Arizona’s Tax Debt Advisors provides Successful IRS Audit Representation

Mesa Arizona IRS Audit Representation

It is almost inevitable that sometime your individual return or small business return will be audited by the IRS. It doesn’t matter how careful or legitimate your return is prepared; the IRS computers can select you for a Mesa AZ audit. The IRS will issue an audit notice within three years of your filing so it is important to keep your records at least three years. If the IRS can prove that you have under-reported income by 25% or more the IRS has more time in which to audit past returns.

Select a competent Mesa Arizona tax representative that will attend the audit with or without your presence. You will have to give your representative an IRS power of attorney to represent you. The initial audit will usually result in what you expect but not always. Taxpayers can take their case to IRS Appeals where there is more latitude on what the IRS will or will not accept what was claimed on your return.

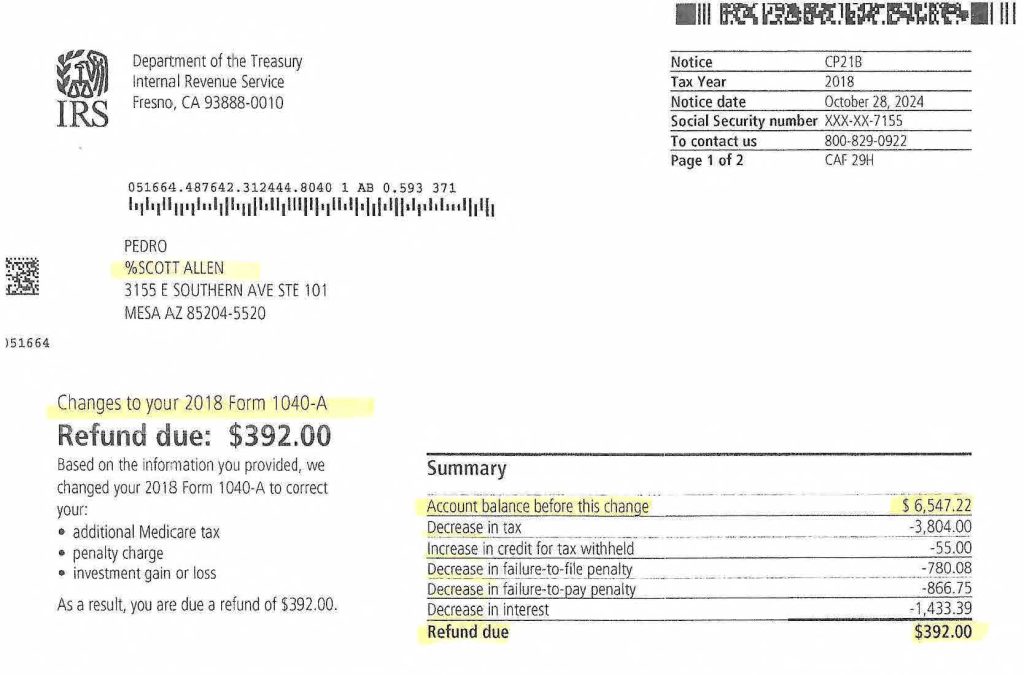

This summary cannot advise you of what you need to do to prepare for a successful audit in Mesa AZ. Contact Scott Allen E.A. for a free initial in office consultation. During your appointment you can decide if you want representation with the audit or with the Appeals office. Scott will not take you case unless it is in your best interest. Call 480-926-9300 to schedule your appointment.