5.12.2016 Tax Debt Advisors Reviews

View Tax Debt Advisors Reviews. For more click here.

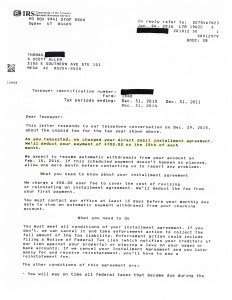

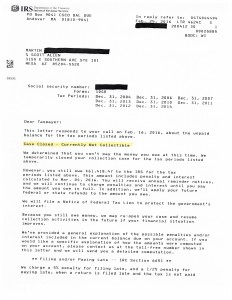

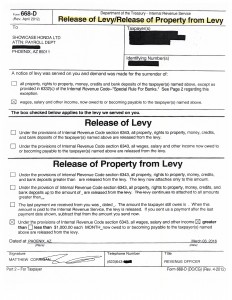

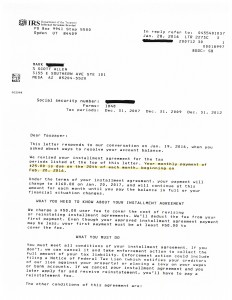

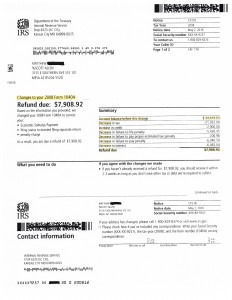

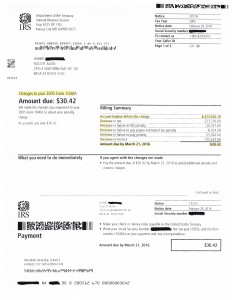

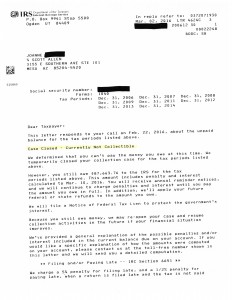

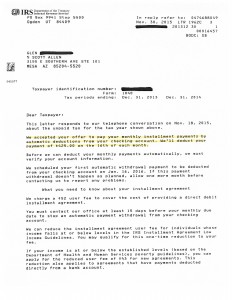

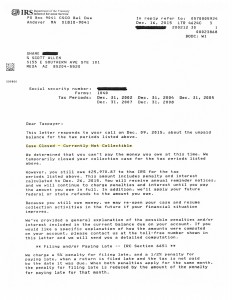

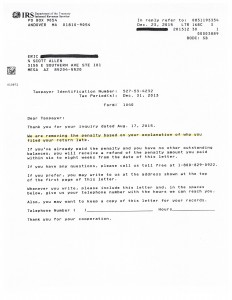

The document below shows the IRS payment plan negotiated for their client, Tom. Tom wanted a payment plan that would be debited directly from his bank account and not have the IRS file a federal tax lien. That is exactly what Scott Allen EA of Tax Debt Advisors did. Another happy client for life. Seeing actual evidence of accomplished work are real Tax Debt Advisors reviews.

Do you find yourself in need of an IRS payment plan (or other negotiation)? Scott Allen EA specializes in IRS problem resolution work. When you need to file Mesa AZ back tax returns, work out a payment plan, currently non collectible status, offer in compromise, or just find out if your taxes qualify for bankruptcy Tax Debt Advisors is the “one stop shop”. All IRS resolution work is personally handled by Scott Allen EA himself. Speak with him today for a no obligation conversation.