Should I use a Phoenix AZ IRS tax attorney?

One of the most important questions you will ask if you have an IRS debt is do I need a Phoenix AZ IRS tax attorney? Often times taxpayers think that their only recourse to get an IRS resolution is to use a tax attorney. We are hear to inform you that there are other options available to you. Tax Debt Advisors, Inc near Phoenix Arizona is a tax company what specializes in IRS debt settlements. They are a family business that began in 1977 and are still operating today.

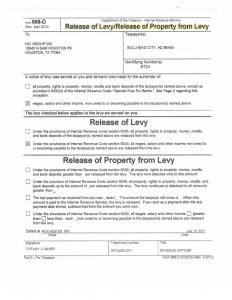

Remember very few IRS debt matters require legal representation of a Phoenix AZ IRS tax attorney. If you have unfiled tax returns, have a large IRS debt to settle, or an audit to go thru then you can use the services of Scott Allen EA with Tax Debt Advisors. He can represent you from beginning to end as your IRS power of attorney. Success in dealing with the IRS comes from years or experience in dealing with the IRS personnel and employees. Scott Allen EA is in the “trenches” day in and day out negotiating with the IRS in matters of collections and audit. There is a proper formula that he will go through with you within your particular case to ensure a positive outcome. That formula can be found by clicking here.

If you are currently with a Phoenix AZ IRS tax attorney and feel like you you are not getting the results you desire look to Scott Allen EA for a honest second opinion. If you desire to make the switch he can file an IRS power of attorney form and begin his representation today. To build that trust he only charges fees as the work is accomplished (pay as you go); not large upfront retainers without guaranteed services.

Call Scott Allen EA today and finally put your IRS nightmare behind you once and for all.

July 2018 update:

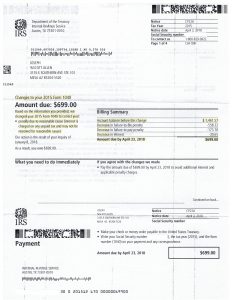

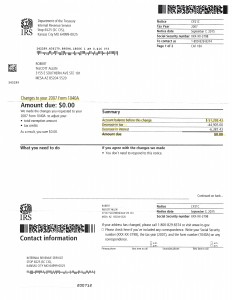

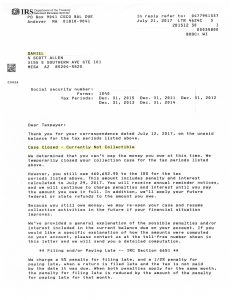

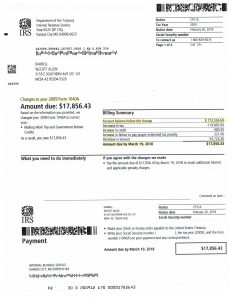

This year Scott Allen EA completed an IRS penalty abatement process for his client Joseph. Not everyone qualifies for penalty abatement cases but its always important to look into to see if you might have a reasonable cause. You may have a 50-60% chance of acceptance. Falsely, taxpayer will believe they need a Phoenix AZ IRS Tax attorney to handle debt and collection matters with the IRS when in fact that isn’t true. Most IRS matters can be handled by an EA or CPA as well. As mentioned earlier call and speak with Scott Allen EA about the tax matter you are facing whether it be penalty abatement, unfiled tax returns, or an audit.