by Tax Debt Advisors Inc. Tax Debt Advisors can help with:

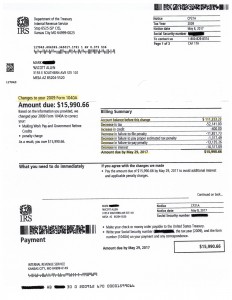

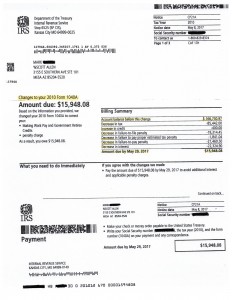

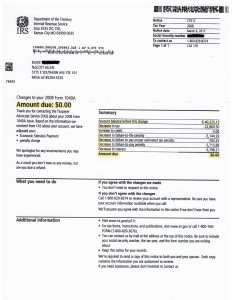

- Income tax audits

- Property tax issues

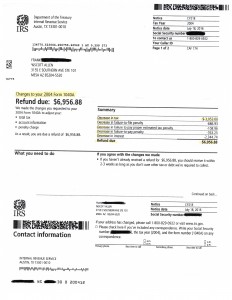

- Offers-in-Compromise

- Business Tax Issues

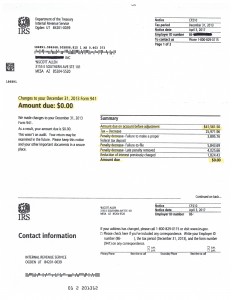

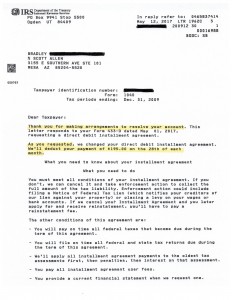

- Installment Agreements

- IRS Liens & Tax Levies

- Tax Audit Defense

- and more

When you are handling issues with the IRS, hiring a tax attorney is not actually required. However, by hiring a Tax Debt Advisor, you will get help from someone dealing with tax issues for over 41 years. If you have found yourself in trouble, Scott Allen can help guide you through any tax situation.

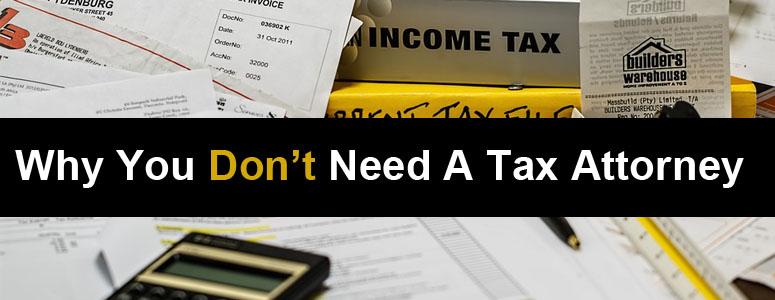

Why You Don’t Need A Tax Attorney

Here are the reasons and warning signs of why you don’t need a tax attorney.

Here are the warning signs:

- If you are considering a tax attorney out of fear, and your situation is not caused by fraudulent or criminally filed returns, you’ll be greatly disappointed. Your fear allows attorneys to generate income. Many clients that began using our services after using a tax attorney often mention they were intimidated that something bad ‘could happen if…’. This ‘if’ is followed with large retainer fees, every time.

- The IRS resolution work is easier to understand than most think, in most cases it is common sense. Having an established relationship improves the understanding with idiosyncrasies. It is common attorneys to use your fear to scare your more, while making you believe it is necessary to pay for their legal training to be successful.

- Another common factor is clients believing they get what they pay for, and comparing the amount paid to the quality of service. In many situations, attorney’s charge between 25% and 400% or more for the same services. If you do consult a tax attorney, you should consider obtaining a second opinion by calling our office for a free consultation.

Feel Confident With Experienced Tax Representation

When looking back over the years, one of the most common factors we notice in poor decision making were those that allowed fear to influence their decision. There is a quote from a Star Wars movie that I have grown to love, as it explains how Anakin became Darth Vader – “It was fear which pushed me to the dark side.”

If you’ve already had an initial consultation with a tax attorney, the first thing you should do is ask yourself “Did they lower my fear, or use it to benefit their profits?” Good representatives leave clients feeling better about their situation, not scared. Great representatives pay attention to the 99% of positive scenarios, things that can go right. Poor representatives focus on the 1% of negative scenarios which rarely occur. When you are considering a representative, take the time to give me a call and get a second opinion, I know you will be glad.

Free Tax Consultations | Do You Really Need A Tax Attorney?

“Tax Debt Advisors handled my tax issues, which included several years of tax returns with IRS issues. The back tax returns were processed quickly with no additional problems or delays. Scott managed every aspect of the IRS problem with ease. Thanks again Scott!” Stacy P

If you are worried about your IRS tax problems and think you need a tax attorney to represent you, give us a call first. This is an important decision to make that requires the experience and knowledge of a highly skilled Enrolled Agent. Scott Allen EA can be that choice for you. There is a great chance that you don’t need legal representation for your tax problems. Our tax debt advisors can help you solve those same tax problems for less money. To schedule you free tax consultation in Chandler to find out if you actually need a Phoenix tax attorney or not, give us a call today at 480-926-9300.