How To Stop A Tax Levy On Your Paycheck In Mesa

If you are looking for information on how to stop a tax levy on your paycheck in Mesa, Arizona this post should help!

What is a tax levy?

The tax levy is one of the harshest collection methods used by the IRS and taxing authorities. This is where they will legally seize your assets to pay off back taxes owed. This is very different from tax liens because a lien is just a claim to the assets while a levy is seizing them. The tax authorities may levy investment accounts, wages, pensions, physical assets, bank accounts, accounts receivable, social security, and insurance policies.

General Tax Levy Process

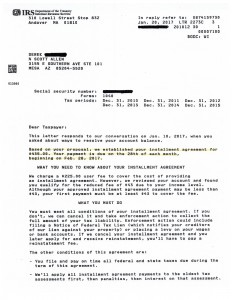

Normally, you won’t be surprised by tax levies due to the IRS going through certain steps before they issue a tax levy. Below are the steps that the IRS will go through before a levy.

- Taxes are accessed from an IRS filed a tax return on your behalf called a Substitute for Return or by a tax return filed by you with money owed.

- Tax bills are sent to the last known address and demands payment for owed taxes.

- You haven’t paid the bill or you made another arrangement to pay.

- A final notice is sent by the IRS with an intent to levy and a notice of your right to a hearing. The levy will begin within 30 days of the notice. The IRS is required by law to notify you of the levy within 30 days before beginning. This became the law as part of the 1998 IRS Restructuring and Reform Act.

Tax Levy Types

The levy form that taxing authorities use will vary depending on your situation. Normally they will use the method that will be the easiest for them to regain money that is owed. Below are common levy types:

-

Wage Garnishment

With wage garnishment, the IRS will contact your employer and demand that HR take out a certain percentage of your pay for your unpaid taxes. Many employers will not really deny this request because the company can be held liable for what you owe. This levy will remain until enough is paid to cover the owed amount plus penalties and interest, other resolution has been made, or the debt owed has expired. Normally, if a tax attorney proves a hardship, the IRS can reduce or remove the garnishment.

-

Bank Levy

A bank levy will have the IRS contact your bank and demand a hold be placed on your funds. Within 21 days, the amount owed will be removed from your account. If it doesn’t satisfy the debt in full the first time, then it may keep coming back as money appears in the account.

-

Property Seizure

The IRS may seize almost any form of asset to sell to cover your owed taxes. They can seize items such as your house, car, or boat.

-

1099 Levy

The IRS may issue multiple types of levies to gain payment for your owed 1099 payments. They can levy the amount you owe, but can’t go after anything owed to you in the future for work that is to be done.

-

Other Asset Seizures

The tax levies aren’t limited to what is mentioned above. The IRS can also levy your licenses, rental income, commissions, retirement accounts, accounts receivable, dividends, or life insurance.

-

Passport Seizure

Although not technically, the IRS may request that the state department deny or revoke your passport if you owe more than $50,000.

Stopping a tax levy

The IRS will normally only use a levy as a last resort option and would prefer to use another arrangement to resolve your owed taxes. In order to stop a levy, it takes swift action by you or a tax professional working for you. There are different types of arrangements that can stop a levy. Below are some options.

-

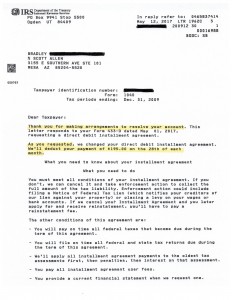

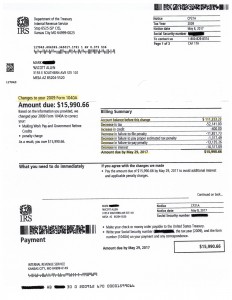

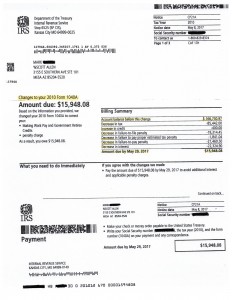

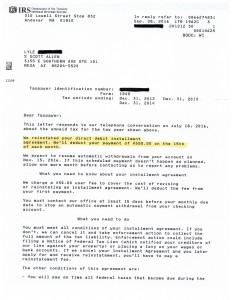

Payment Plan

The IRS have a variety of payment plans based on your financial situation. Once the agreement is made for a payment plan, the levy will stop.

-

Submit an offer in compromise

This is an agreement to pay less than what is actually owed. This option is for those who are struggling financially and may qualify. Talk with a tax professional to see if this is for you.

-

Prove Financial Hardship

If you can prove that a levy will create a financial hardship, then this may stop the levy against you. This doesn’t mean that you don’t need to pay what is owed, but it will stop collection actions.

-

File an appeal

You can appeal the levy if taxes were paid before the notice was sent. You can also appeal if you were in bankruptcy before the notice, there was an error in the assessment, you want to make spousal defense, or want to talk about other options. There may be times that you can appeal because you weren’t able to dispute tax liability, or the statute of limitations has expired for the debt.

Contact us today for help with a Tax Levy

We can assess your situation and find the best method to get the levy released. Scott from Tax Debt Advisors will work on your behalf to find the arrangement that will work for you and not the IRS. Scott can help you stop IRS tax levy or release a levy quickly!