Tax Debt Advisors Inc Reviews: Jan 2016

Removal of IRS penalty: Tax Debt Advisors Inc Reviews

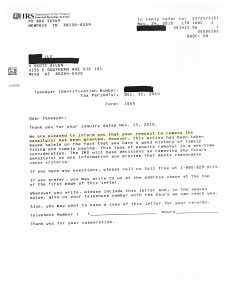

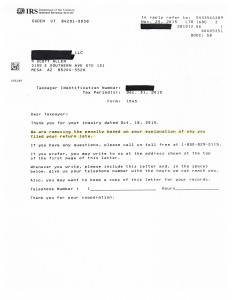

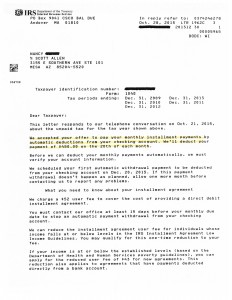

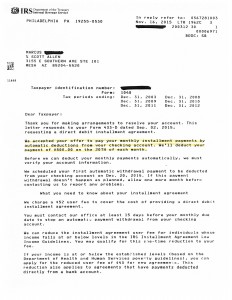

Below is a recent IRS letter showing proof of full removal of IRS penalty assessed on the taxpayers form 1065 tax return. This work was accomplished by Scott Allen EA of Tax Debt Advisors Inc.

Have you ever paid a late filing penalty for your partnership tax return? Did you pay it already? If so, there could still be an option for you to retrieve your money back. If you have not paid it yet there may be an option to get it removed.

One of the best ways to apply for penalty abatement is to simply ask. If you have never ask for relief before you may qualify for a one time or first time abatement.

Scott Allen EA is a local tax resolution specialist who offers straight answers and follow through service. Do not hire an out of state company who guarantees or promises penalty abatement without knowing anything about your specific case. You are most likely talking to a salesperson trying to make a quick commission and not out for your best interest. Tax Debt Advisors Inc is a family owned business here in Mesa, AZ since 1977. Meet with Scott Allen EA today for a free evaluation.