You can’t have your cake and eat it too, sorry! IRS Help from Tax Debt Advisors, Inc.

Virtually every prospective client believes that we are telling them the truth when it come to fixing their tax problem. Yet many will go to get a second opinion. That is fine, even expected. Then the most amazing thing happens. The client says, “I like you guys, trust you guys, but I like the other guy’s solution more than I like your solution. Will you do the other guy’s solution? If you will, I will use you.”

The big problem is that if the other guy’s solution would work, we would have advised you that in the first place. We know the best solution that will work. We will not take your money to do another guy’s solution that will not work.

So you know what happens, the prospective client goes to the other guy, and they are ripped off, then they come back and want us to do what we advised in the first place. Many times the window of opportunity has been lost, or it is not as good because of changes in their financial ability to pay, or their bank accounts or wages have been levied.

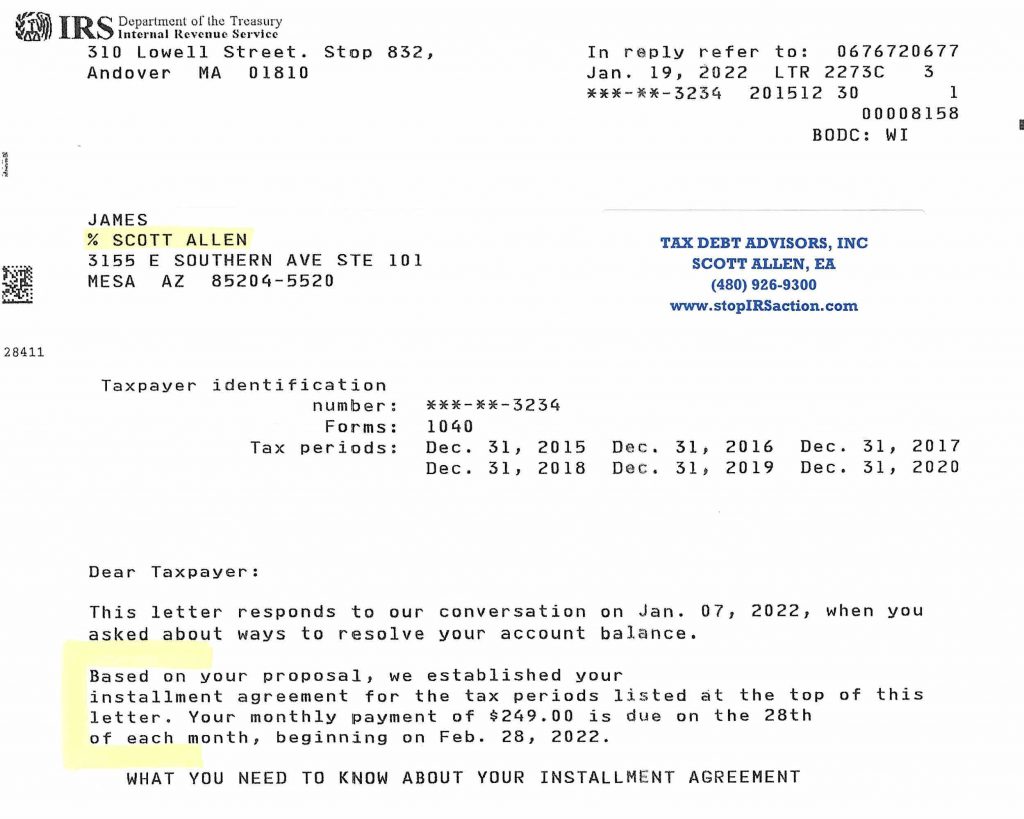

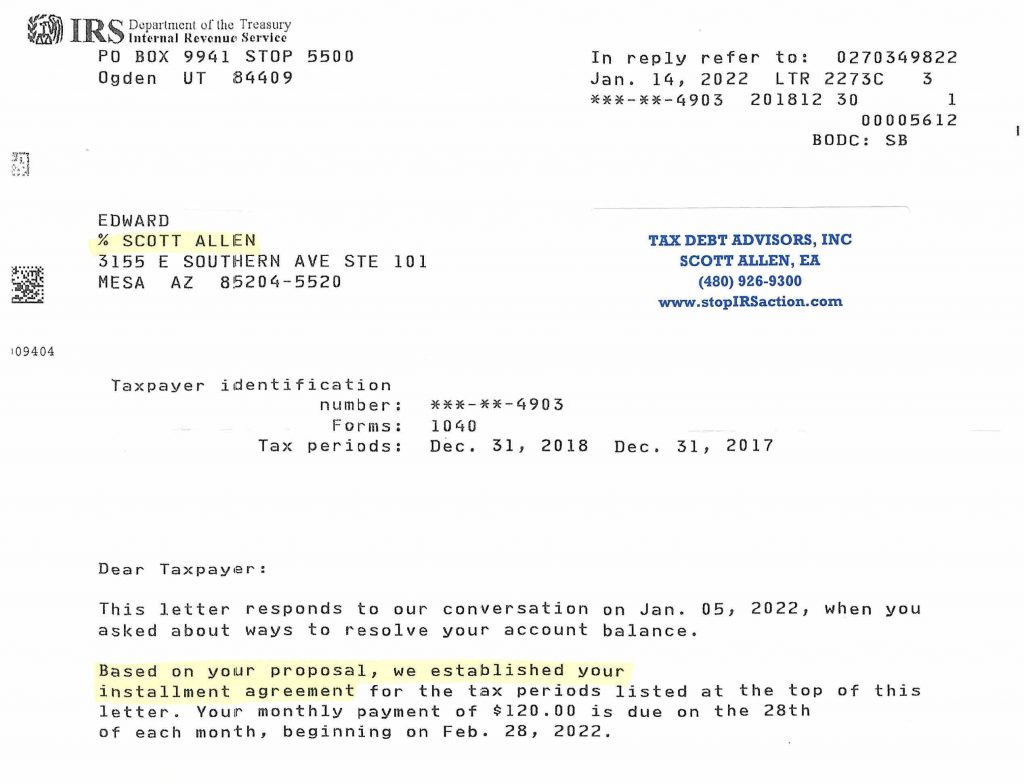

Go with the guy you trust. Believe the solution of the guy you trust instead of what you want to hear or believe. Perhaps that is why the client got in trouble with the IRS in the first place. Tax Debt Advisors Inc Reviews are actual notices of completed work for their clients they represent.

Scott Allen E. A.

Tax Debt Advisors Inc Reviews

Recent Tax Debt Advisors Inc Reviews: 2022

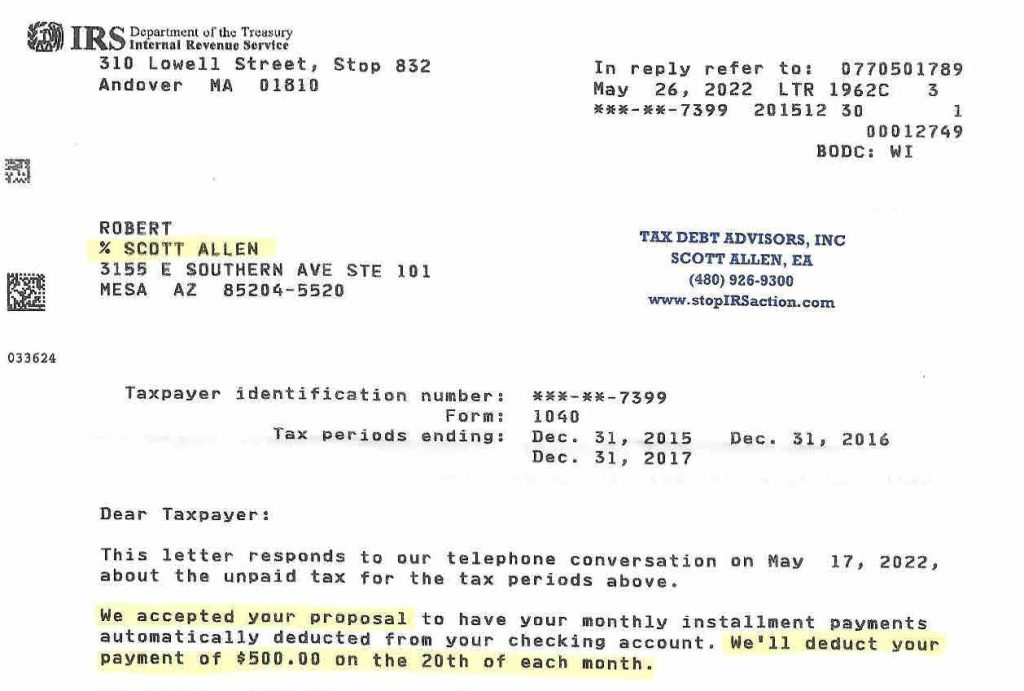

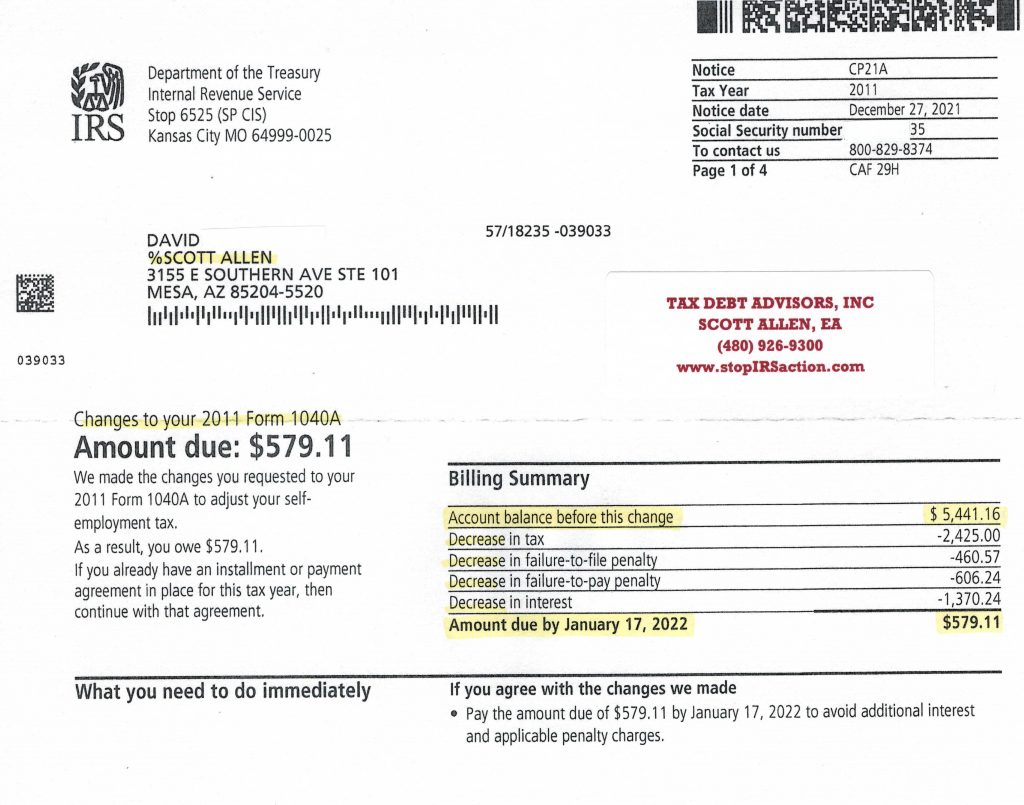

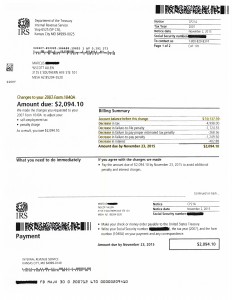

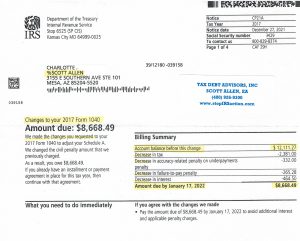

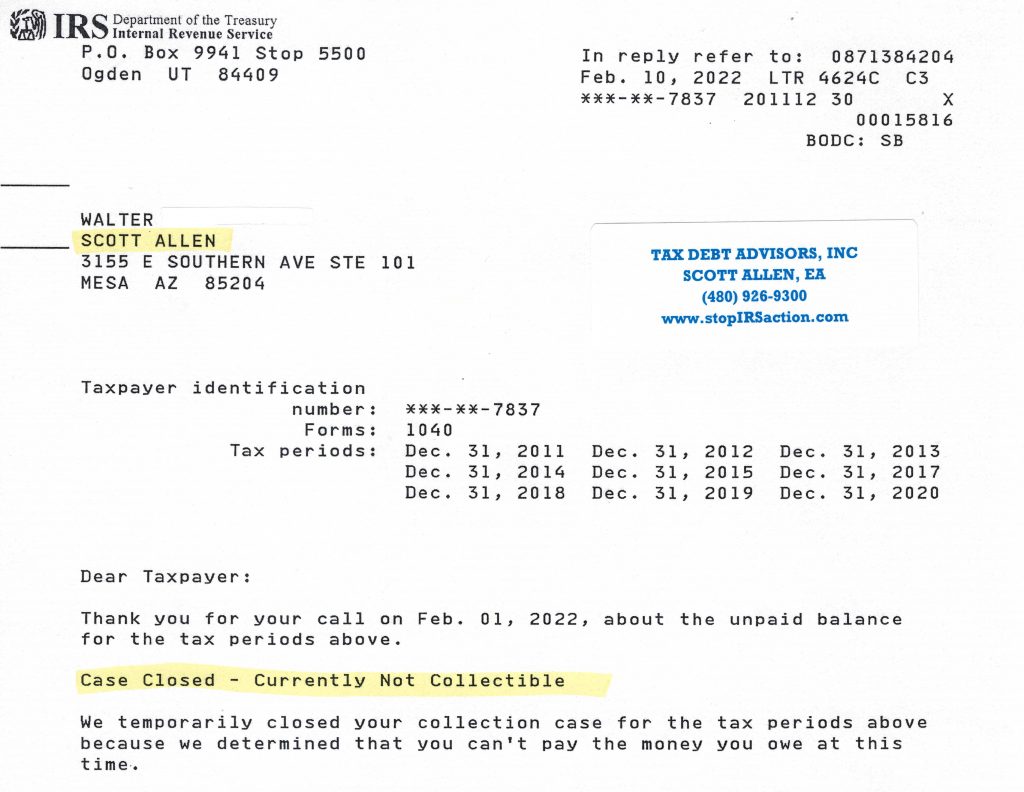

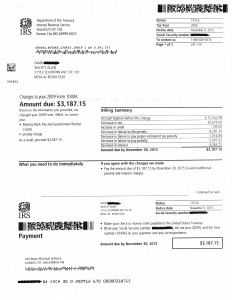

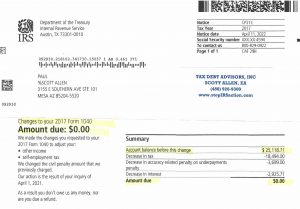

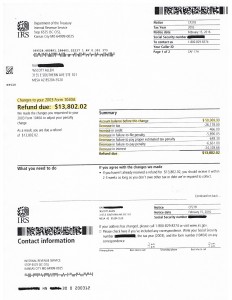

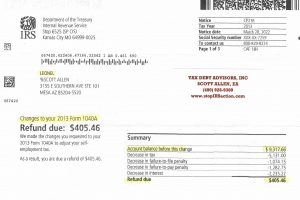

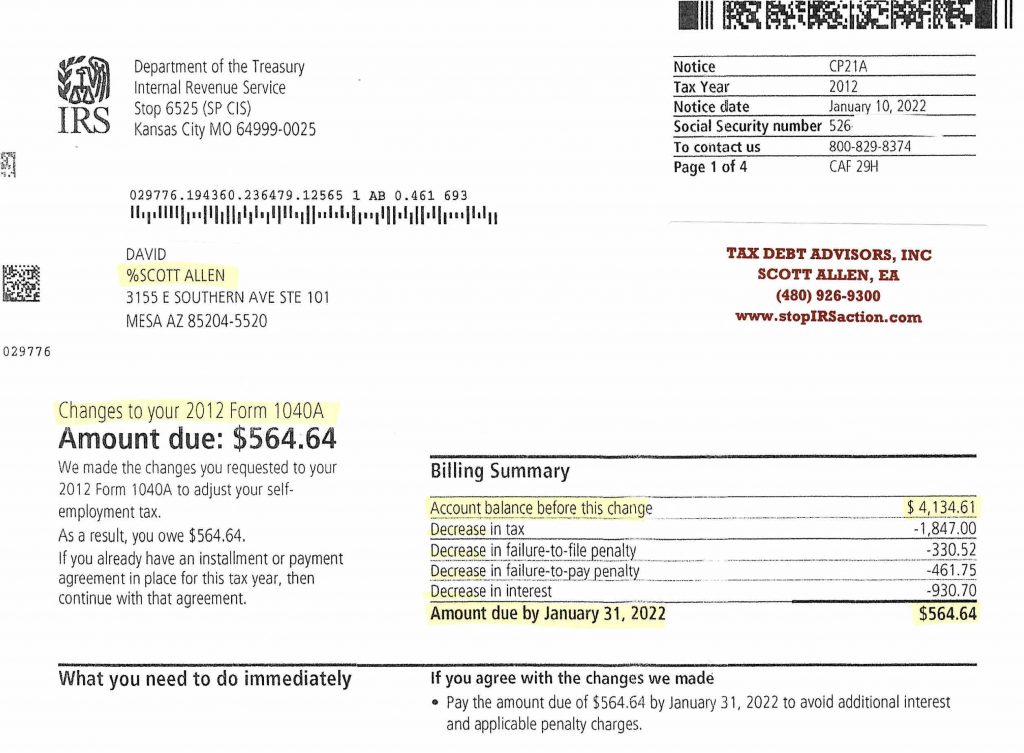

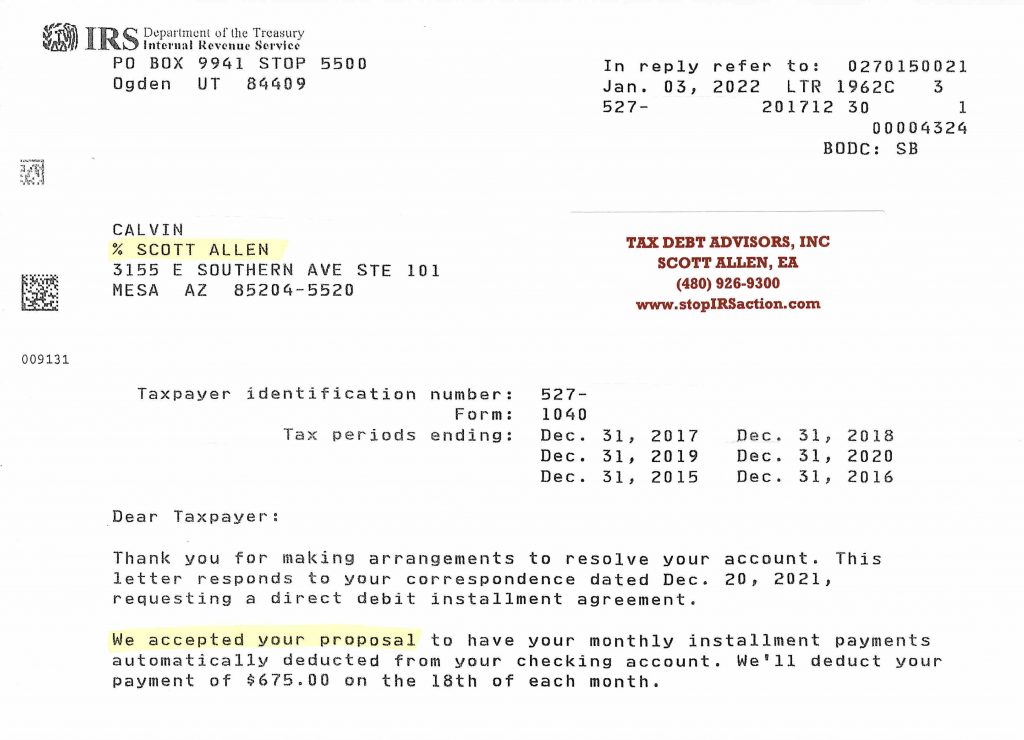

See how Tax Debt Advisors Inc solved Calvin’s IRS problem. He filed six years of back tax returns and settled them all into one low monthly payment plan of $675 per month. The key to having success with the IRS is being proactive. Far to often taxpayers become reactive when it comes to the IRS. Whether its because of their fear or due to other hardships being reactive puts you at a disadvantage. Don’t delay any longer and get a positive outcome just like Calvin did. A payment plan is just one of several options to settle an IRS debt. With Tax Debt Advisors Inc you will be aware of all available options.

Tax Debt Advisors Inc Reviews

Tax Debt Advisors, Inc. provides IRS help to the following Arizona cities:

Apache Junction, Avondale, Bisbee, Buckeye, Bullhead City, Camp Verde, Casa Grande, Catalina, Chandler, Chinle, Chino Valley, Coolidge, Cottonwood, Dewey, Douglas, Eagar, El Mirage, Eloy, Flagstaff, Florence, Fountain Hills, Gilbert, Glendale, Globe, Goodyear, Green Valley, Kingman, Lake Havasu City, Lakeside, Marana, Mesa, Nogales, Oro Valley, Page, Paradise Valley, Payson, Peoria, Phoenix, Pinetop, Prescott, Prescott Valley, Safford, San Luis, Scottsdale, Sedona, Show Low, Sierra Vista, Somerton, Sun City, Sun City West, Sun Lakes, Surprise, Tempe, Thatcher, Tuba City, Tucson, Winslow, Yuma

Call Tax Debt Advisors, Inc if you have questions about any of these issues:

IRS Help, IRS Representation, IRS Problem, Tax Problem, IRS Negotiations, IRS Settlements, IRS Tax Debt Settlements, IRS Tax Settlements, IRS Audit, Guarantee of IRS Services, IRS Attorney, IRS Tax Discharged, IRS Statute of Limitations, IRS Installment Arrangements, IRS Abatement of Interest, IRS Abatement of Penalties, IRS Offers, IRS OIC, IRS Offers in Compromise, IRS POA, IRS Power of Attorney, IRS Form 2848, IRS Forms, IRS Offices, IRS Phone Numbers, IRS Filing Back Taxes, IRS Back Taxes, Copies of Old Tax Returns, Filing Old Returns, Filing Amended Returns, Filing 1040X, Filing 140X, Arizona Department of Revenue, AZDOR, IRS Estimated Taxes, IRS Withholdings, IRS Form W-4, IRS Amnesty, IRS Tax Amnesty, Tax Amnesty, IRS Not Collectible Status, IRS Currently Not Collectible Status, Not Collectible Status, IRS Non-Collectible Status, IRS Currently Non-Collectible Status, Non-Collectible Status, IRS Bankruptcy, IRS Tax Bankruptcy, Tax Bankruptcy, IRS Chapter 7 Bankruptcy, Tax Chapter 7 Bankruptcy, IRS Payment Plans, Defaulting IRS Payment Plans, Defaulting IRS Installment Arrangements, IRS Levy, Tax Levy, IRS Tax Levy, IRS garnishment, IRS Tax Garnishment, Tax Garnishment, IRS Wage Levy, IRS Bank Levy, IRS Wage Garnishment, Levy Bank Account, IRS Lien, Tax Lien, IRS Tax Lien, IRS Form 433-A, IRS Form 433-B, IRS Notices, IRS Form CP 501, IRS Form CP 503, IRS Form CP 504, IRS Form CP 2000, IRS Tax Court Petition, IRS Appeals, Tax Appeals, IRS Collection Due Process, IRS Collection Appeals Program, IRS CAP, IRS Collection Due Process Appeal, IRS Collection Due Process Hearing, IRS Audit Appeals, IRS Taxpayer Advocate Office, IRS Tax Preparation, IRS Help for Medical Professionals, IRS Help for Construction Workers