Tax Debt Advisors Reviews: Innocent Spouse Relief

“Proof is in the pudding”: More Tax Debt Advisors Reviews

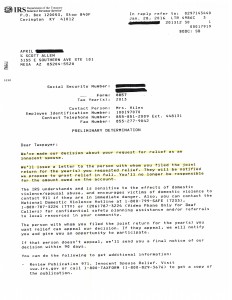

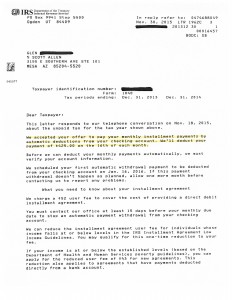

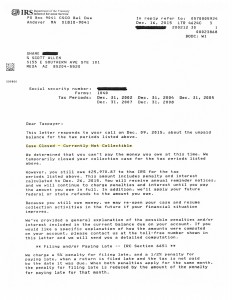

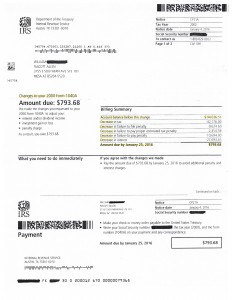

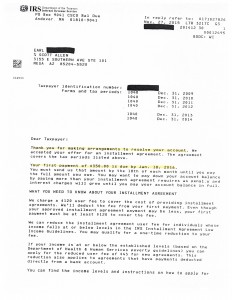

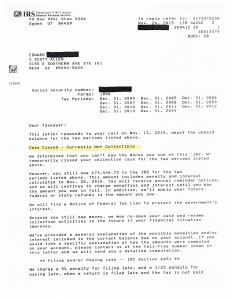

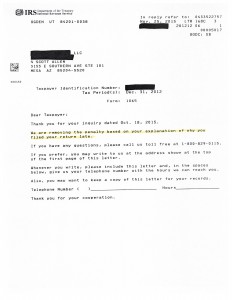

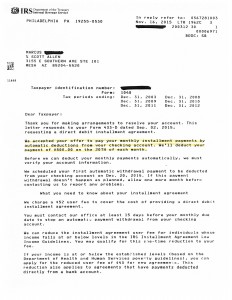

Below is an actual notice of success accomplish by Scott Allen EA of Tax Debt Advisors. You can view other Tax Debt Advisors Reviews by clicking here. April was caught up in a messy relationship with her now ex-spouse. He was not an ethical man and lied and hide finances from her. He controlled everything she could or couldnt do. Upon evaluating her situation within her family life and also her current financial situation it was determined that she was a prime candidate for innocent spouse relief. Because everyone isn’t, its important to find out before applying for relief. The process can take up to 12 months so you don’t want to go down that road only to have it denied. For April is was about 10 months before it was approved. Don’t just take our word for it. Click and view the image below.

Scott Allen EA will only take on your case if it is in your best interest to do so. He will meet with you for a free consultation to analyze your case. He will represent you before the IRS, or if not needed, he will tell you how to fix the case on your own. If you are not a strong candidate for an innocent spouse claim Scott will go over the other settlement options with you.

Along with helping with innocent spouse relief Scott Allen EA also assist taxpayers with yearly tax preparation, unfiled back tax returns, and settling IRS debts. Speak with him today!