A tax advisor is a financial expert or tax consultant that is extremely knowledgeable of tax law and has advanced training that can help solve IRS problems without hiring a tax attorney. Generally, a tax advisor’s services are retained to help minimize taxation, but remain compliant with local and federal laws, which often include financial situations that get complicated. The term tax advisor includes various titles, including tax attorneys, Certified Public Accounts (CPA), and financial advisors.

Tax preparers and advisors are not licensed, but regulated by the Internal Revenue Services (IRS). A tax advisor’s duties are outlined by the Treasury Department Circular No. 230. Reg. 10.33(a). If one fails to comply with these outlined standards provided by the IRS, disciplinary action and penalties can occur.

Enrolled Agents Are Tax Advisors

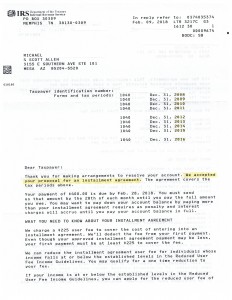

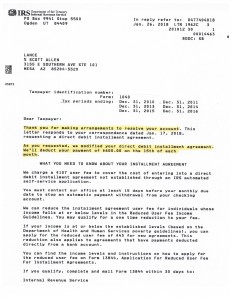

Searching for an enrolled agent is a good approach. An enrolled agent is an expert tax advisor who is requited to pass a complex test, currently licensed to represent people in front of the Internal Revenue Service, and achieve annual continued education requirements. An enrolled agent is able to provide some tax-planning advice and prepare income tax returns. If you have received a penalty letter by the IRS, an enrolled agent can help with this.

An enrolled agent works within a range of environments. Some may have a firm of their own, some work at tax-preparation chains, while others are certified financial planners or CPAs too. You are able to locate enrolled agents using the National Association of Enrolled Agents (www.naea.org). Typically, they charge per tax form when preparing returns, meaning the more complex your return the more you pay. For tax planning, they commonly charge per hour.

Who Needs a Tax Advisor?

Many people, if not the majority would benefit by employing a tax pro, especially those of us who fall under specific circumstances. Naturally, if your tax life is complicated, including factors like real estate transactions, retirement savings accounts, self-employment income, trust funds, rental property income, home office, stock options, etc., you can find the service of a tax pro to be helpful. In addition, those who live and work in multiple states or countries can benefit from tax pro services, when buying, selling, or running your own business, or simply living an active lifestyle.

Consulting a tax advisor is smart when experiencing major life events, including when adopting or having a child, getting married or divorced, have dependents you financially care for (such as parents or children), are a widow, received inheritance, buying or selling a home, starting a job or lost a job.

Not only can a good tax professional provide useful services through tax season, when tax returns are prepared, but year-round. This is because they keep updated with the latest tax laws, rules, regulations and are able to answer questions, provide advice, and give tax strategies to save money. For instance, effectively timing a sale for different asset types, allowing you to benefit from all credits and deductions available, and more.

How to Choose a Tax Advisor

One way to find a good tax consultant includes asking relatives or friends for their recommendations. Anotehr way is to find one on your own, such as using the National Association of Enrolled Agents website. You should ensure the tax pro has experience with your type of situation. For instance, small business taxes or personal income tax. Search for a professional that has more than a couple years of experience within the area, ensure they have a preparer tax ID number.

After you find a few possible tax pros, conduct due diligence research, ensure they are trustworthy and do not have a negative history. You can use the Better Business Bureau to do this search for accountants, and the board of accountancy within your state. To conduct research on enrolled agents, search for any licensing issues or disciplinary actions using the IRS Office of Enrollment.

Other things to ask about include certifications, professional affiliations, licenses, educational background, and references are a common request as well. If you are employing a tax consultant to prepare tax returns, question what happens in the event of an audit. Also, a significant factor is that you are comfortable working and speaking with the professional you choose.

You should not assume that employing a tax consultant is something only for the wealthy, or that one is not needed. It could cost a few hundred dollars to employ one, but it could save thousands, or more!

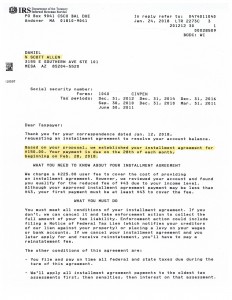

Need A Tax Advisor In Arizona?

Scott Allen E.A. Is an enrolled agent and experienced tax advisor that can help with numerous tax problems and more.