Tax Return Help Mesa

Welcome to Tax Debt Advisors! We offer tax return help in Mesa, Arizona. If you are experiencing tax return problem with the IRS, we can help, give us a call today at 480-926-9300! View below to see a list of our tax return help services.

Our tax return help services include:

- Unfiled Tax Return Help

- Tax Settlement Help

- IRS Tax Debt Help

- IRS Tax Problem Help

- Tax Preparation Help

- IRS Payment Plan Help

- Help With IRS Notices

- Help With IRS Audits

Whether you need to get your back tax returns filed, need assistance with IRS problems, or just need a simple tax return completed, Tax Debt Advisors can help! We have years of experience in dealing with the IRS and can help you with whatever type of tax return problem you are experiencing.

Whether you need to get your back tax returns filed, need assistance with IRS problems, or just need a simple tax return completed, Tax Debt Advisors can help! We have years of experience in dealing with the IRS and can help you with whatever type of tax return problem you are experiencing.

Tax Debt Advisors is family owned and operated tax services provider. We have helped settle over 108.000 tax debts in the Mesa area.

Unfiled Tax Return Help

Need help with unfiled tax returns in Mesa? Tax Debt Advisors specializes in preparing unfiled tax return to get you back on a good track with the IRS. If you desire marriage without financial stress, home ownership, bank accounts, or to start saving again for your retirement, contact Tax Debt Advisors today. Read More

Need help with unfiled tax returns in Mesa? Tax Debt Advisors specializes in preparing unfiled tax return to get you back on a good track with the IRS. If you desire marriage without financial stress, home ownership, bank accounts, or to start saving again for your retirement, contact Tax Debt Advisors today. Read More

Tax Settlement Help

Clients often think that there is only one option to settle IRS tax debt. That assumption is wrong, there are actually 6 option available for tax payers to settle their IRS debt. Read More

Clients often think that there is only one option to settle IRS tax debt. That assumption is wrong, there are actually 6 option available for tax payers to settle their IRS debt. Read More

IRS Tax Debt Help

IRS tax debt usually stems from one big problem. Failure to discover the real issue will quickly get you back in trouble with the IRS again. Taxpayers do not get into trouble with the IRS on purpose. Usually there is some crisis happening to them. It may be an illness, a death in the family, a business failure, divorce, drug or gambling addiction, being laid off from work for an extended period of time, or severe emotional issues with depression or anxiety. Read More

IRS tax debt usually stems from one big problem. Failure to discover the real issue will quickly get you back in trouble with the IRS again. Taxpayers do not get into trouble with the IRS on purpose. Usually there is some crisis happening to them. It may be an illness, a death in the family, a business failure, divorce, drug or gambling addiction, being laid off from work for an extended period of time, or severe emotional issues with depression or anxiety. Read More

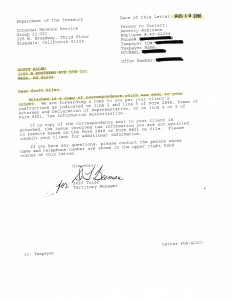

IRS Tax Problem Help

The company you hire to assist with your IRS tax problems are one of the most important decisions you will make. Do not rely on out of state company hype. Most of the time, these companies will contact you via phone, usually a sales person who is trained to scare you to get more money out of your vulnerable situation. If the company you are dealing with doesn’t have an office you can visit, you will most likely be disappointed in your results. Read More

The company you hire to assist with your IRS tax problems are one of the most important decisions you will make. Do not rely on out of state company hype. Most of the time, these companies will contact you via phone, usually a sales person who is trained to scare you to get more money out of your vulnerable situation. If the company you are dealing with doesn’t have an office you can visit, you will most likely be disappointed in your results. Read More

Tax Preparation Help

Welcome to Tax Debt Advisors Inc. We offer tax preparation help, IRS tax debt, tax relief, tax settlements and tax preparation services in Mesa, AZ. Market research has proved that 75% of tax payers are unhappy with their current tax preparation company. We have years of experience in getting taxpayers the most money back on their tax returns. We look deep to find all the deductions and credits that will help you save you the most money. Read More

Welcome to Tax Debt Advisors Inc. We offer tax preparation help, IRS tax debt, tax relief, tax settlements and tax preparation services in Mesa, AZ. Market research has proved that 75% of tax payers are unhappy with their current tax preparation company. We have years of experience in getting taxpayers the most money back on their tax returns. We look deep to find all the deductions and credits that will help you save you the most money. Read More

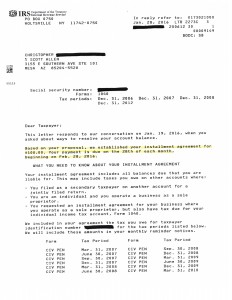

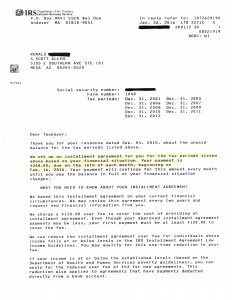

IRS Payment Plan Help

There are a variety of options you can choose to settle your IRS debt in Mesa. One of our previous clients, Stephen, negotiated an IRS payment plan on six full years of unfiled tax returns. We can help you set up a monthly IRS payment plan, setup currently non collectible status, setup an offer in compromise, or setup a plan to discharge your taxes in bankruptcy. Read More

There are a variety of options you can choose to settle your IRS debt in Mesa. One of our previous clients, Stephen, negotiated an IRS payment plan on six full years of unfiled tax returns. We can help you set up a monthly IRS payment plan, setup currently non collectible status, setup an offer in compromise, or setup a plan to discharge your taxes in bankruptcy. Read More

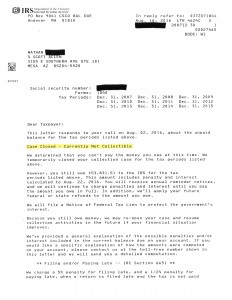

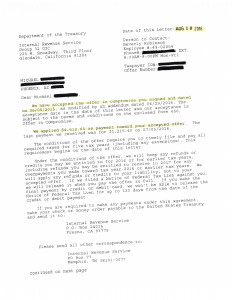

Help With IRS Notices

Every letter you get form the IRS should be taken seriously. If you receive a IRS letter for a tax return you recently filed, it’s probably concerning one of three things, either you owe more taxes, you are due a larger tax refund, or the IRS needs more information to process your tax return. Read More

Every letter you get form the IRS should be taken seriously. If you receive a IRS letter for a tax return you recently filed, it’s probably concerning one of three things, either you owe more taxes, you are due a larger tax refund, or the IRS needs more information to process your tax return. Read More

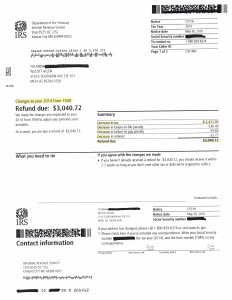

Help With IRS Audits

The CP2000 audit the most common type of IRS audit. More CP2000 IRS notices get sent out more than any other notice. A CP2000 audit comes about when you report amounts that do not line up with the amounts you reported to the IRS. Read More

The CP2000 audit the most common type of IRS audit. More CP2000 IRS notices get sent out more than any other notice. A CP2000 audit comes about when you report amounts that do not line up with the amounts you reported to the IRS. Read More

Tax Return Problems Solved

Tax Debt Advisors is here to help with any tax return problem you may be experiencing with the IRS. We have helped settle over 108,000 tax debt to date. Call us today at 480-926-9300 to get professional help in dealing with tax return issues and the IRS.