Sedona AZ IRS Problem

Read our thoughts on this and how philosophy can help you through your Sedona Arizona IRS problem. We all have “rocks” in our life whether its the IRS, a bad divorce, or eating too much candy. Hopefully these thoughts we have written down here for you can be of some help or some inspiration.

Albert Camus (1913-1960)

Finding Meaning in Life through Engagement not Reflection.

The Myth of Sisyphus

Sisyphus was a character in Greek Mythology. He was condemned by the gods to a truly pointless task. He had to roll a rock up a mountain and when he got it to the top it would roll down from its own weight, and Sisyphus would have to do it over again and again and again. This condemnation of the gods was for all eternity. Camus refers to this as “the absurd.” The task assigned to Sisyphus has reference to what we do in our lives. Don’t we all at some time look at our lives and ask, “What does this all add up to?” In the case of Sisyphus, I cannot think of anything more absurd than a lifetime filled with futile labor.

The absurd to Camus is a confrontation between the rational human mind and the mind that deserves and demands justice and expects the universe to be comprehensible. Camus says that the conflict comes when we realize that we live in “universe of benign indifference.”

We are all born with a sense of justice and fairness. Even young children know how they want to be treated. We project this longing for justice and fairness onto the universe, and we expect the universe to fulfill our demands. We think, for example that evil should be punished and goodness rewarded.

Sisyphus is immortal. What makes his life absurd is the fact that he is condemned to an eternity of futility. To be condemned to a life with eternal futility is even more absurd than the life we live. I remember learning about our city and state and country and being amazed by the size of the world. Then I learned about our solar system and the Milky Way galaxy and that there are billons of stars larger than our earth in our galaxy. And then I learned that there were billions and billions of galaxies. I started to feel very insignificant especially when I realized that the universe was over 15 billion years old and that my life time was so infinitesimally short compared to the age of the universe.

I am always intrigued when my children would come to me with something they don’t understand and they ask, “Why?” And that is followed by another and another “Why?” Eventually I have to say to the child that I don’t know. Eventually we run out of answers for all of their whys and have to eventually accept that we just don’t know. There is a limit to what our reason can justify in life. Eventually we will always be back into the corner of the absurd.

One must eventually ask, “How does Sisyphus cope with the absurd?” Camus makes it very clear, in telling this story that he refers to Sisyphus as “the absurd hero.” While we might readily agree that the situation is absurd, but what makes him a hero?”

Camus says that “Sisyphus makes his rock, his thing.” He puts his whole self into his labor, and one can imagine Sisyphus as he rolls the rock up the mountain coming to notice, appreciate, and even love the various contours and markings on the rock itself. He comes to study and appreciate, and even become very fond of, the various bumps and levels that the rock has to proceed along. There is a sense, in which, what he does, is throw himself into his labor. The consequence of this, Camus tells us, is that Sisyphus must be considered happy. He can be content and satisfied with his situation through engagement.

There is a way of guaranteeing that you will hate any routine task at home or work. By always looking at the clock and seeing how much more time you have to go—or looking at the task itself and saying, “I am only half way through,” as you reflect on what you are doing, you in fact undermine it. Reflection poisons the experience.

Insofar as we get into what we do—make ourselves simply love every moment of it; we love the process, even though it might be painful or tedious at times—to the extent we live our lives to the fullest we are happy. What is interesting here is that the role of reflection—reason—is a problem insofar that reflections has to do with asking ourselves the question, “What does this amount to?” The answer is going to be deeply unsatisfying. You read in Ecclesiastes in the Bible that our lives amount to essentially nothing.

One of the themes of Camus’s philosophy is rebellion. Sisyphus rebels, but what is interesting is he does not do what we would expect him to do; to drop the rock and refuse to push it any further. He continues to push the rock. That is his fate. As he does it, he rebels in the sense that he refuses to accept the absurdity that has been imposed upon him by the gods. Nietzsche calls this “amor fati”—love of fate.

Sisyphus must say, “This is what I do, and I am not going to think about the fact that for eternity it will add up to nothing.” To Dostoevsky consciousness is not a blessing. Consciousness is not our aim. Consciousness is the problem. Camus says of Sisyphus: “If his story is tragic, it is tragic because the hero is conscious.” Conscious means self-conscious or reflective. The universe is absurd and does not satisfy our moral demands or our demands for understanding it as well.

To Camus, we either find the meaning of life, in our lives, or we are not going to find it at all. The message of The Myth of Sisyphus is that insofar as you are wholly engaged in your life and you taste the experience that you have, that is what gives it meaning. Once you elevate yourself to a philosophical level and start reflecting, and start asking yourself the questions, “What does it all amount to? What is its meaning?’—then suddenly you don’t have any answers.

What we get in Camus is a very interesting perspective on our lives in which the idea is not to look at our lives objectively from a distance. When we do that –detach ourselves from our own experience and engagements—the result is something that is utterly unsatisfactory. If you watch a couple kissing, there is a sense in which it looks ridiculous. It is only when you are the one that is engaged in that activity that it becomes meaningful. Camus wants to see that it is only when we are fully engaged in our lives that life makes sense.

So what is your rock in life? Each of us has at least one rock and most of us have a bagful. The admonition of Jesus to “take up your cross, daily” is a directive to get engaged in positive activity and to do it to the point that we become unaware or even concerned what your activity adds up to. Sisyphus’ rock is the equivalent to taking up our cross.

I have read stories of ordinary citizens in Germany, after their city was devastated by Allied bombers during World War II, would be stacking bricks, putting the rubble into piles, sweeping the sidewalks and streets and cleaning up the debris the very next morning. Those who could play a musical instrument would accompany the work being done with Mozart and Beethoven.

The German people did this even though they knew their city would be bombed the very next day and the day after that. Is it any wonder that Germany, despite the terrible devastation brought against them by the American and Russian armies was the first country to successfully restore its economy after the war?

Conclusion

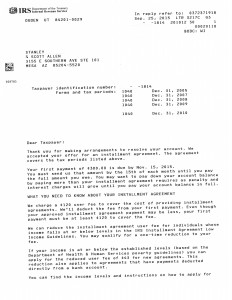

I guess it is pretty easy to guess if you are reading this blog that your IRS problem in Sedona AZ is your rock. The only difference is that it is a temporary event, not one for eternity. However Albert Camus shares with us in his great story, The Myth of Sisyphus the importance of getting engaged in resolving your IRS matter and not just sitting around reflecting on it. May I suggest that you contact Scott Allen E.A. and schedule a free consultation to determine the best way to take action to resolve your Sedona AZ IRS problem. Scott can be reached at 480-926-9300. It will be the best engagement action you can take and he will make sure that your “rock” (IRS) goes away.