Do I need a Gilbert AZ IRS tax attorney for my IRS problem?

Reading this blog will be a win-win situation for you. First, you do not need a Gilbert AZ IRS tax attorney to settle your IRS debt. Second, Tax Debt Advisors, Inc is not a law firm. They are a tax firm that specializes in unfiled back tax returns and negotiating IRS debts. Scott Allen EA will always share this one analogy: Your tax problem is not a “DUI hit and run”, it is a “delinquent parking ticket”. Just as you wouldn’t find the need to hire an attorney for your parking ticket, you do not need to hire one for your back tax debt problem. Using the services of Tax Debt Advisors, Inc will result in fees 25%-400% less then what an attorney would charge you to do the same work.

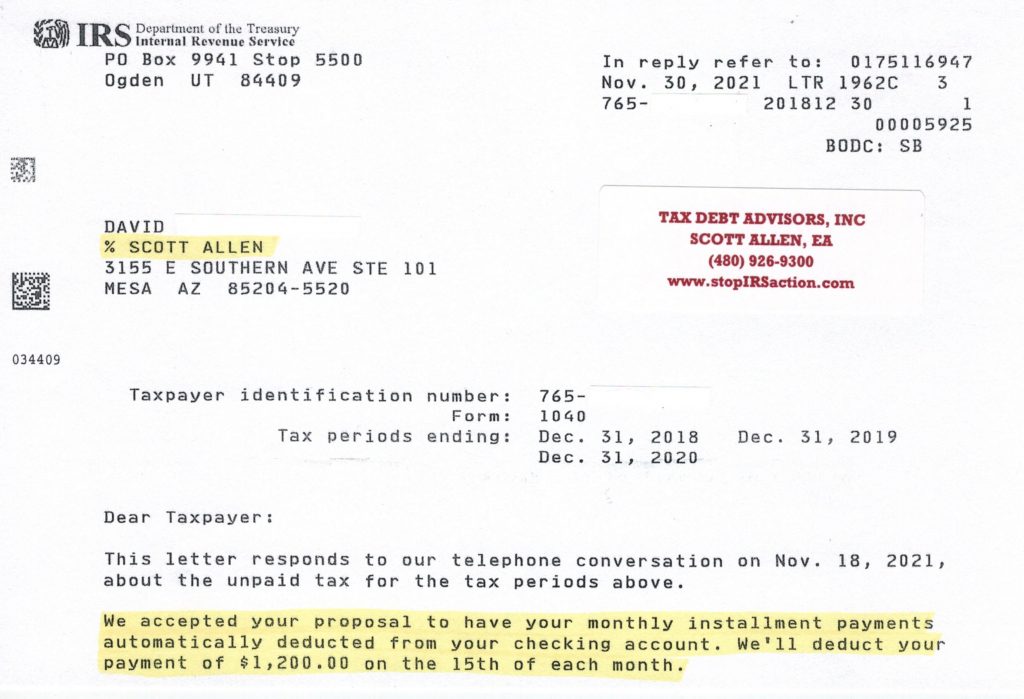

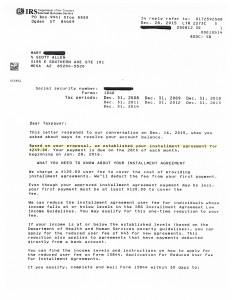

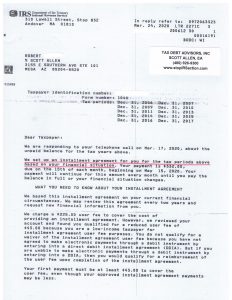

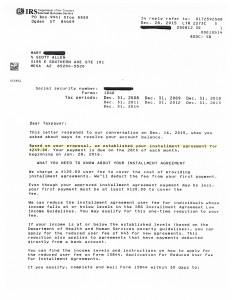

View the IRS notice attached to see what Scott Allen EA of Tax Debt Advisors, Inc was able to negotiate for his client, Mary.

Gilbert AZ IRS tax attorney

Mary was going through a very difficult time when she first came in to meet with Scott Allen, EA. She was newly divorced and had discovered that she was entangled in an IRS nightmare that her ex-husband left her to deal with. As you can see by the notice she was behind on several back tax returns that needed to be filed with the IRS. She didn’t know how to where to make quarterly estimated tax payments. And, the IRS was threatening to place a levy on her only source of income.

Scott Allen EA was able to get Power of Attorney representation for Mary and put a stop to all enforcement action by the IRS. Year by year they went through the tax preparation process beginning with 2008. They were able to get her caught up all the way through the 2014 tax return. Along with that, Mary is also caught up on her estimated tax payment requirement for 2015. Surprisingly, she is actually looking forward to preparing and filing her 2015 tax return as she knows she does not have to write them a big check April 15th. This is the most important and critical step with the IRS. If they see you making estimated tax payments they can tell that you are trying to correct the matter. Without that being done a settlement for Mary either might not have been possible or she wouldn’t have gotten as good of a result.

Just the other day Mary called with excitement to let Scott Allen EA know she made the January 28th monthly payment on time and online! She settled her IRS debt on a $249/month payment plan and could not be more relieved knowing the IRS isn’t going to zap her wages or bank account.

Gilbert AZ IRS Tax Attorney needed?

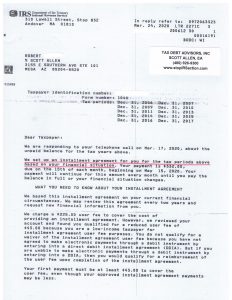

2020 Case Update:

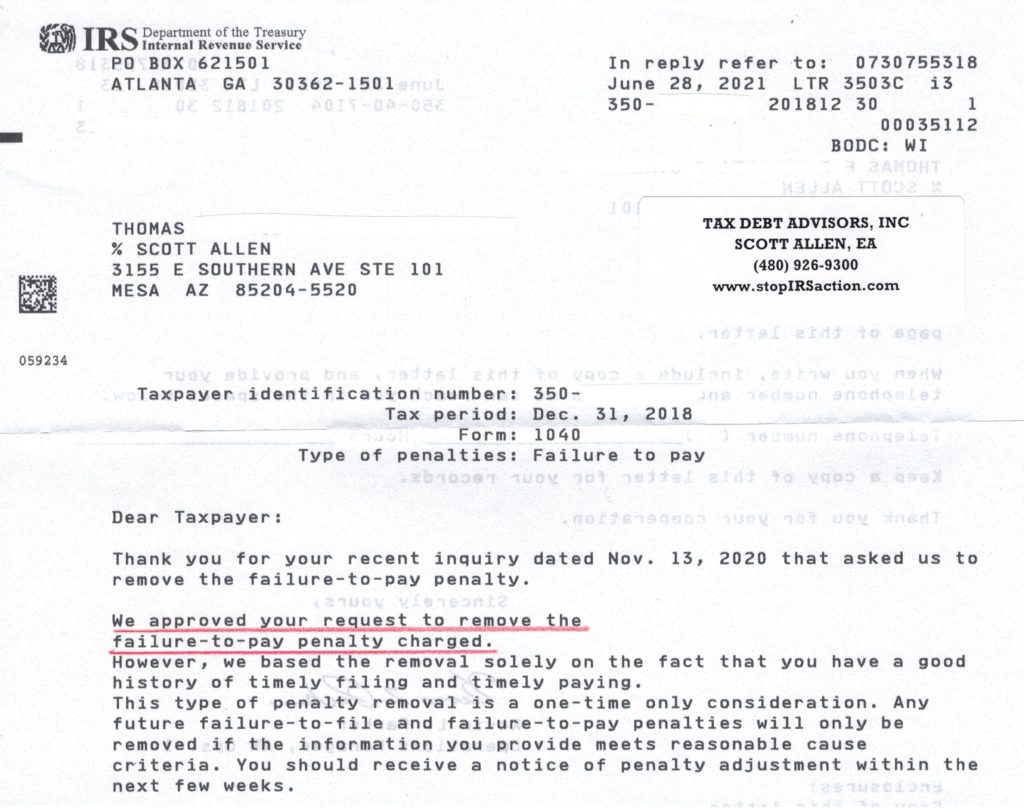

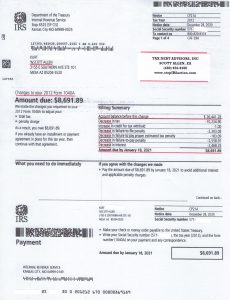

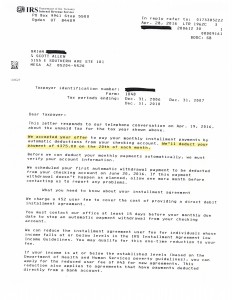

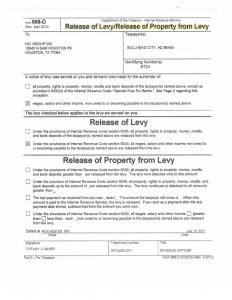

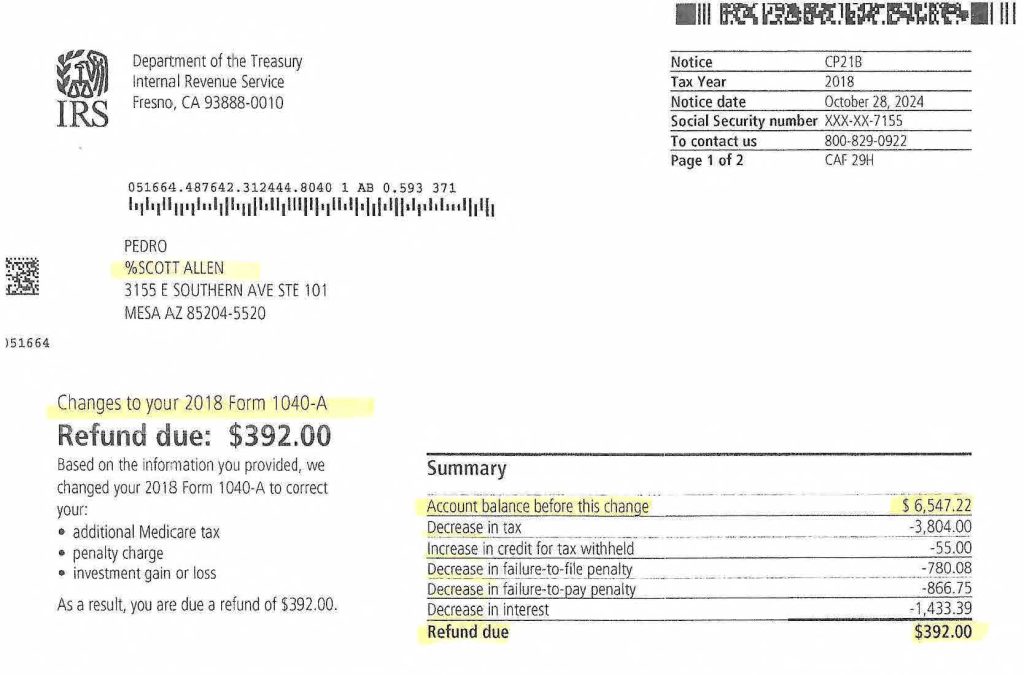

Scott Allen EA is continuing to resolve IRS matters without the need of a Gilbert AZ IRS Tax Attorney. View the notice below to see another successful resolution for his client Robert. Scott Allen EA will go over ALL available options with you, reviewing the pros and cons to each before negotiating an aggressive agreement with the IRS.

Gilbert AZ IRS Tax Attorney

What if your financial situation changes with the IRS and can no longer afford the payment agreement that was set up? The IRS will work with you. It may require an update of financials to prove your current financial status and how it has changed. Upon qualifying, the IRS will modify your agreement. The key to success with the IRS is to be proactive with them rather then reactive.

If you would like to set up a consultation appointment with Scott Allen EA call our office today at 480-926-9300.