The Restructuring and Reform Bill of 1998 for the IRS was a law that really put respect for the taxpayers back into the system. It forces the IRS to actually communicate with the public and grant due process rights to the taxpayers.

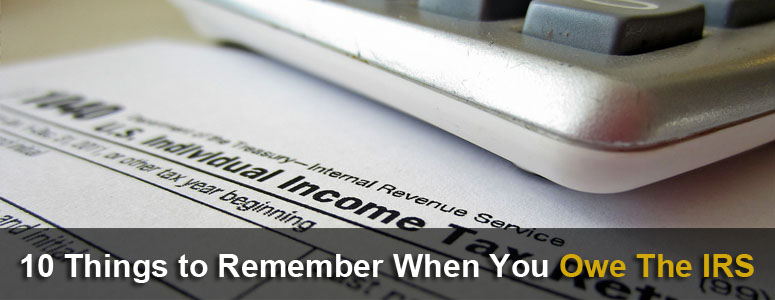

Below are 10 things to remember when you owe the IRS

When the IRS comes to collect, eventually you will have to face the music. If you begin to play games with a tax collector, the system has been designed to make your life horrible. Below are some important things to remember when you owe the IRS:

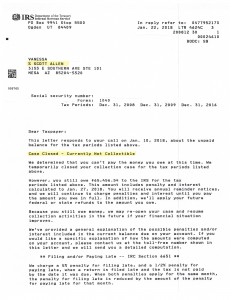

1. Don’t Ignore the IRS notices.

Most people will get into more trouble than bargained for just because they ignored the notices from the IRS. Some IRS notices are sent through certified mail, if you believe that you can ignore the notices by not going to pick them up, then you are wrong. Respond to the IRS each time.

2. The IRS has to explain your rights during your IRS interview.

The IRS Collection Process that was revised in 2015 states that you have the right to be represented and you have the right to be treated in a courteous and professional manner. If you don’t like how you are being treated, then you can stop that interview and ask to talk to a supervisor.

3. Before going to the IRS, spend time with a tax expert or accountant

This may be the best time that you have spent in a while. An expert will let you know how you could prepare to meet for a tax interview, how you should act, and make you aware when a revenue officer is trying to take advantage of you. Just remember the Revenue officers job is to collect money for the government. Furthermore, hiring professional bookkeeping and accounting services can help you avoid ever having problems with the IRS in the first place.

4. Never go to the IRS alone.

Collection interviews aren’t fun and you need representation. Chances are that you will have better results if you have representation.

5. The IRS isn’t Infallible.

The IRS was actually audited by the General Accounting Office and it looks like the IRS needs a bit of cleaning up. Often times, the IRS can’t track how much you actually owe, especially if you have been making regular payments. The IRS can make mistakes, so don’t take their word for everything.

6. You have due process.

The IRS can’t just take your home, bank account, business, car, or even do wage garnishes without making sure that they have given you a notice or an opportunity to challenge the IRS. When you challenge the IRS, everything stops.

You can take the IRS to court and they can’t collect until the judge makes a decision. You can tie their hands for years. The IRS isn’t going to tell you what to do or how you can protect yourself.

7. You are a possible innocent spouse.

Are you separated, widowed or divorced? Do you have tax issues that came from any former spouse? You may state yes, then you could get relief for being an innocent spouse. This could cause your whole tax bill being wrote off. There are states that offer this as well.

8. If you don’t pay, you won’t go to jail.

No one will go to jail for owing taxes. You can go to jail for cheating on your taxes and you can go to jail for tricking a tax collector, but you can’t go to jail because you owe the IRS and your unable to pay.

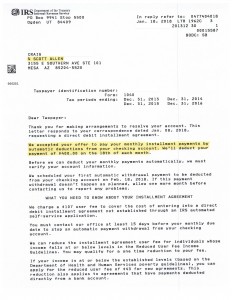

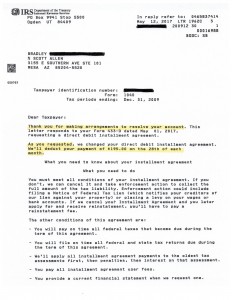

9. You have options when you owe the IRS.

People who owe taxes whether to their state or the IRS, will have options. If you owe and can pay in full, then do so. However, if you can’t pay in full, 4 options may be for you:

- Hardship suspension. This allows the IRS to temporarily leave you alone. Your account will be reviewed over time and even though the IRS leaves you alone, interest is accruing on the account is compounded daily.

- Installment payments. The IRS will let you may monthly payments. The IRS will want the bill paid off in 3 years. You will need to fill out a financial statement and pursue a bank loan. Interest will accrue and is compounded daily.

- It isn’t for everyone, but sometimes you could discharge your tax bill with Chapter 7 bankruptcy. Other chapters let you pay the bill off with monthly payments with no interest or little interest. Bankruptcy rules are complicated so talk to an attorney who understands tax and bankruptcy laws.

- Offer in compromise. The IRS will accept the payment of a smaller sum for a large tax debt. Some states have similar procedures. If you do this and its accepted, all of your tax liens will be removed and you can start over. You need to talk to an attorney who specializes in tax laws.

10. Respect the tax collector power.

IRS tax collectors have more power than most in the federal government. They have very little rules. They can make life easy or miserable. Most success when dealing with a tax collector is done with communication in a prompt manner. They can do these items if you don’t pay your taxes:

- Levy your bank account

- Close your business

- File a tax lien against you

- Garnish your wages

- Damage employment and business relationships

- Seize and sell your home

- Put you in a monthly payment plan that is too high

- Assess you personally for corporate employment taxes

- Go after third party transferees

- Contact your friends, bankers, neighbors, and any relationship for business about tax liabilities.

Get started on your taxes with a free legal evaluation from Tax Debt Advisors

If you happen to owe taxes to the IRS and are unsure of how to pay it, you will want to have professional assistance. A tax debt advisor may help to find a plan that works for you and your budget, while making sure that proper procedures are followed. Start today by having your situation evaluated by a local tax expert for free. If you would like a free tax evaluation, Give Scott from Tax Debt Advisors a call today at 480-926-9300.

Our service area includes Phoenix East Valley Cities including: Mesa, Tempe, Chandler, Gilbert, Tempe and more.