Tax Debt Advisors recent success

Looking for success in resolving your tax debt? Call Tax Debt Advisors

Tax Debt Advisors is a locally and family owned practice here in Mesa AZ. Started in 1977 the company is on its second generation of IRS debt help service. When dealing with an IRS matter, whether it be tax preparation, settling IRS debt, or navigating through unfiled tax returns your top priority should be finding the right fit in a local company. Beware of out of state companies advertising IRS resolution work making false promises up front before knowing anything about your case. Only pay for services as they are to be performed rather then large up front retainers. Tax Debt Advisors breaks up the resolution process into three steps and you only pay for the work when it is to be accomplished one step at a time.

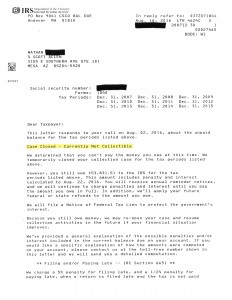

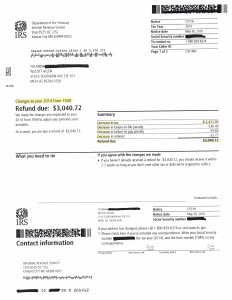

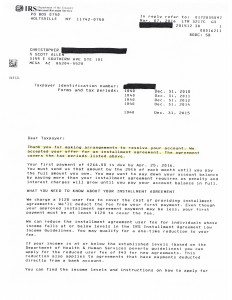

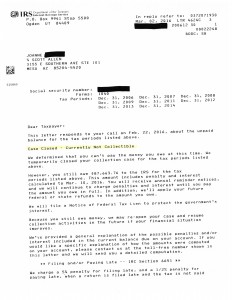

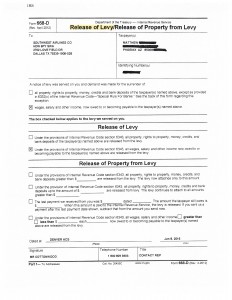

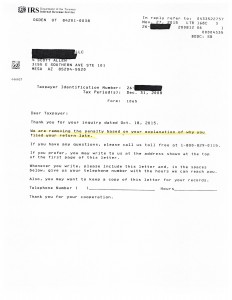

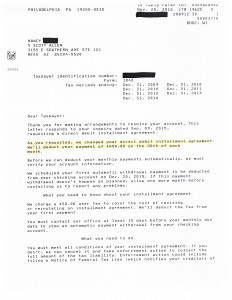

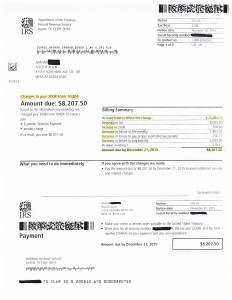

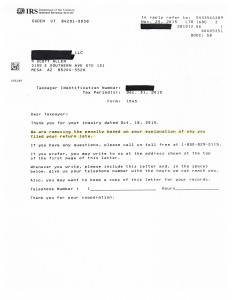

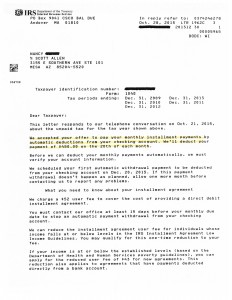

Nathan, a client of Tax Debt Advisors had existing tax liabilities, unfiled tax returns, and threatening letters of wage garnishment. Upon getting started Scott Allen EA was able to get in contact with the IRS, hit the pause button on any levies or garnishments, and begin the tax preparation phase. After he got Nathan caught up on his back tax returns then they could move onto the third phase; the IRS resolution phase. Based upon his current financial state he qualified for a currently non collectible status. What does that mean? Nathan does not have to pay a dime on his back tax returns because he cannot afford to do so. View the notice below to see the IRS acceptance letter.

Could Nathan qualify to settle his IRS debt in an Offer in Compromise? Yes he could and would probably qualify but he does not have the means to save up or borrow to afford the lump sum settlement offer. But, if his situation changes he could qualify and submit an offer with the IRS at a later date. It is important to know about all available options before starting a negotiation.