Are you searching the internet for “Tax Refund Less Than Expected” in Mesa, AZ or in any of the sourounding Phoenix Valley? If so, your probably wondering why your tax refund is less than you though it was going to be. The information on this page should help provide you with some understanding. Furthermore, if after reading you think that you are still entitled to the full refund, do not hesitate to give Scott at Tax Debt Advisors a call today 480-926-9300.

It is very frustrating to think you are receiving a certain number of dollars back in your refund just to be let down when it comes. This does not account for the amount you wish you were getting back, but the amount you were planning on after filing your taxes. However, there are many different reasons that this might happen, and it does happen to a lot of tax payer’s every year, creating confusing and making them frustrated.

Why The Government Takes Portions Of Tax Refunds

The government will take money from your refund for certain debts owed, such as Student loans, HUD loans, Child Support, delinquent taxes, debts to federal agencies (non-taxed), and many other obligated debts, which will reduce the amount of your refund. They will even take out any monies you may owe for fraudulent compensation from unemployment. So, if you have a refund coming from the federal government be warned that they will take what you owe out.

The Financial Management Service (FMS) of the Treasury Department are the ones who issue the tax refunds from your federal income, however, Congress has given authorization for a Treasury offset Program, this allows the Financial Management Service the right to take out any of your refund needed for paying these delinquent debts.

Reasons Your Tax Refund Might Be Less Than Expected:

- All types of federal taxes you may owe.

- Child support that is past due.

- Non-tax debts to federal agencies, such as Student loans.

- States taxes past due, local taxes past due, and even library fines that are past due.

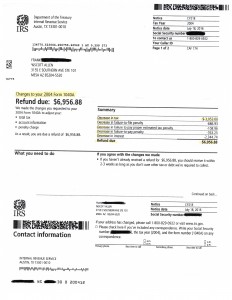

You will receive a letter explaining the offset whenever your federal refund has been reduced or use up completely. Anytime that run into your refund being delayed or reduced, you may contact the FMS at (800) 304-3107 to get additional information. If your delinquent debts do not take all of your refund due you will still receive the balance of it in the matter in which you requested originally, either via deposit or by mail.

Married Filing Jointly

If you are married filing jointly and only one of you are actually responsible for the debt of the FMS collection, the IRS has special process that will allow part of the refund to still be processed for the one that isn’t responsible for the debt. In order to get a share of a refund which has been reported to the FMS for collection, you will need to complete the IRS Form 8379 (Injured Spouse Allocation), it lets the tax payer that is not responsible for the debt a chance to provide the needed information to the IRS and they will determine what step to take next with the tax refund.

The form can either be filed when the taxes are initially filed (if you know in advance that there will be an offset for a debt) on Form 8379, or it can be filed after the refund has been reduced by the offset or completely eliminated by the Offset Program. If you have an Installment Agreement request with the Internal Revenue Service, the FMS is going to intercept your refund and apply it to the principal balance owed on your tax debt. Unless this offset pays off the entire debt, you will still be responsible to continue your agreed on monthly payments to the IRS.

Call The IRS

In any case, if you do not receive the amount of tax refund you expected or it did not come at all, by all means, you should call and check on it. However, there will probably be a good reason for this, and the reduced amount may be correct, but, it is also possible that it was an error of some sort, something else could have happen to it and it ended up in the wrong hands, or misused, and could have even been stolen.

It is important that you act quickly and find out, to ensure that the amounts that were removed or offset will get settled and everything is accurate. The best place to begin this process would be with whoever prepared your tax return, as they will be able to work with you throughout the process to make sure you get back what is due you.

Make An Appointment With Tax Debt Advisors

If you still think that you are entitled to the full tax refund or don’t want to contact the IRS yourself, do not hesitate to give Scott at Tax Debt Advisors a call today 480-926-9300.