Can the IRS Take My Retirement Money?

If you are wondering whether the IRS can take your 401k, pension or retirement account money, this post should help! Here we discuss why your accounts are at risk in the first place, if the IRS can actually take money from these accounts or not, and what you can do to protect your money.

Why Is The IRS Trying To Levy or Take My 401k, Pension or Retirement Money?

Even though retirement accounts are protected from creditors, the IRS is an exception. The general rule is that if you can get it the IRS can get it too.

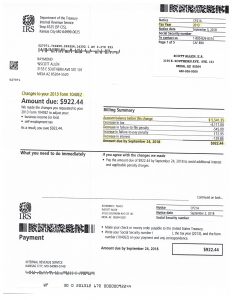

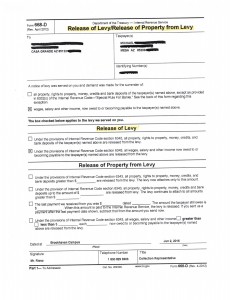

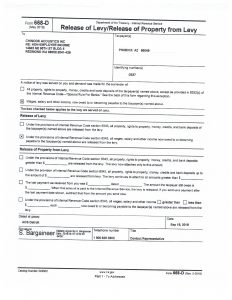

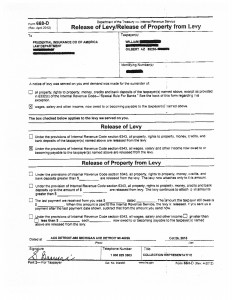

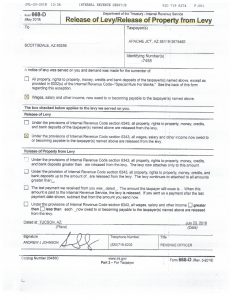

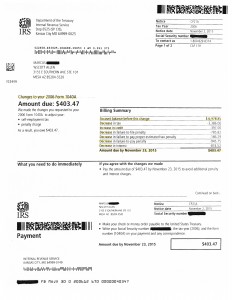

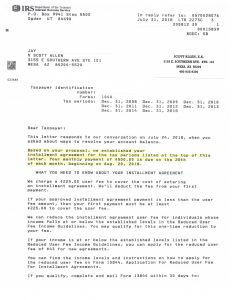

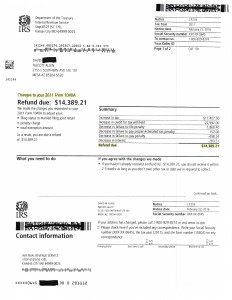

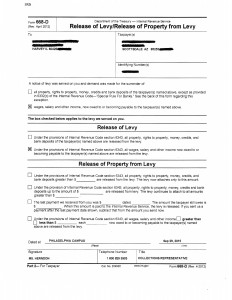

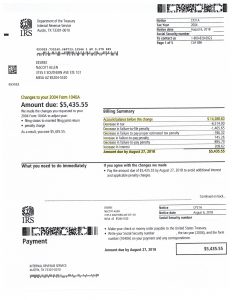

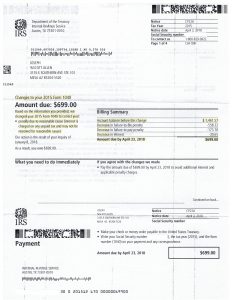

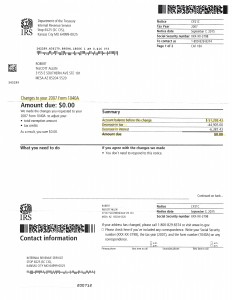

The main reason the IRS would try to levy your 401k, pension or retirement accounts is because you owe back taxes. An IRS levy is basically a seizure of your assets to cover your tax debt. The IRS will usually send a notice and demand for the payment to be made. If you ignore this notice, they will send a final notice of intent to levy which will be issued 30 days in advance before the levy happens. Usually, before they perform the seizure, they will investigate assets you own to see if they have sufficient equity to pay off your back taxes, or else the seizure is prohibited.

The Internal Revenue Service can seize all types of retirement accounts, including IRAs, 401k plans, and other self-employed plans like Keogh plans and SEP-IRAs. There are currently no prohibitions in the IRS code against it.

Many clients come to me who have been forced to live off of their retirement accounts because of being laid off. When they get the tax bill for the taxes owed and the 10% early distribution penalty, they have no way to pay the amount owed. If your only source of money is taking distributions from money still available in your retirement accounts, the IRS will expect you to liquidate the account to pay off the taxes.

Can the IRS take My 401k If I Owe Taxes?

Yes, the IRS can take your 401k account if you are eligible to take distributions from it. The IRS cannot take your 401k money if you are restricted from taking money from your account due to plan restrictions or age.

Can the IRS take My pension If I Owe Taxes?

Yes, the IRS can take your pension as it is not a protected asset. They can also take money from Social Security benefits, your bank account and even take your home depending on how much you owe. However, the IRS will usually give you options to pay the money back before performing a levy.

Can the IRS Take My Retirement Money If I Owe Taxes?

Yes, the IRS can take your retirement money if you owe back taxes. Retirement accounts that can be levied by the IRS include:

- Keogh plans

- SEP-IRAs (self employement)

- IRAs

- Company profit sharing

- Stock bonus plans

- Qualified pension plans

How To Defend Your Retirement Accounts

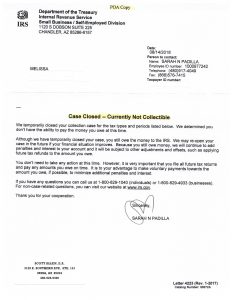

In order to defend your retirement account(s) from Internal Revenue Service seizure is to know that the IRS can only get what you get. More specifically, if you can’t access your retirement money, neither can the IRS. How is this possible?

Many retirement plans deny you access to your retirement funds until you retire, die, become disabled or take a job with another company. Reference IRS Manual 5.11.6.2 for information about government seizures on retirement funds. Also, The IRS cannot force you to terminate your employment. As long as you stay employed, the IRS cannot have access to your retirement account. In this case the IRS will look at your wages and other personal assets to pay your back taxes owed.

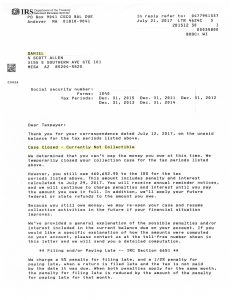

However, if you have access to your retirement money, the IRS most likely has access to. Whether they will take money out of that fund depends on whether you conduct leading up to the tax liability was flagrant or not. Conduct deemed flagrant includes, fraud, tax evasion, or making contributions while taxes were not being paid. If you can show the IRS that your conduct wasn’t flagrant or that you depend on that retirement money, IRS manual 5.11.6.2 states that the retirement fund cannot be levied.

The IRS will back off if we can establish that they have no rights to your retirement money. Although, I have seen aggressive IRS officers levy wages, assets, and non-retirement assets, if retirement money is not withdrawn voluntarily.

The Internal revenue service is typically hesitant to take retirement money, and many times they have no rights to your retirement money, but proper negotiation, handling, and knowledge of this process is helpful to defend your precious retirement accounts.

What Do I Do To Keep My 401k, Pension or Retirement Money?

The best way to protect your 401k, pension and retirement money is to setup a payment plan to pay your back taxes. However, if your deliberately didn’t pay taxes, the IRS will seize your money for sure. Although, proving you need the money for living expenses can lower the amount of money they can take.

Don’t Go At It Alone, Stop IRS Levy Today!

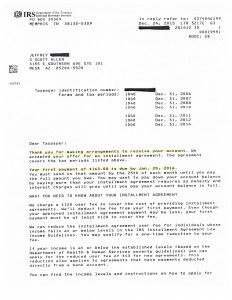

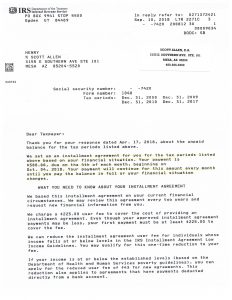

Dealing with the IRS can be confusing and frustrating, especially when your retirement money is up for risk. Don’t go at the IRS Alone, Tax Debt Advisors have helped over 108,000 tax payers settle their debt with the IRS. Is the IRS trying to seize one of your retirement accounts? Contact Scott Allen, he has helped resolve over 108,000 tax debts, and has over 39 years of experience in dealing with the IRS.

If you need to file back tax returns, having problems with the IRS or just need a great tax debt advisor, schedule your free tax consultation with Scott Allen E.A. from Tax Debt Advisors today by giving us a call today at 480-926-9300.

Scott Allen E. A. Tax Debt Advisors, Inc taxdebtadvisors.com

– Scott Allen – info@taxdebtadvisors.com