Gilbert IRS Problems

Gilbert IRS Problems getting solved

Stephen came to Tax Debt Advisors to get his Gilbert IRS problems solved. Like Stephen, many people desire to have bank accounts free from IRS garnishment, home ownership that is tax lien free, marriage without financial stress, or just to be able to start saving for retirement. If you have any of these desires and have an IRS problem that needs to be solved make today the day you get that process started.

Scott Allen is an Enrolled Agent licensed in all 50 states to solve difficult IRS matters. He will often hear clients say to him, “I need to get my Gilbert IRS problem fixed so my girlfriend will marry me” or “I have not had a bank account in my name in over five years worried the IRS will take my money”. Scott Allen EA has help hundreds of clients get married and get a bank account for the first time. The process to getting an IRS problem fixed is broken down into 3 phases.

The phases are:

Feel free to click on any of the above links to learn more about those phases. Every phase may not be applicable to you (i.e. if all your tax returns are filed we can skip the 2nd step). After reviewing the information call and speak with Scott today.

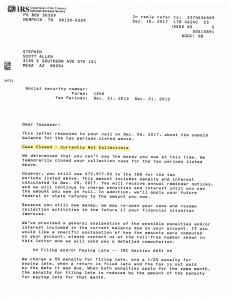

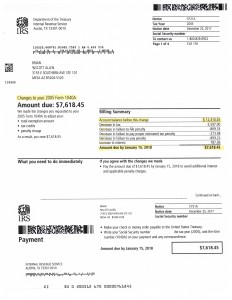

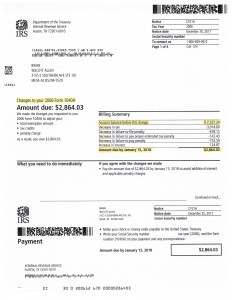

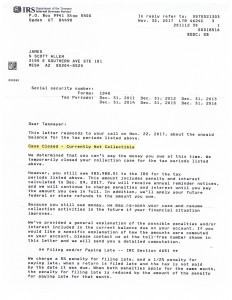

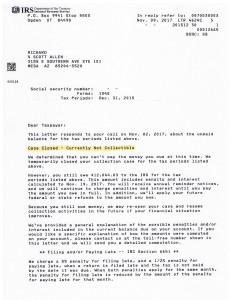

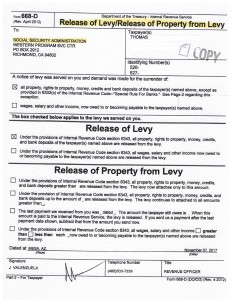

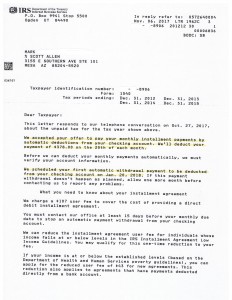

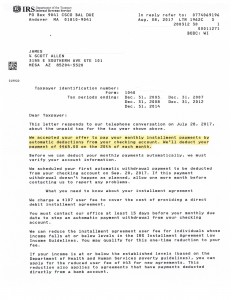

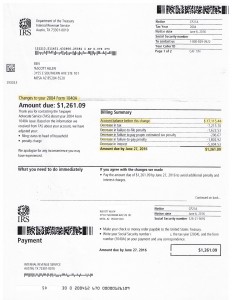

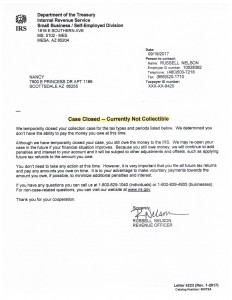

Stephen is a client of Tax Debt Advisors who recently went through the process and received his letter of settlement approval from the IRS. Click on the image below to view. This is a “true testimonial” or review of Tax Debt Advisors by seeing a recent actual accomplishment.