2017 Phoenix IRS Settlement

Another 2017 Phoenix IRS Settlement

There are may different options when it comes to a Phoenix IRS settlement. Most taxpayers are usually under the impression there is only one. To read about what some of those options are click below.

1. Let it expire

2. Suspend it

3. Adjust it

4. Pay it

5. Compromise it

6. Discharge it

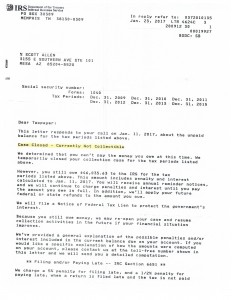

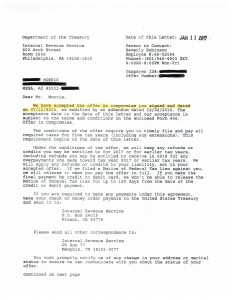

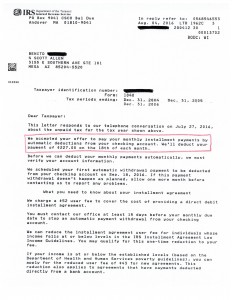

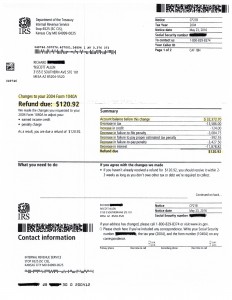

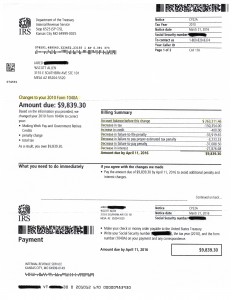

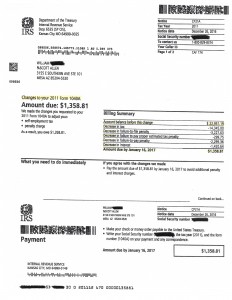

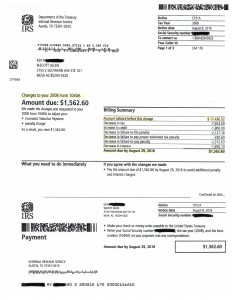

For a recent taxpayer option #2 was successfully completed by Scott Allen EA. All of his back tax debt was suspended and put into a Currently Non Collectible Status. Click on the image below to see the actual letter of success from the Internal Revenue Service. As long as he does not default the agreement by not filing and paying his future tax obligations timely he will remain in that status. A big component to keeping in compliance for self employed individuals is to pay quarterly estimated tax payments. If you are self employed you too need to get started making estimated tax payments.

Tax Debt Advisors has been resolving IRS debts, IRS liens, and unfiled tax returns since 1977. If you are in need of a Phoenix IRS settlement please contact and speak with Scott Allen EA today.