Need Scottsdale AZ IRS Penalty Abatement

Might you qualify for Scottsdale AZ IRS penalty abatement?

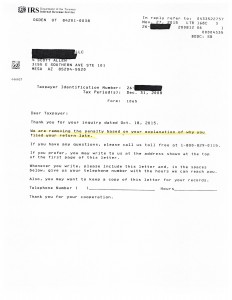

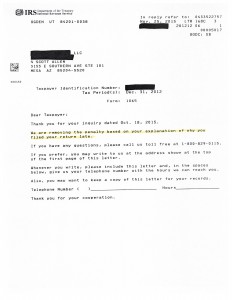

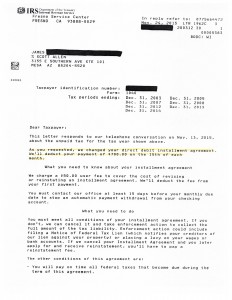

As we all know the IRS issues penalties and they do so often. Most the time we have to accept those charges due to are own wrongdoing. However, there are legitimate reason of why you might qualify for all or some Scottsdale AZ IRS penalty abatement. Consult with Scott Allen EA today to see if you are a candidate. By clicking on the document below you will find a recent success of his in regards to abatement of penalties.

This IRS will issue penalties for a few reasons but the most common are for failure to file on time and failure to pay on time. The penalty for filing your 1040 taxes late is 5% a month up to five months. The penalty for paying your taxes late is only 0.5% a month. Scott Allen EA always reminds his clients the best way to prevent your tax burden from multiplying is to always file your tax returns on time even if you do not have the money. You will be 90% better off.

The proper way to protest IRS penalties is to apply by using IRS form 843. This is the best way to “plead your case” for relief. If you apply without the form the IRS may never respond back to you. Scott Allen EA has heard this many times from clients who have tried to write the IRS a letter on their own. Always abate IRS penalties with form 843. Scott Allen EA has years of experience of protesting IRS penalties. Meet with him for a consultation to see if you case is worth applying for. He will gladly represent you.

In addition to Scottsdale AZ IRS penalty abatement, Scott Allen EA also help taxpayers with unfiled back tax returns and negotiating IRS settlements. You can read further information by viewing his complete website.