Do I Need a Phoenix AZ IRS Attorney for Tax Debt Relief?

You do not need a Phoenix AZ IRS Tax Attorney

Getting tax debt relief is not always a legal matter.

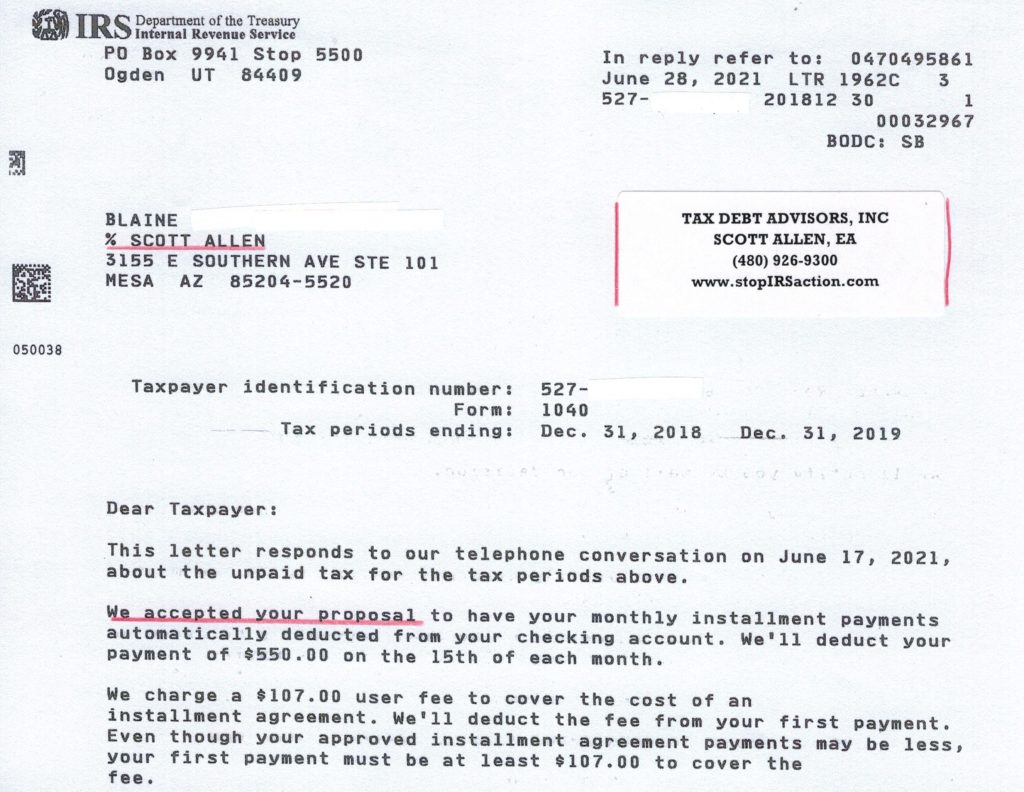

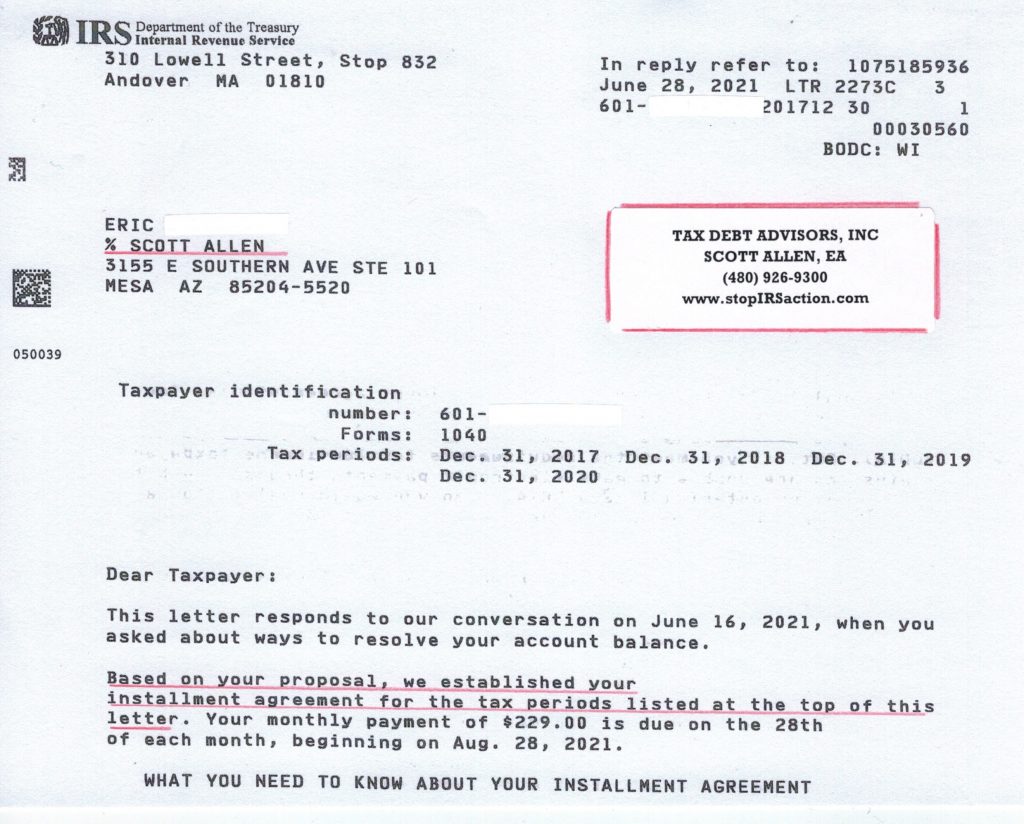

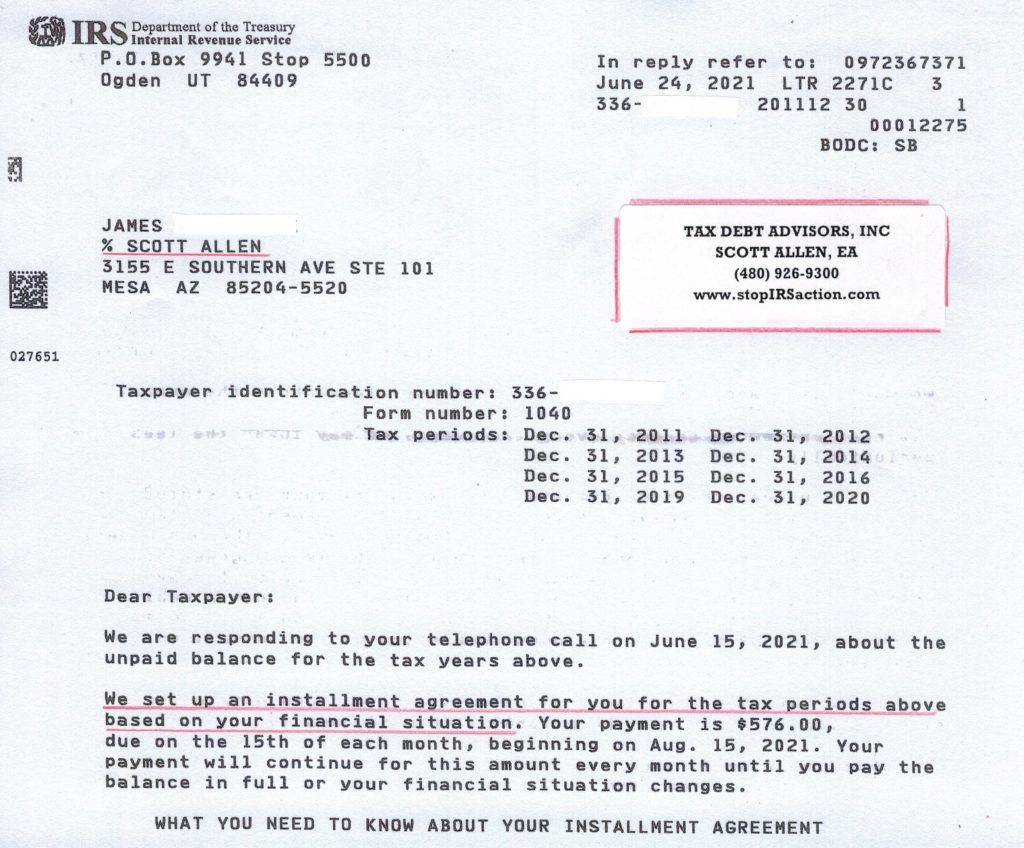

It is a matter of finding the right person that can do the job for the least cost to you with the best settlement allowed by law. The best way to do that is to first schedule a free consultation with Scott Allen E.A. located just outside of Phoenix Arizona. In your initial appointment you will be confident you have come to the right person for you. Scott does all the IRS tax settlement work from beginning to end. He doesn’t turn you over to any employee and will return your phone calls promptly. But Scott is not a magician. He needs your help and cooperation and it needs to be accurate and timely. There are deadlines to meet once Scott enters into negotiations with the IRS. Just because you have the right person representing you doesn’t mean you can go fishing and think that Scott can do everything himself. Scott will not ask you to do things that are difficult but they do need to be done timely. You cooperation is your guarantee that Scott can do what he promises. It’s that simple. Call Scott Allen E.A. at 480-926-9300 and schedule an appointment today. Let Scott make today a great day for you and take care of your IRS nightmare.

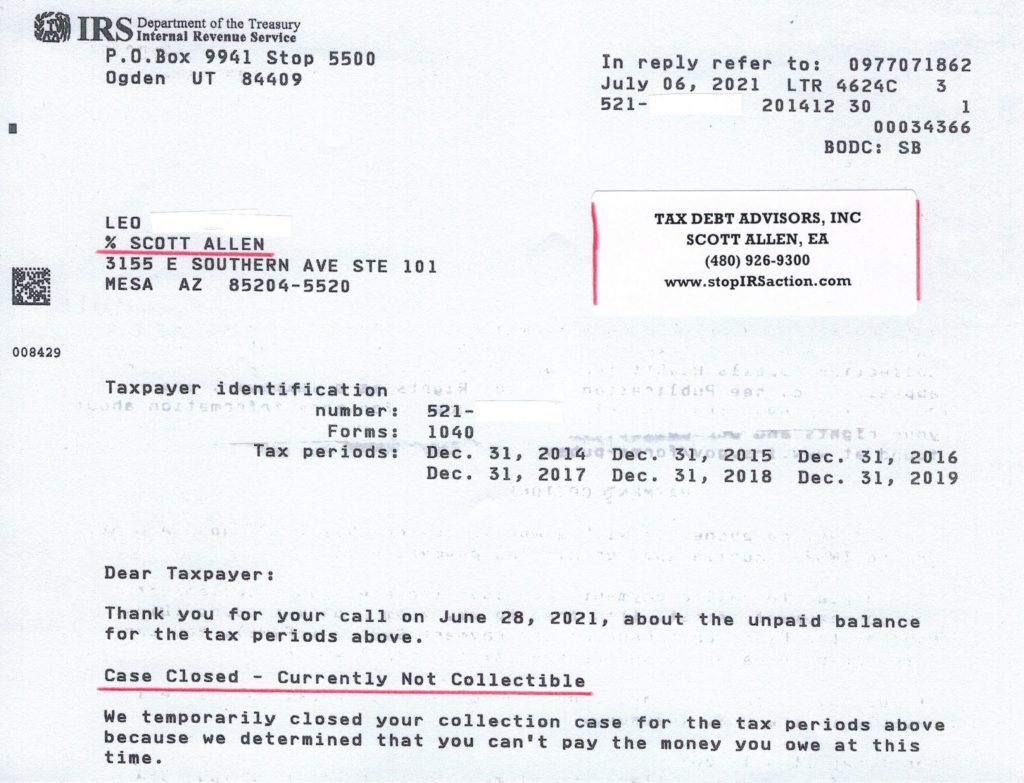

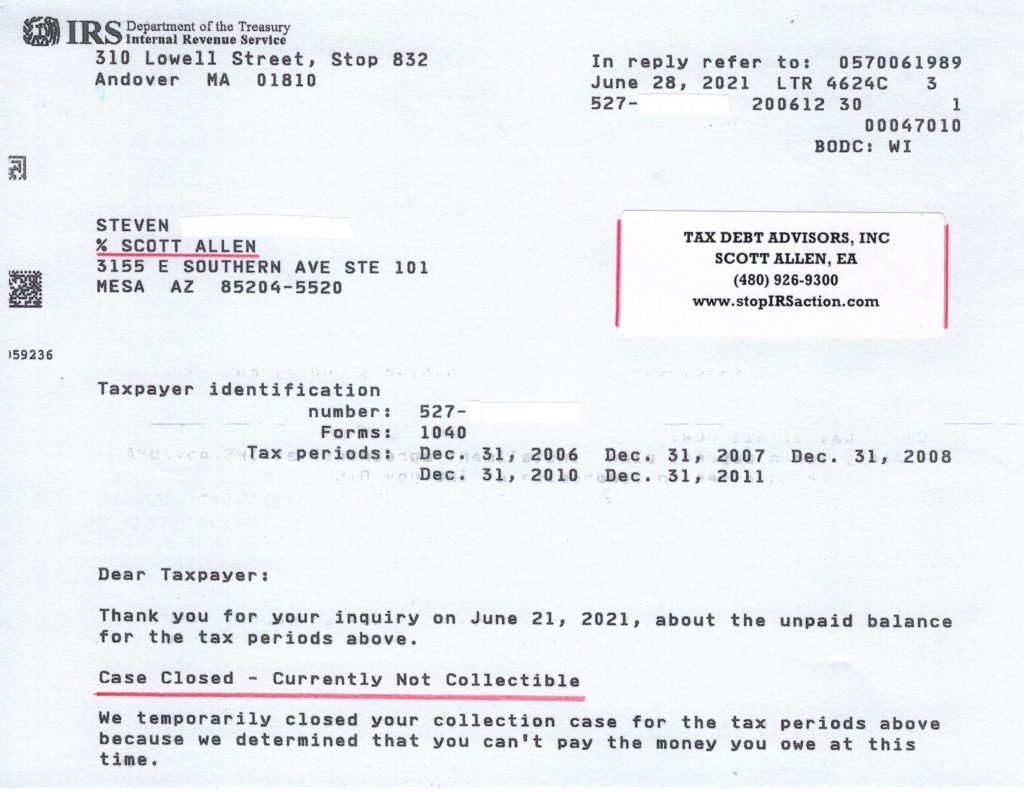

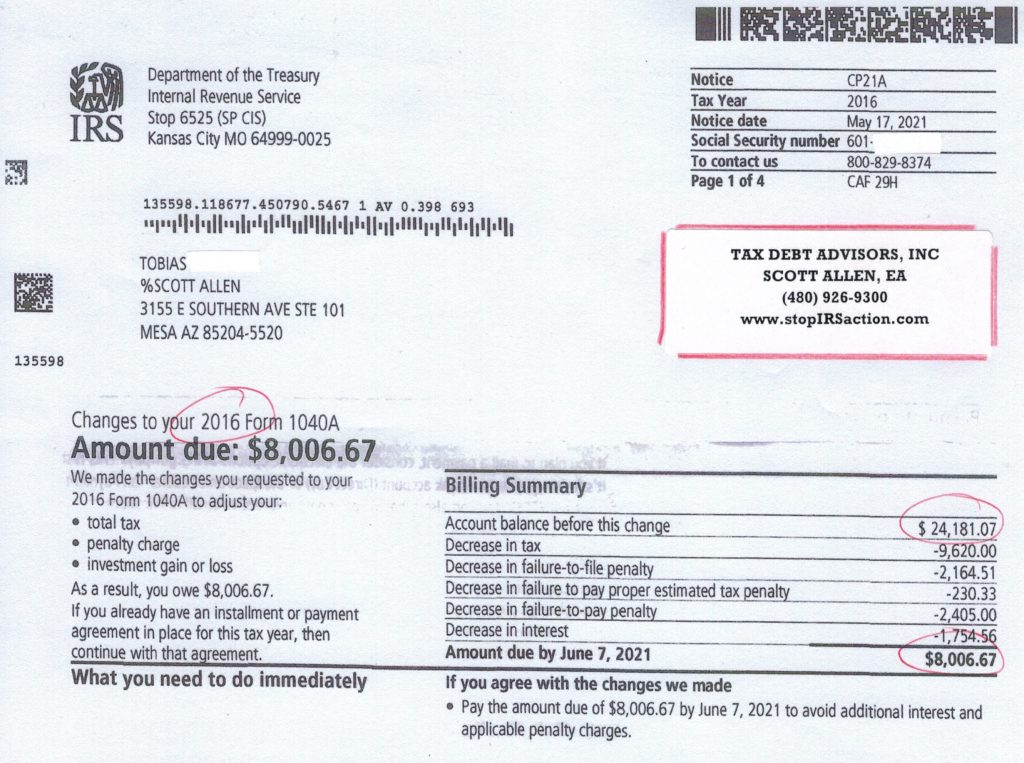

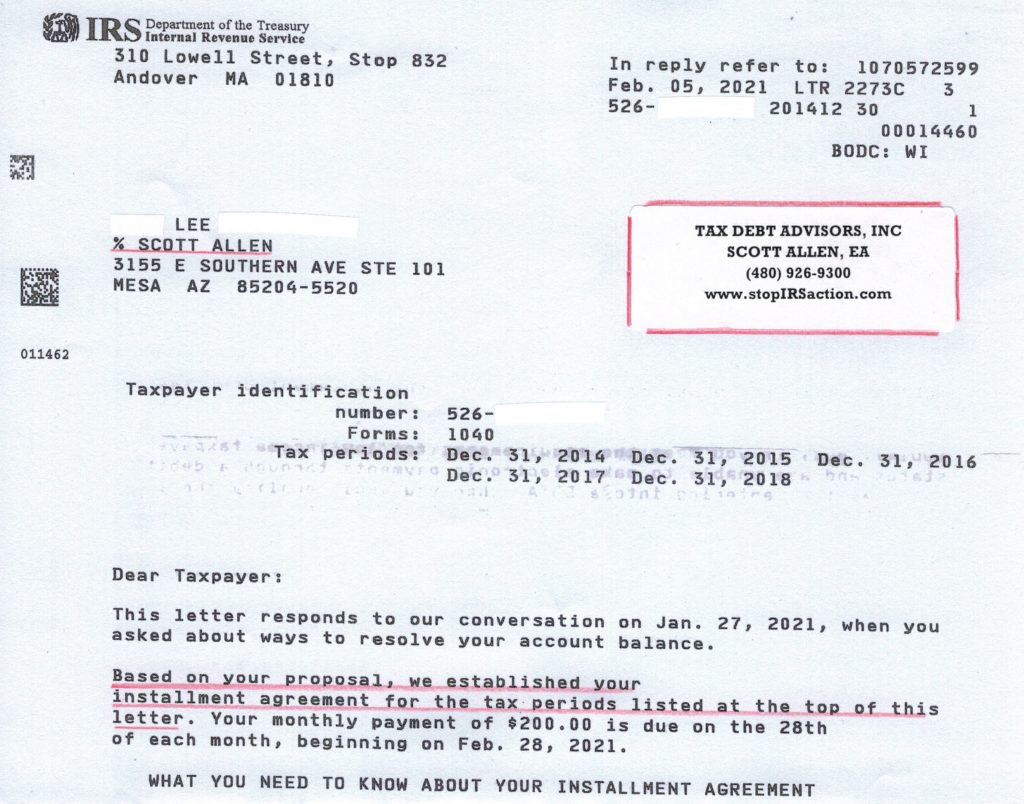

See what Scott Allen E.A did you his Client Leo (view IRS letter below). Leo was way behind on filing his taxes and paying his taxes. He runs a small contracting business himself. He is great at digging trenches but not so great at staying on top of his taxes. Rather then calling a Phoenix AZ IRS attorney, Leo called Scott and hired him to be his Power of Attorney. He was able to file all of his back tax returns, get him on a schedule to pay his current estimated tax payments, and settle his IRS debt in a Currently Not Collectible status. Leo is not required to pay a nickle on his back taxes as long as he remain current and compliant with his friends at the IRS.

Phoenix AZ IRS Attorney