Scott Allen E.A. if you need to File Back Tax Returns in Chandler AZ

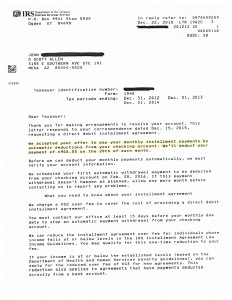

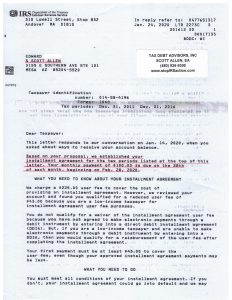

If you have not filed all of your delinquent tax returns, the IRS will not allow you to enter into a settlement for IRS relief. This leaves you vulnerable to IRS wage garnishments and bank account levies. If you owe on your back tax returns in Chandler AZ, they are accruing additional interest and penalties. Probably the worst penalty that the IRS enforces on back tax returns is refunds older than three years will not be paid to you nor applied to balances due on other years. Eventually the IRS will assess you with substitute for returns which are prepared in the most negative way possible. When this happens you will need to file a protest with your correct return. This can take several months to be accepted by the IRS and leave you vulnerable to paying on a larger liability with a potentially higher monthly installment arrangement. If you cannot pay the taxes due, you extend the statute of limitation, which is 10 years, until your taxes are assessed.

May I suggest that you contact Scott Allen E.A. at 480-926-9300 to file your back tax returns in Chandler AZ and assist you in selecting and negotiating the best settlement allowed by law? Your initial appointment is free and Scott will make that day a great day for you!

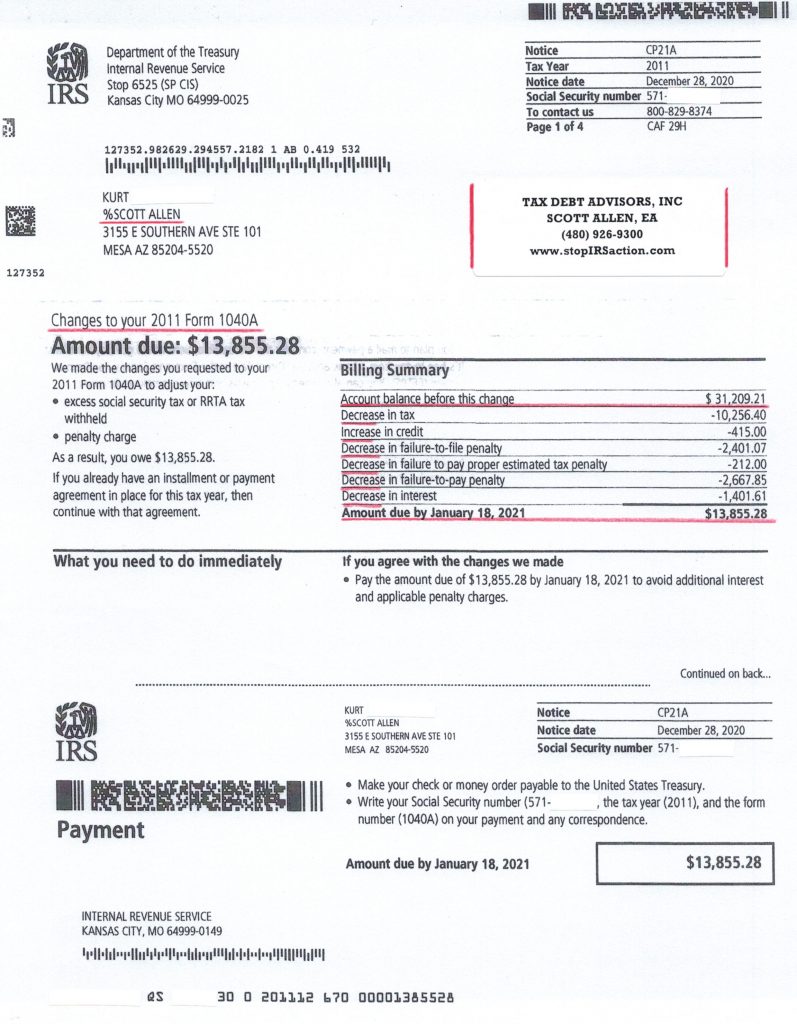

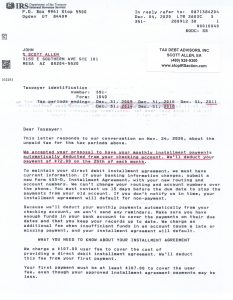

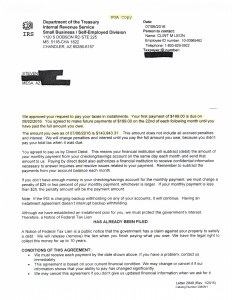

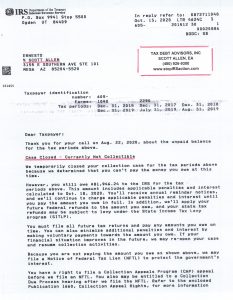

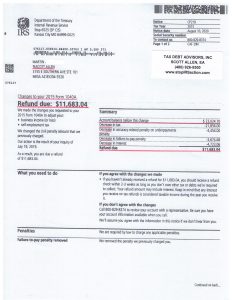

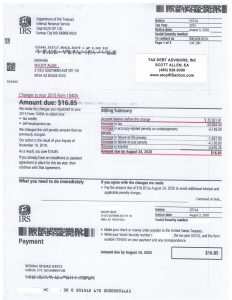

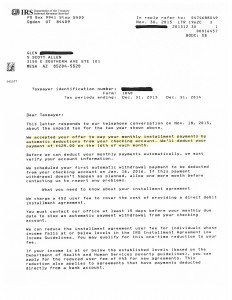

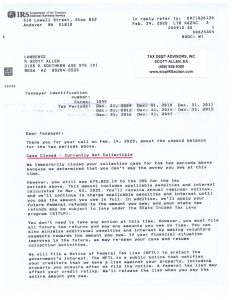

View the notice below to see how Scott Allen E.A. helped Kurt file back tax returns in Chandler AZ so he can negotiate a reasonable settlement on his IRS debt. Over $18,000 in tax, interest and penalties was reduced.

Arizona’s Premier IRS Tax Problem Service Advisor

Serving: Phoenix, Mesa, Queen Creek, Tempe, Scottsdale, Chandler, Gilbert, Glendale, & Peoria Arizona