Scottsdale IRS Problems

Scottsdale IRS Problems 101

Scottsdale IRS Problems can come from a variety or ways. Maybe a taxpayer forgot to file a tax return, unable to pay the taxes owed, getting audited, or even identity theft. Whatever the scenario is it may be in your best interest to seek out professional help. In most cases a tax professional who specializes in IRS problems has probably seen a situation similar to the one you are currently in.

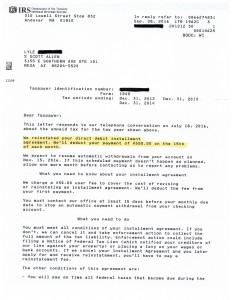

Tax Debt Advisors can help in three ways. First off, after meeting with you it may be determined that you don’t need to hire professional help. It can be recommended to handle it on your own after pointing you in the right direction. Secondly, you may only need to have Tax Debt Advisors in an advisory role. Just paying for one or two hour long appointments (as needed) to help help along the way. Taxpayers may choose this route if finances are tight and would like representation but cannot afford to. Lastly, most taxpayers who meet with Scott Allen EA will hire him to be their advocate between them and the IRS. You will give him power of attorney to represent you in all matters pertaining to the Internal Revenue Service. He can help you file back tax returns and settle your IRS debts.

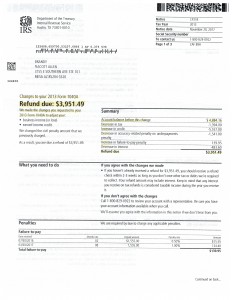

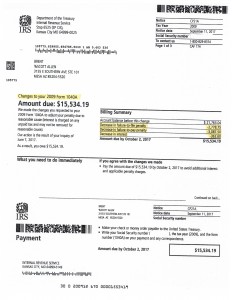

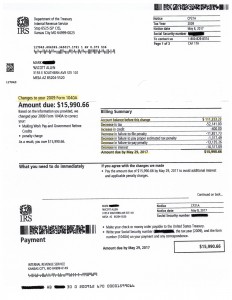

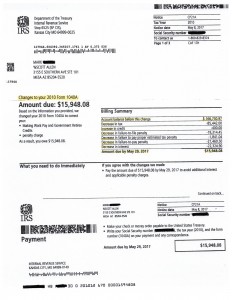

View the notice below to see an actual success completed by Scott Allen EA. Upon making a correction to the 2013 tax return Brandy went from owing the IRS $4,884 to receiving a refund of $3,951. WOW! That is a difference $8,835.

If you are in need to correcting Scottsdale IRS problems speak with Scott Allen EA today. Let him point you in the right direction at the very least. And at the very best Scott Allen EA can be your Power of Attorney and seek out the best settlement the law will allow. All result vary based upon ones current situation but for Brandy is was a decision that saved her almost $9,000 that the IRS would have collected from her.