If you are wondering “what is a tax levy” and “how do I get a tax levy released” this post should help! Furthermore, if you live anywhere in the Phoenix Metropolitan area in Arizona, Scott from Tax Debt Advisors can help you get your levy released.

What Is a Tax Levy?

A levy is the action of legalized seizure of one’s property for the purpose of satisfying tax debt. Unlike liens, levies are different. Whereas a lien is the legal claim on a property for securing tax debit payment, a levy takes the property for satisfying tax debit.

Where does the IRS (Internal Revenue Service) authority to levy originate from?

Levies are authorized by the Internal Revenue Code (IRC) for collecting delinquent taxes. Reference IRC 6331. Any property or the right of property belonging to the delinquent taxpayer, or which a Federal tax lien is able to be levied, unless the property has been exempt from a levy by the IRC.

Prior to issuing a levy, what actions are required by the IRS?

Typically, the IRS only issues a levy after the following three requirements have been met:

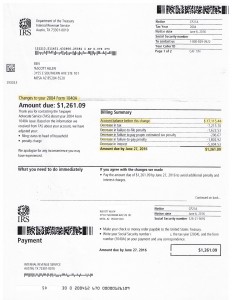

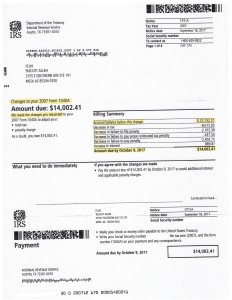

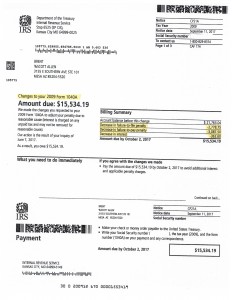

- Tax has been assessed by the IRS and a Notice and Demand of Payment (invoice) has been sent;

- You have refused or neglected to make payment;

- A Final Notice of Intent to Levy was sent to you, and you were informed with a Notice of Your Right to A Hearing (the levy notice) a minimum of 30 days prior to the levy being issued. This notice may be delivered by the IRS in person, left at your home or workplace, or mailed to the last known address using registered or certified mail and a return receipt request.

Note: The IRS is also allowed to issue a levy on state tax refunds as well. In this case, you might be sent a Notice of Levy on Your State Tax Refund, along with a Notice of Your Right to a Hearing after your refund is levied.

When is a levy issued by the IRS?

In the event you do not pay your tax or make other arrangements for settling debt, the IRS can determine the next appropriate action is issuing a levy. A levy can be issued by the IRS for any property you own or right to property you have an interest in. For example, the IRS is able to levy a property which is yours, but held by another person (such as retirement accounts, wages, bank accounts, dividends, rental income, licenses, accounts receivable, cash loan values of commissions or life insurance, etc. Otherwise, the IRS is able to seize and sell property which is held by you, such as house, boat, or cars.

How Can I Release a Levy?

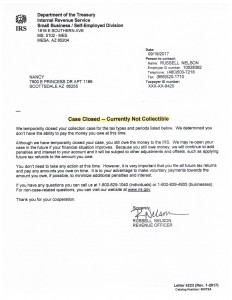

Upon receiving the IRS notice of the levy, you should contact the IRS right away to resolve any tax liability and request for a levy release. In addition, the IRS is able to release a levy when determining the levy is resulting in immediate economic hardship. If the release request is denied by the IRS, you may request an appeal on the decision. You can file an appeal before or after the levy is issued on your bank account, wages, or property. One proceeds from the levy has been sent to the IRS, you may file claim to request they be returned. If denied, you may submit an appeal on the decision of returning the levied property. The following is a full explanation of your rights to appeal: Publication 1660, Collection Appeal Rights (PDF).

In the event the following are determined, the IRS is required to release the levy:

- The amount owed has been paid

- The collection period ended before the levy was issued

- A levy release will help you pay delinquent taxes

- You make Installment Agreements and the agreement terms do not allow the levy to remain active

- Economic hardship is caused by the levy, which means the IRS determines issuing the levy will prevent you from being able to meet basic and reasonable living expenses.

- The property value is higher than the amount owed, and a levy release does not affect the ability to collect the owe amount.

- Note: a levy release does not indicate you do not have to pay the balance amount due. You are still required to pay your balance amount, and should contact the IRS to make arrangements for resolving tax debt or they can reissue a levy.

For More Information On Tax Levy & IRS Collection Process

For more information, see Publication 594, The IRS Collection Process (PDF).

Help With Tax Levies In Arizona

Scott from Tax Debt Advisors is an expert at helping IRS tax payers resolve tax levies in Arizona. Scott can help you get your tax levy released in Phoenix, Mesa, Tempe, Chandler, Gilbert, Scottsdale and more. Give us a call today at 480-926-9300 for more information.