Matthew needed a Phoenix AZ Levy Release and got it

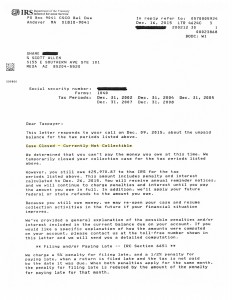

Don’t let the IRS control your finances by placing a hefty levy on your wages. Matthew was in desperate need of a Phoenix AZ levy release. He was getting behind on his bills and it got to a point where he had to ask his 19 year old son for money. To see the work Tax Debt Advisors did for Matthew view the image below. This notice is the levy release document that was faxed into his employer, Southwest Airlines within 24 hours of giving Tax Debt Advisors power of attorney to represent him.

Phoenix AZ Levy Release

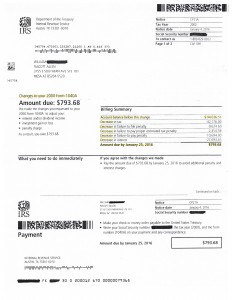

The IRS can levy someones wages for a number of reasons. Obviously it is because they are delinquent of some sort. They either have unfiled tax returns or owe on back tax returns. How does the IRS levy wages on unfiled tax returns? Its simple, the IRS can file tax returns for a taxpayer if they do not. This happens a lot more often then you might think. Matthew had never filed his 2008 tax return and the IRS filed it for him in 2011 resulting in $30,000 of taxes owed. With about six years of interest and penalties adding up the debt grew to over $50,000. Matthew did not even make $50,000 that year.

Long story short, Scott Allen EA was able to get in touch with the IRS and get a release of it. The next week Scott Allen EA prepared his 2008 tax return. The result of the taxpayer filed return was a bill of only $3,011. I would call this a great settlement from the $50,000 the debt started at. It will take the IRS several weeks to process the new return and get the account adjusted but the levy is off and Matthew can get himself caught back up on his late bills. What a big stress relief for Matthew. If only he could have taken care of it before the wage levy started.

If you might be in a similar situation its always best to contact the IRS before they contact you. Don’t wait until a wage levy has started. Give Scott Allen EA power of attorney to represent you properly before the IRS. He battles the IRS every single working day.

Video on Phoenix AZ Levy Release