We are Mesa Arizona’s Top IRS Problem Solvers for Unfiled Tax Returns

Mesa Arizona’s Unfiled Tax Returns

The sad part of not filing tax returns is the emotional toll it exacts on the noncompliant taxpayers. Always living in fear that their wages or bank accounts will be taken by the IRS without any warning at the worst possible time is no life. Never being able to own a home or purchase a vehicle without paying outrageous interest on the loan is depressing.

So what is the good news. The good news is that Scott Allen E.A. of Tax Debt Advisors, Inc. can file all of your Mesa Arizona’s unfiled tax returns even if you have lost your records. Scott Allen E.A. offers a free consultation and can be reached at 480-926-9300 to schedule a convenient confidential tax appointment. Now is the time to act and Scott Allen E.A. is the right choice to file all of your unfiled and back tax returns. One free appointment and you will be comfortable that you made the right decision.

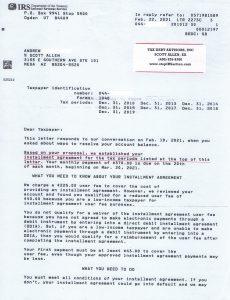

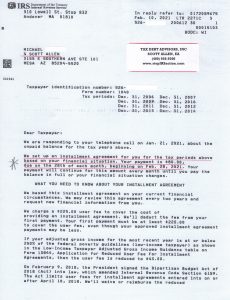

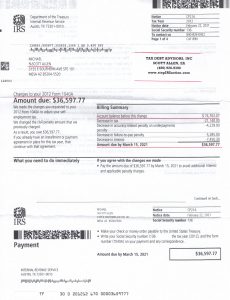

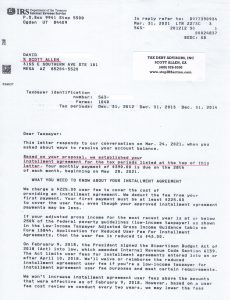

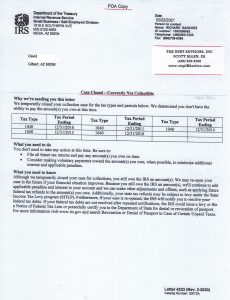

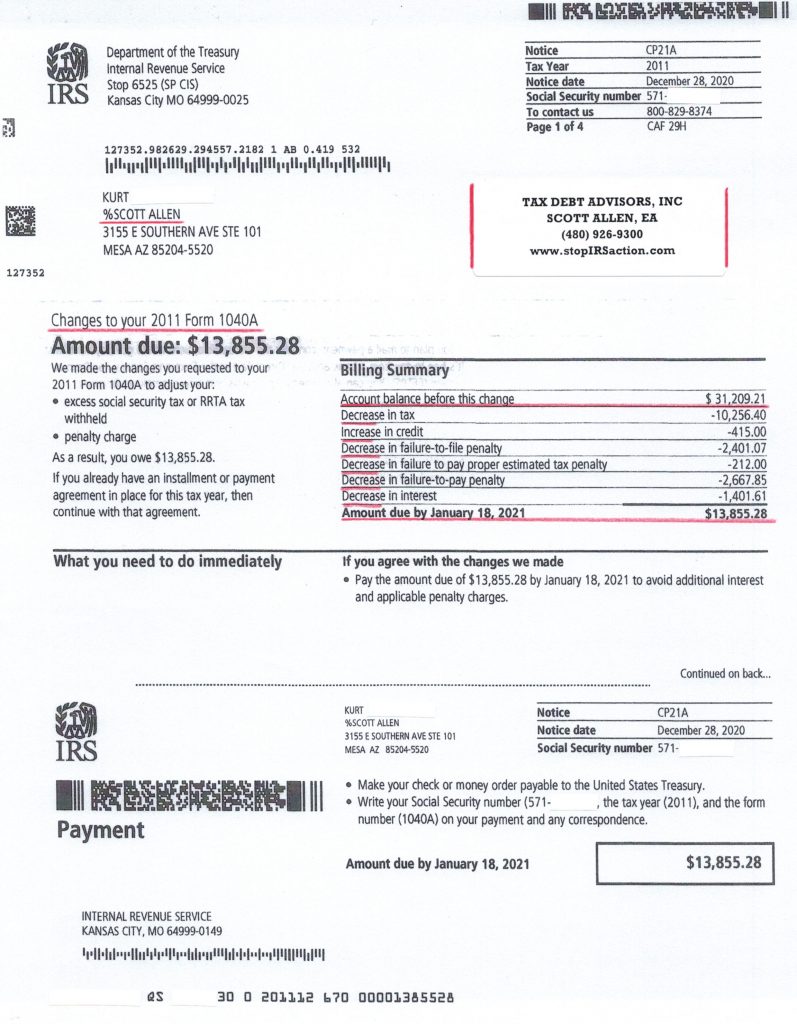

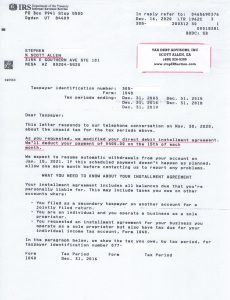

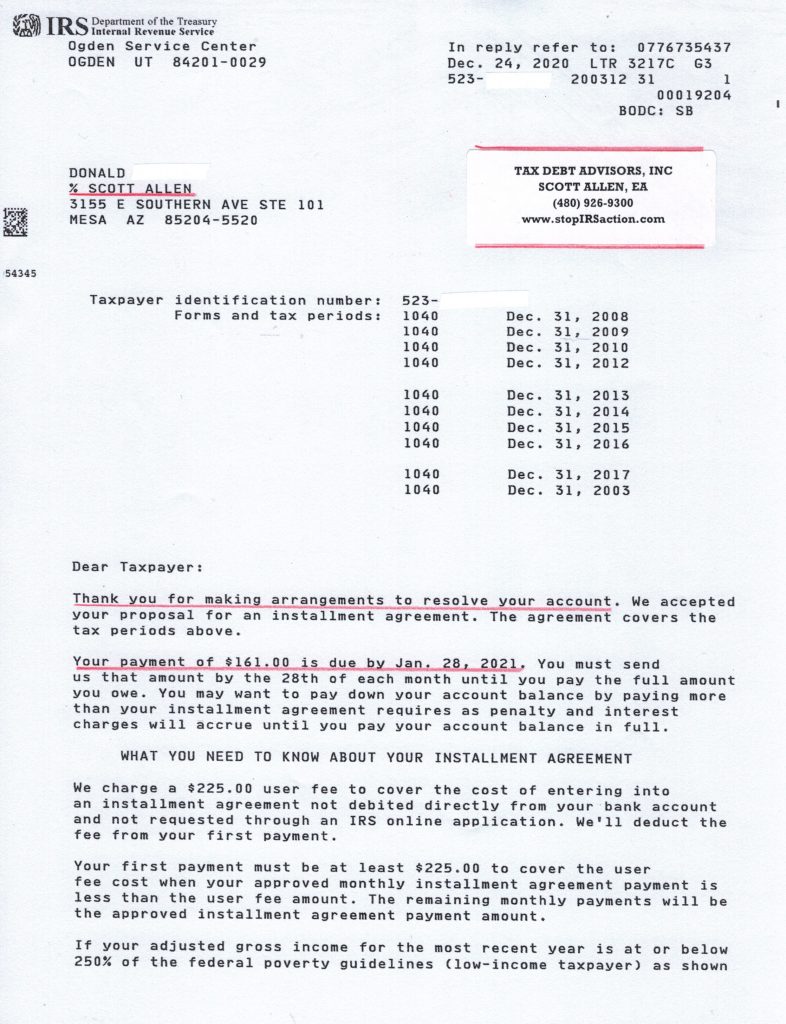

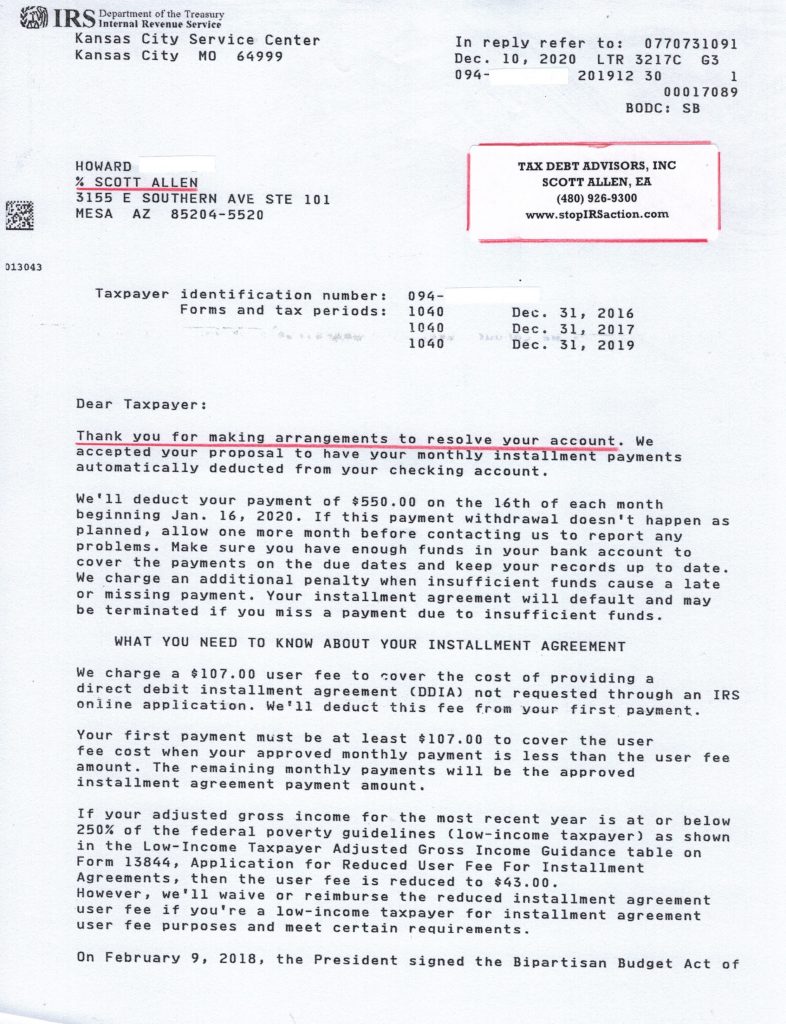

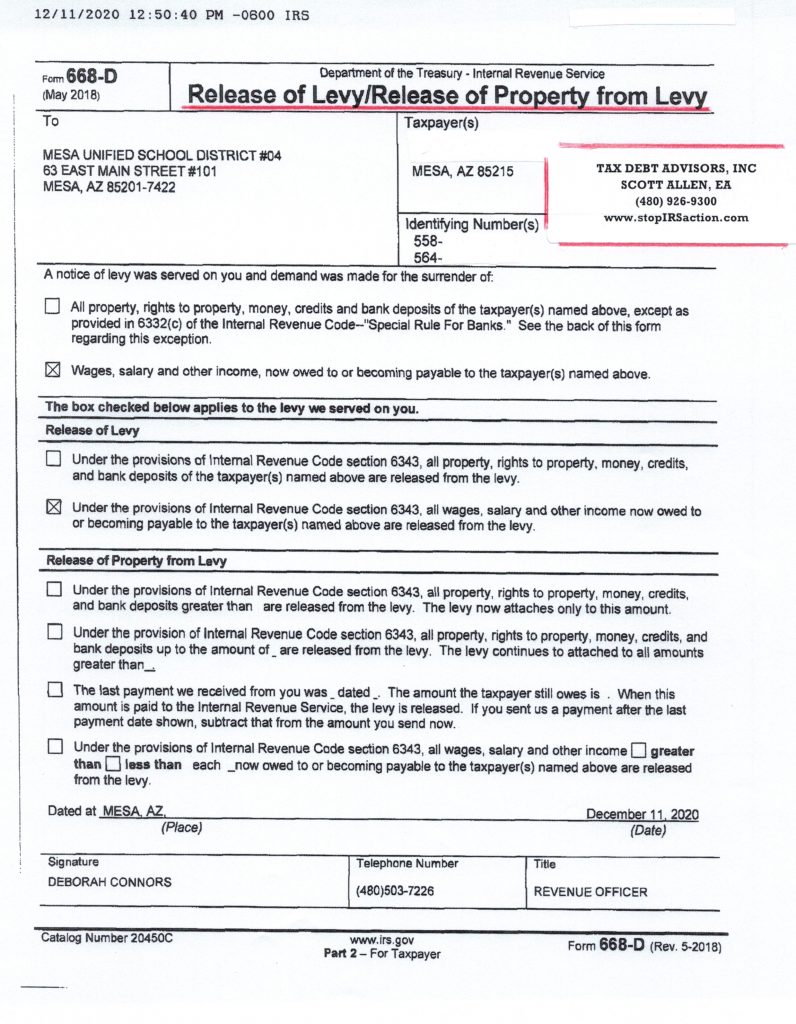

Andrew was a client who had several years of unfiled tax returns dating back to 2010. He needed help getting them prepared and negotiated into a settlement. Below is a copy of the approved agreement letter. Andrew can now move forward with his life and business knowing his back taxes are all taken care of and the threat of levy or garnishment by the IRS is gone.