If you are searching for “do i need to file taxes 2017” or “do i need to file taxes 2018“, this post should help! Everyone is not required to file their taxes every year. Generally, one’s total income for the entire year has not exceeded the amount of their standard deduction, with one exemption, and they are not a dependent of another tax payer. So, if you can claim yourself under the above requirements you may not have to file a tax return every year. It depends on the yearly income that one’s has earned, the type of that income, their age, and their filing status, as to whether or not they would have to file any taxes for that year.

The gross income thresholds

Anyone who pays taxes and files a return can claim the standard deduction and they can also claim one other person as an exemption, as long as that person is not being claimed by someone else. The amounts of the standard tax and the exempt get fixed by the government every year by the time the tax season comes around and it is also taken care of for any increases due to inflation every year as well.

You Do Not Need To File Taxes If Your Income Doesn’t Exceed Your Standard Deduction

The IRS does not require anyone to file a tax return in the years that their income does not exceed their standard deduction, including any exemptions that they might be able to take. In other words, if their income is equal to or less than their standard deduction plus exemptions they do not have to file for that year. Tax exempt income is not included when trying to determine if you need to file or not. For instance, in the year of 2017, those who were under the age of 65 and they were single, would have to file their tax return if they made over $10,400 and over, that is how much the standard deduction was for that year for a single taxpayer, including one exemption.

The income thresholds for those 65 and over

Anyone who is at least 65 years of age and is receiving Social Security income must go by the filing requirements the same as those who are still working. Although, those on Social Security can usually receive more income than working tax payers before they having to file a return. With the exception of those who are married and file separate returns. If this is the case, they would have included their Social Security income to evaluate their gross income will exceed the standard deduction, including one exemption. Additionally, should the IRS require someone to pay taxes on a portion of their Social Security income on account of their other income be too much, they would have to calculate that taxable amount, no matter what their filing status or marital status is.

Tax filings for dependent filers

Taxpayers that are claimed as a dependent on another taxpayer’s return will be subject to a different set of IRS filing requirements, whether they be a child or an adult. Dependent taxpayers are unable to claim themselves as an exemption, it makes it necessary for them to file a tax return when their income is equal to or more than their standard deduction (for single filers), which in the year of 2017 the standard deduction was $6,350 dollars. The dependents threshold on their income decreases over $1,050 for unearned income, like dividends and interest.

Claiming your tax refunds

Even on the years that a person would not have to file a return they might want to think again. The only way to receive a refund is to file a tax return for those who have federal taxes withheld out of their paychecks. For instance, a single taxpayer that earned $2,500 throughout the year, and they had $300 of that withheld for their federal tax, they would be entitled a refund for all of the $300 because their earnings were less than their standard deduction and an exemption. The IRS will not just automatically send anyone a refund, they would first have to file a tax return.

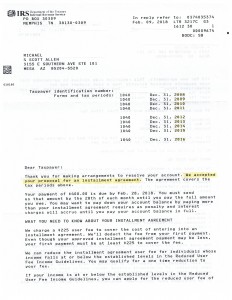

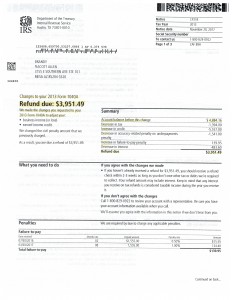

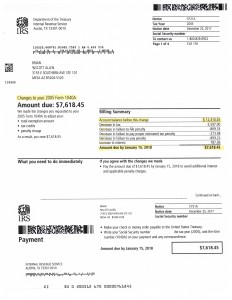

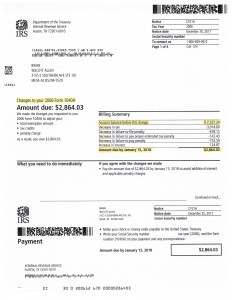

You Need To File A Back Tax Return If You Haven’t Filed Already

If you are reading this article, you have already missed the date to file your taxes on time. You can always file a back tax return with the IRS. If you are not sure how to do this, Tax Debt Advisors can help! We help tax payers file back tax returns in Phoenix, Gilbert, Scottsdale, Mesa and other areas in the Valley.

Tax Debt Advisors Can Help With Back Tax Returns & More

If you need to file back tax returns, having problems with the IRS or just need a great tax advisor, schedule your free tax consultation with Tax Debt Advisors today by giving us a call today at 480-926-9300.